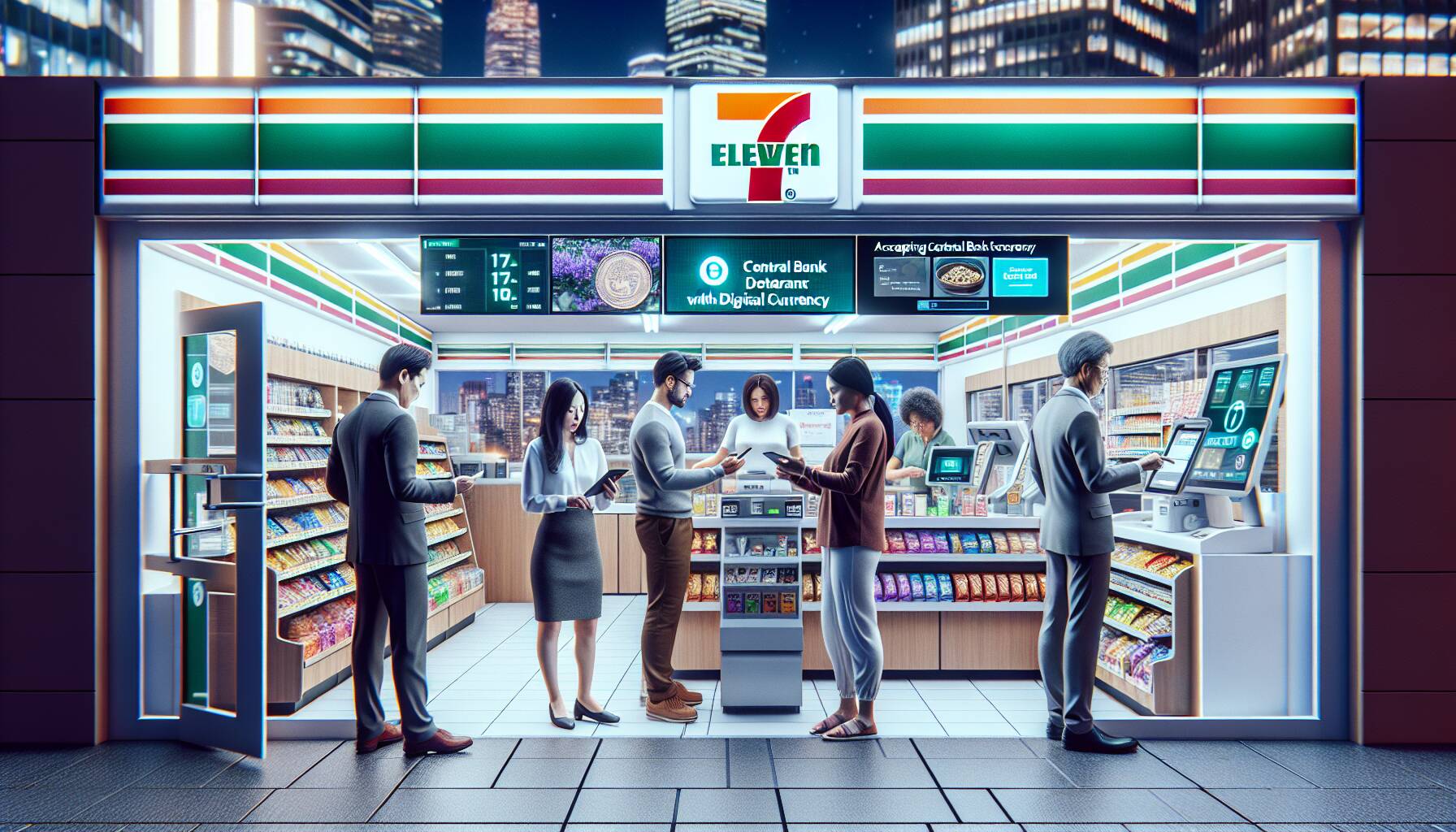

In a significant move for the cryptocurrency landscape, South Korea’s 7-Eleven stores have begun accepting the Bank of Korea’s central bank digital currency (CBDC) as part of a pioneering pilot project. This limited-time initiative, dubbed the “Hangang Project,” will run through June and aims to explore the practical applications of digital currency in everyday retail environments.

Customers holding accounts with one of seven participating banks, including names like Kookmin, Shinhan, and Woori, can engage in transactions by simply scanning a QR code from their digital wallets at checkout. This method mirrors the common functionality seen in popular mobile payment applications, making the transition seamless for users.

“By participating in this digital currency payment test, we’ve taken another step forward in digital transformation,”

stated Moon Dae-woo, head of digital innovation at 7-Eleven. To further entice customers to participate in this trial, 7-Eleven is offering a 10% discount on all products purchased using the digital currency throughout the testing period.

This pilot program marks one of the first real-world examinations of a central bank digital currency in a retail setting in South Korea, highlighting the increasing urgency expressed by the country’s central bank governor regarding the embrace of CBDCs. The initiative not only serves to test digital payments but also positions 7-Eleven as a leader in retail innovation, experimenting with cutting-edge technologies to enhance overall store efficiency.

As the lines between traditional finance and digital currency continue to blur, the success of this pilot could pave the way for broader acceptance of CBDCs in South Korea and beyond, inviting deeper conversations about the future of money and retail transactions.

South Korea’s 7-Eleven Tests Central Bank Digital Currency

The recent pilot program by South Korea’s 7-Eleven stores is a significant step in the adoption of digital currencies. Here are the key points related to this development:

- Central Bank Digital Currency (CBDC) Trial:

- The pilot runs through June and is part of the “Hangang Project.”

- This is one of the first real-world trials of a CBDC in a retail environment in South Korea.

- Eligibility for Participation:

- Only customers with accounts at partner banks—Kookmin, Shinhan, and Woori—can participate.

- Payments are made by scanning a QR code from a digital wallet, similar to mobile payment apps.

- Incentives Offered:

- 7-Eleven is providing a 10% discount on all products when purchased with the CBDC during the trial period.

- Digital Transformation:

- Moon Dae-woo, head of digital innovation, mentioned that the trial aims to improve store efficiency.

- The initiative signifies a step toward broader digital transformation in retail.

- Importance of CBDC:

- The central bank governor stated there is an “urgency” in introducing a CBDC, highlighting its potential significance in the economy.

This initiative could impact readers by shaping the future of how they make transactions and potentially reduce costs through incentives like discounts.

South Korea’s 7-Eleven Embraces CBDC with Innovative Pilot Program

The recent news of South Korea’s 7-Eleven stores integrating the Bank of Korea’s central bank digital currency (CBDC) as part of the “Hangang Project” marks a notable shift in the retail landscape. This initiative places 7-Eleven at the forefront of digital innovation, especially as it is one of the first real-world trials of a CBDC in this specific retail context, providing them a significant competitive edge in the rapidly evolving digital payments arena.

Compared to other global giants such as Amazon and Walmart, which have slowly integrated digital payment options, 7-Eleven’s proactive approach in adopting a CBDC set it apart. Unlike typical loyalty programs or conventional cash-back offers from competitors, 7-Eleven’s immediate 10% discount incentive for transactions made with the digital currency appears to be a strategic move to quickly capture consumer interest. This aggressive marketing technique could position them as a leader in customer engagement, particularly among tech-savvy consumers eager to experiment with new payment methods.

However, this move does not come without its challenges. The requirement for customers to have accounts with specific partner banks may alienate a significant portion of potential buyers who prefer broader banking options or those who are unbanked. Additionally, while the trial period undeniably creates urgency and excitement, the limited window may not provide enough time for customers to fully adapt to the new system, which could lead to mixed experiences and dissatisfaction. If this pilot program fails to create a seamless user experience, it might even deter rather than attract patrons from opting into digital currency payments.

This initiative may benefit younger, tech-oriented consumers who are more inclined to explore digital currency options for their everyday purchases. At the same time, it could create hurdles for traditional cash users or older demographics who may feel overwhelmed or confused by the technological leap. Thus, while 7-Eleven seeks to enhance efficiency and customer experience, they must also tread carefully to ensure inclusivity in their digital transition.