In a significant event for the decentralized finance (DeFi) sector, Loopscale, a newly-launched lending protocol on the Solana blockchain, experienced a major security breach leading to the loss of approximately $5.8 million. On April 26, a hacker executed a series of undercollateralized loans that allowed them to drain roughly 5.7 million USDC and 1,200 Solana (SOL) from Loopscale’s vaults. The incident has raised alarms within the cryptocurrency community as it highlights ongoing vulnerabilities faced by DeFi platforms.

“Our team is fully mobilized to investigate, recover funds, and ensure users are protected,” said Mary Gooneratne, co-founder of Loopscale, in a post on X.

In response to the exploit, Loopscale temporarily halted its lending markets while restricting most app functions, including withdrawals from their vaults, to safeguard user assets as investigations unfold. Despite this setback, Loopscale has restarted loan repayments and top-ups, showcasing their commitment to customer service during this challenging situation.

The breach comes amidst a troubling trend in the cryptocurrency industry, with over $1.6 billion stolen from exchanges and smart contracts in the first quarter of 2025, according to blockchain security firm PeckShield. A significant portion of these losses was linked to the notorious Lazarus Group, a hacking organization with ties to North Korea.

Loopscale launched just a couple of weeks ago, after a six-month test period, as a DeFi lending platform aimed at capital efficiency through a unique order book model. Unlike traditional DeFi peers that rely on liquidity pools, Loopscale strives to match lenders and borrowers directly, an approach that allows for specialized lending markets and innovative lending strategies.

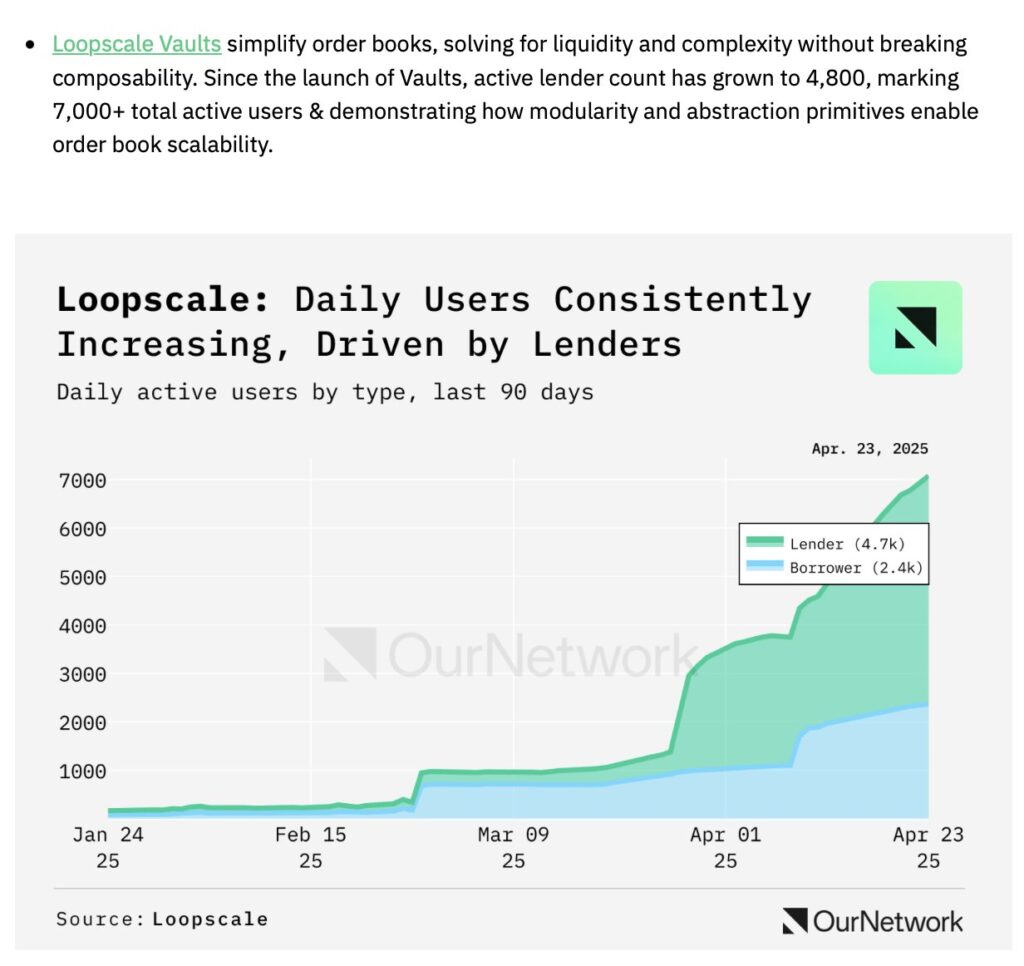

Despite the current crisis, Loopscale boasts an impressive total value locked (TVL) of around $40 million and has drawn in over 7,000 lenders, highlighting its early traction. As the DeFi landscape continues to grow, this incident will serve as a crucial test for Loopscale and a reminder of the importance of security in the rapidly evolving crypto environment.

Loopscale Exploit: Key Updates and Implications

On April 26, 2025, significant events unfolded surrounding the decentralized finance (DeFi) protocol Loopscale. Here are the crucial points regarding the exploit and its implications:

- Significant Financial Loss

- Loopscale experienced an exploit resulting in approximately $5.8 million stolen, comprising 5.7 million USDC and 1200 SOL.

- This loss represents around 12% of Loopscale’s total value locked (TVL).

- Halting of Operations

- The protocol temporarily halted its lending markets to investigate and mitigate the effects of the exploit.

- Currently, all app functions, except for loan repayments and top-ups, are restricted while the team investigates.

- Rapid Response from the Team

- Loopscale’s team is actively working to investigate and recover funds to protect users’ investments.

- Co-founder Mary Gooneratne emphasized the commitment to user protection via an X post.

- Context of Recent Crypto Hacks

- In Q1 2025, over $1.6 billion worth of crypto was stolen from exchanges and smart contracts, with a major attack on ByBit attributed to the Lazarus Group.

- This context underlines the growing vulnerabilities in the crypto space and the need for enhanced security measures for users.

- Unique Lending Model

- Loopscale’s approach uses an order book model to match lenders and borrowers directly, differing from typical liquidity pool models.

- It supports specialized lending markets that include structured credit and undercollateralized lending, aiming to enhance capital efficiency.

- Attractive Yield Rates

- The protocol offers competitive annual percentage rates (APRs), exceeding 5% for USDC and 10% for SOL.

- It is designed to attract diverse users and provide various lending opportunities across multiple tokens.

The implications of this incident not only impact the users of Loopscale but also reflect broader trends in the vulnerabilities of decentralized finance protocols. Awareness and security measures are crucial for anyone participating in the DeFi space.

Loopscale’s DeFi Protocol Disruption: A New Dawn or a Dark Cloud?

The recent exploit faced by Loopscale has thrown the spotlight on the vulnerabilities in decentralized finance (DeFi), particularly in newer protocols aiming to differentiate themselves from established players like Aave and Compound. While Loopscale’s unique positioning as a direct matching platform for lenders and borrowers is commendable, the breach has raised questions about its operational robustness and security measures. This unfortunate incident highlights both the potential and the pitfalls of innovative DeFi lending models.

Competitive Advantages: Loopscale’s approach to lending, particularly through specialized markets for structured credit and undercollateralized loans, positions it as a pioneer in the evolving DeFi landscape. Unlike traditional models that rely on liquidity pools, Loopscale employs an order book system, which may provide better transparency and efficiency in matching borrowers with lenders. This innovative model, combined with attractive annual percentage rates (APRs) of over 5% and 10% for USDC and SOL vaults respectively, could appeal to investors seeking higher yields.

Additionally, the prompt response from Loopscale to restrict vault withdrawals while investigating the exploit shows a commitment to user safety, which might enhance trust among existing and future users who previously perceived DeFi as high-risk.

Competitive Disadvantages: However, the incident undoubtedly dampens Loopscale’s reputation in an arena where security is paramount. The fact that almost 12% of its total value locked (TVL) was exploited raises red flags regarding its security framework, potentially steering cautious investors towards more established platforms which have a proven track record of safeguarding assets. With over $1.6 billion lost to various crypto exploits in the early months of 2025 alone, the stakes are high, and consumers may prioritize security over innovation.

Moreover, Loopscale’s ongoing investigation could lead to prolonged restrictions on various functionalities, limiting the user experience and frustrating both lenders and borrowers during a crucial period for the platform’s growth. The impact could be far-reaching, deterring potential new users who may have been intrigued by its unique offerings but are now put off by the recent events.

Who Benefits and Who Faces Challenges? Institutional investors and tech-savvy crypto enthusiasts who understand the risks involved may find opportunities in Loopscale’s recovery strategies and revamped security measures. If the platform successfully addresses the current vulnerabilities, it could turn the tide and regain user confidence. Conversely, less experienced users may feel overwhelmed and disheartened, leaning towards platforms with a more established safety net. Furthermore, competitors like Aave may see Loopscale’s misfortune as an opportunity to attract wary users looking for safety, thereby increasing their market share in a time of uncertainty.