Caitlin Long, the founder and CEO of Custodia Bank, has raised strong concerns about the U.S. Federal Reserve’s current stance on cryptocurrency regulations. In a recent post on X (formerly known as Twitter), she criticized the Fed for maintaining policies that favor stablecoins issued by major banks while restricting traditional banks from directly engaging with cryptocurrency assets. Despite the Fed’s recent decision to relax certain rules regarding bank involvement in crypto, Long pointed out that a key policy statement has remained unchanged since January 2023, effectively blocking banks from issuing stablecoins on open and permissionless blockchains.

Long emphasized that this regulatory environment gives larger financial institutions an unfair advantage in launching their own versions of stablecoins, as the market awaits clearer legislation from Congress. She urged lawmakers to expedite potential stablecoin legislation that could override these restrictive policies. According to Long, the Fed’s guidelines not only hinder banks from entering the stablecoin market but also prevent them from acting as market makers in popular cryptocurrencies like Bitcoin and Ether.

“The Fed has maintained a regulatory preference for permissioned stablecoins (i.e., big-bank versions),” Long stated, underscoring her belief that such policies create unnecessary obstacles for banks looking to participate in the evolving crypto landscape.

Moreover, she highlighted operational issues that banks face when looking to offer crypto custody services, such as complications with covering transaction fees—an element crucial for any custodian working with blockchain technology. In her critique, she noted that the Fed has effectively added “sand in the wheels” of banks that are eager to engage in crypto custody while promoting stablecoins backed by traditional financial players.

“The Fed definitely won on PR spin—it listed a long list of guidance it rescinded but omitted ANY mention of the guidance it kept,” Long remarked, indicating that the Fed’s communication may have misled many observers.

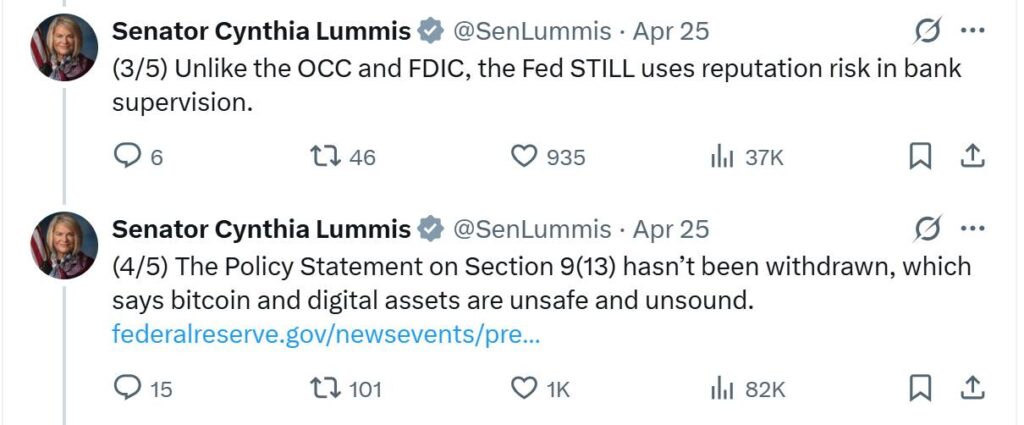

In response to Long’s comments, Senator Cynthia Lummis, a prominent advocate for digital assets, echoed similar sentiments, labeling the Fed’s recent moves as mere “lip service.” She referred specifically to the section of the Fed’s policy that categorizes digital assets like Bitcoin as “unsafe and unsound.” Meanwhile, not all reactions to the Fed’s announcement have been negative; some industry figures, like Michael Saylor, have welcomed the news as a step toward enabling banks to support Bitcoin more freely.

Caitlin Long Critiques Fed’s Crypto Policy

Caitlin Long, founder and CEO of Custodia Bank, has voiced significant concerns regarding the US Federal Reserve’s ongoing regulatory approach to cryptocurrency. Here are the key points from her recent comments:

- Criticism of Fed’s Policies:

- The Federal Reserve has kept an anti-crypto policy favoring big-bank-issued stablecoins.

- Recent rescindments of crypto guidelines still leave important restrictions intact, particularly from a January 2023 statement.

- Banks are prohibited from directly engaging with crypto assets and from issuing stablecoins on permissionless blockchains.

- Preference for Permissioned Stablecoins:

- Long argues that this regulatory preference gives traditional financial institutions an unfair advantage to launch private stablecoins.

- Existing regulations effectively delay broader market participation in stablecoin legislation.

- Impact on Banks’ Crypto Participation:

- The Fed’s policy restricts banks’ ability to participate in crypto markets as principals, hindering market-making efforts for currencies like Bitcoin (BTC), Ether (ETH), and Solana (SOL).

- Operational challenges for banks desiring to offer crypto custody services are intensified, particularly in managing on-chain transaction fees.

- Call for Legislative Action:

- Long urges Congress to expedite the passing of a federal stablecoin bill, which could potentially override the Fed’s restrictive stance.

- She emphasizes the importance of quick legislative action for the future of digital assets in finance.

- Reactions from Politicians and Executives:

- Senator Cynthia Lummis criticized the Fed’s policies as “lip service,” indicating potential legislative pushback.

- Some crypto executives interpreted the Fed’s recent announcements positively, signifying newfound opportunities for banks to support cryptocurrencies.

“The Fed keeps ‘sand in the wheels’ of banks entering crypto custody while advancing permissioned stablecoins backed by major financial institutions.” – Caitlin Long

Understanding these dynamics is crucial for individuals interested in the evolving landscape of cryptocurrency and its integration into the traditional financial system. The tension between regulatory frameworks and banking policies could significantly impact the accessibility and adoption of digital assets in everyday finance.

Caitlin Long vs. The Federal Reserve: A Fork in the Crypto Road

Caitlin Long, the influential founder and CEO of Custodia Bank, has raised significant concerns regarding the Federal Reserve’s stance on cryptocurrency regulations, particularly its inclination towards big-bank-issued stablecoins. While the Fed’s recent easing of previous crypto partnership guidelines might seem beneficial, Long’s critique highlights a deeper issue: a systemic bias that could stifle competition and innovation in the crypto space.

Competitive Advantages of Long’s Position: By positioning herself as a champion for decentralized finance, Long advocates for a level playing field that could empower smaller firms and startups. Her critique of the Fed suggests that maintaining restrictions on banks engaging with crypto hinders opportunities for competition, which is essential for a vibrant market. The backdrop of an anticipated stablecoin bill in Congress could serve as a linchpin for legislative reform, potentially allowing crypto-native businesses and new entrants to flourish. This proactive stance may resonate positively with advocates of financial decentralization who believe in the democratization of finance.

Disadvantages and Potential Consequences: On the flip side, Long’s emphasis on the restrictive policies and their implications may alienate traditional banking institutions that have been grappling with integrating crypto into their existing frameworks. The Fed’s preference for permissioned stablecoins appears to provide a solid foundation for larger banks to consolidate their influence in the crypto sector. This consolidation could create an uneven playing field, favoring established players over innovators, which may eventually lead to a homogenized market less favorable to end-users.

Who Could Benefit or Struggle: The ongoing tug of war between crypto proponents like Long and traditional financial institutions could have varied implications for different stakeholders. Companies entrenched in finding innovative solutions within the decentralized finance world may gain from Long’s advocacy and the potential for legislative change. On the other hand, traditional banks, while initially benefiting from the Fed’s protective stance, may eventually find themselves with increased scrutiny as lawmakers become more hostile to monopolistic practices. Ultimately, each group must navigate the dynamic landscape shaped by regulatory shifts, public opinion, and the potential for legislative action in the near future.