Today’s headlines in the cryptocurrency industry reveal exciting developments that could reshape the future of digital finance. Tether CEO Paolo Ardoino has announced an ambitious new AI platform that will support transactions in popular cryptocurrencies such as Bitcoin and Tether’s own USDT. This initiative not only promises to enhance the user experience with the integration of artificial intelligence but also aims to prioritize a decentralized approach with its “fully open-source AI runtime” operating on a peer-to-peer network.

In another significant update, the Solana Foundation has successfully addressed a serious security vulnerability that could have allowed unauthorized minting of certain sensitive tokens. Discovered on April 16, this zero-day bug raised concerns among users, but swift action was taken, and all funds remain secure as no exploit has been reported. The measures taken by Solana demonstrate their commitment to safeguarding their ecosystem.

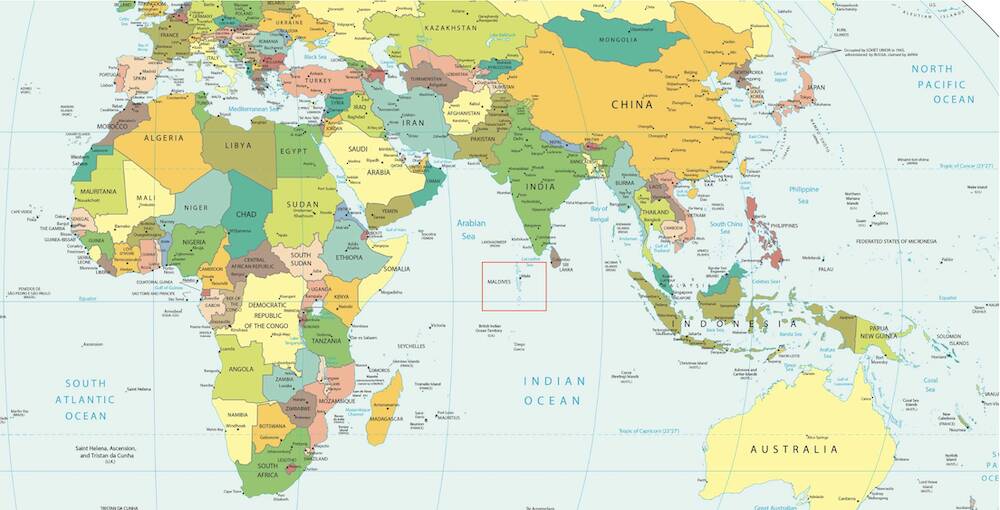

Meanwhile, the Maldives has signed a remarkable $9 billion deal with Dubai-based MBS Global Investments to establish itself as a burgeoning international crypto hub. This ambitious project plans to build an extensive facility in the capital, Malé, aimed at hosting blockchain, crypto, and Web3 firms. The deal is seen as a strategic move to diversify the Maldivian economy, which heavily relies on tourism.

As the cryptocurrency landscape continues to evolve, these announcements highlight the innovative strides being made in technology and investment, signaling a dynamic shift in how these digital assets are integrated into global economies.

Important Developments in the Crypto Space

The recent announcements and updates in the cryptocurrency sector could have significant implications for users, investors, and the overall market. Here’s a summary of key points:

-

Tether AI Platform Launch:

- Tether CEO Paolo Ardoino announced the development of Tether’s AI platform, which will support peer-to-peer transactions using Bitcoin and USDt (USDT).

- The platform aims to offer “personal infinite intelligence” and will not utilize API keys, ensuring decentralization.

- The launch is anticipated by the end of Q1 2025, emphasizing the growth of AI integration in cryptocurrency transactions.

-

Solana Security Vulnerability Fixed:

- A security flaw in the Solana network allowed for unlimited minting of Token-22 tokens but has been patched successfully.

- The issue was discovered on April 16, with validators adopting fixes soon after, ensuring that all funds remain secure.

- This highlights the importance of vigilance in blockchain security and fosters user confidence in cryptocurrency platforms.

-

Maldives to Become a Crypto Hub:

- The Maldivian government signed a $9 billion agreement to develop a crypto hub, aiming to attract foreign investments and diversify the economy beyond tourism.

- The project is expected to encompass an extensive facility for blockchain and Web3 companies, potentially enhancing the region’s economic landscape.

- This move could influence crypto investors and businesses, opening new avenues for economic growth and collaboration in the crypto space.

These developments underscore the rapid evolution of the cryptocurrency landscape, indicating shifting dynamics that may impact user experience, security, and investment opportunities.

Crypto Innovations and Developments: A Comparative Analysis

The world of cryptocurrency and blockchain technology continues to evolve at an astounding pace. Recently, several significant announcements have emerged, each presenting unique competitive advantages and drawbacks in the crypto space. For instance, Tether’s introduction of its AI platform promises to merge cutting-edge technology with crypto payments, presenting an intriguing proposition for users who crave both innovation and security.

Tether’s AI Advantage

Tether’s foray into the AI realm is particularly notable due to its integration with stablecoins such as USDT and Bitcoin. This innovative move allows users to execute transactions directly within a highly modular and composable framework, underscoring Tether’s commitment to decentralized technology. With an “unstoppable peer-to-peer network,” Tether AI could attract tech-savvy users seeking both convenience and security in transactions, potentially reshaping the landscape of digital payments.

However, this bold initiative could pose challenges for existing financial systems hesitant to adopt such radical changes. Traditional payment platforms may find themselves at a disadvantage as they scramble to keep pace with the rapid evolution of decentralized finance (DeFi) solutions offered by Tether. The added layer of adaptability across various devices could appeal to a demographic increasingly wary of centralized control, making Tether a formidable competitor in the evolving payment ecosystem.

Security Improvements in Solana

Nonetheless, even with the successful resolution of the vulnerability, the incident could have lingering effects on the perception of Solana’s security infrastructure. Competitors could leverage this opportunity to underscore the importance of robust security protocols, potentially swaying prospective users who prioritize stability and trust when choosing their blockchain platforms.

Maldives’ Ambitious Crypto Hub

However, the ambitious scale of the project presents potential pitfalls. The reliance on foreign investment could create vulnerabilities, especially if global market conditions shift unfavorably. Additionally, local governance and regulatory frameworks must evolve to adapt to the complexities of the crypto ecosystem. Failure to do so could result in operational challenges, posing risks to the investment landscape that might deter future projects.

In summary, while Tether, Solana, and the Maldives are paving the way for exciting advancements in the crypto industry, each has its own set of competitive advantages and challenges to navigate. As these developments unfold, the responses from traditional financial sectors, the concerns of investors, and the adaptability of regulatory environments will greatly influence the success of these crypto initiatives.