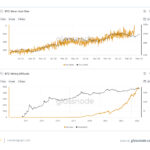

In a significant shift for the cryptocurrency sector, investment bank Compass Point has downgraded Marathon Digital (MARA) from a neutral to a sell rating, slashing its price target from $25 to just $9.50. This move suggests that the bank anticipates a dramatic downturn of more than 25% from the current price, which hovers around $13. Analysts highlighted the company’s declining profitability, citing Marathon’s hash price dropping below 5.5 cents as a troubling sign.

Marathon Digital’s core business revolves around bitcoin mining, where companies earn Bitcoin in return for their computing power. However, as rewards from mining decrease and energy expenses remain high, the financial dynamics of this operation have come under intense scrutiny. With Compass Point estimating a significant cash burn on the horizon, the specter of shareholder dilution looms large.

“There’s better ways to get BTC beta,” analysts noted, pointing to the challenges currently faced by Marathon.

This downgrade comes at a time when the entire high-performance computing (HPC) and AI infrastructure industry is experiencing a downturn. Other companies in the space, like Core Scientific (CORZ) and TeraWulf (WULF), have similarly struggled as excitement around AI has diminished. Valuations within the HPC sector have plummeted, with multiples falling from as high as 15 times last year to around 5 times at present. This downturn is fueled by concerns over customer concentration and revenue variability from major players such as Microsoft cutting back on capital expenditures.

Despite these challenges, Compass Point does see potential long-term benefits for the sector, noting an increasing demand for AI infrastructure and investment commitments from cloud services providers. Yet for now, Marathon Digital’s fundamentals appear insufficient to support its current market valuation, leaving investors and stakeholders to navigate a difficult landscape.

Marathon Digital Downgraded by Compass Point

The recent downgrade of Marathon Digital (MARA) by Compass Point highlights several critical aspects that could impact investors and stakeholders in the cryptocurrency and high-performance computing sectors. Here are the key points:

- Downgrade to a Sell Rating:

- Compass Point downgraded Marathon Digital from neutral to a sell rating.

- Price target slashed to $9.50 from $25, indicating over 25% downside from the current price.

- Declining Profitability:

- Marathon’s hash price is now below 5.5 cents, which signals a decrease in profitability.

- Operational levels suggest significant cash burn, posing a risk of shareholder dilution.

- Dependence on Bitcoin Mining:

- Marathon’s business model relies heavily on bitcoin mining, compensation through computing power.

- Mining rewards are reducing while energy costs are persistent, complicating economic viability.

- Comparison to Bitcoin Prices:

- Marathon is trading at a premium compared to the price of bitcoin itself, which is unfavorable for investors.

- Bigger Market Context:

- Broad slump in high-performance computing (HPC) and AI infrastructure impacting valuations.

- Peer companies like Core Scientific and TeraWulf are also facing underperformance year-to-date.

- Sector multiples have declined from as high as 15x to around 5x currently.

- Long-Term Outlook:

- Potential future tailwinds include rising demand for AI infrastructure and capital expenditure commitments from cloud service providers.

- Current fundamentals of Marathon remain too weak to support its market valuation.

Impact on Readers’ Lives:

Investors considering exposure to cryptocurrency-related stocks may need to reassess their strategies in light of these developments. Awareness of sector-wide trends can help inform more robust investment decisions.

Marathon Digital’s Downgrade: What It Means for Investors and Industry Peers

The recent downgrade of Marathon Digital (MARA) by Compass Point from neutral to sell marks a significant shift in investor sentiment within the cryptocurrency mining sector. This decision highlights the growing concerns over the sustainability of Marathon’s business model amidst declining hash prices and increasing operational costs. With analysts projecting a substantial downside from the current trading levels, potential investors may want to tread carefully.

One of the key competitive advantages that competitors in the cryptocurrency mining market may harness in light of Marathon’s downgrade is the opportunity to attract capital and talent away from a company perceived as struggling. As noted in the downgrade, Marathon’s hash price now resting below 5.5 cents signals a challenging profitability scenario, which might lead to cash burn and subsequent shareholder dilution. Rivals such as Core Scientific (CORZ) and TeraWulf (WULF), although not without their own issues, may present more appealing options for investors seeking exposure to bitcoin mining.

While it’s true that the broader high-performance computing (HPC) sector is feeling the pinch, with collapsing valuations and waning investor enthusiasm in sectors like AI, companies that can leverage capital expenditures and customer commitment will likely weather the storm better. Such market dynamics suggest that companies with more robust financial health or lower operational costs could turn this uncertainty into an advantage, potentially capturing market share from Marathon.

However, it’s not just rival companies that could benefit; savvy investors looking for bargains might find that the downturn presents a strategic entry point into the sector. Observers might argue that while Marathon is currently overvalued, certain market shifts could favor a rebound if the demand for cryptocurrency mining revisits its previous highs. Yet, the persistent discussions around energy costs and profitability could deter more risk-averse investors. Moreover, firms that are heavily involved in HPC with diversified portfolios may also face challenges, as consumer concentration and slowed spending from tech giants like Microsoft could hamper growth across the board.

As with any investment, the implications of Marathon’s downgrade ripple across the market landscape, indicating a need for caution and strategic positioning. Investors and industry players will need to navigate these waters carefully, weighing the risks against potential long-term rewards in the evolving digital currency and computing realms.