In a bold move to enhance financial accessibility, Thailand’s Ministry of Finance is set to launch a new initiative aimed at engaging retail investors in the nation’s digital economy. The government plans to issue $150 million worth of digital investment tokens, known as “G-tokens,” which will allow everyday citizens the opportunity to invest in government bonds. This announcement was made by Finance Minister Pichai Chunhavajira during a recent briefing, following the cabinet’s approval of the initiative.

According to Patchara Anuntasilpa, the director-general of the Public Debt Management Office, these tokens will play a crucial role in raising funds from the public as part of the existing budget borrowing plan. One of the key benefits of the G-token system is its accessibility; retail investors can start investing with as little as $3, a significant departure from the traditional investment landscape in Thailand that has primarily catered to institutional and affluent investors.

Minister Pichai highlighted that this initial token mint aims to test the market, providing investors with a potentially more rewarding investment compared to the low yields offered by commercial banks, which currently hover around 1.25% for a 12-month fixed deposit. Notably, the G-tokens will not be classified as cryptocurrencies and will be tradable exclusively on licensed digital asset exchanges.

“One big selling point of the token is that it allows more retail investors to become part of the digital economy,”

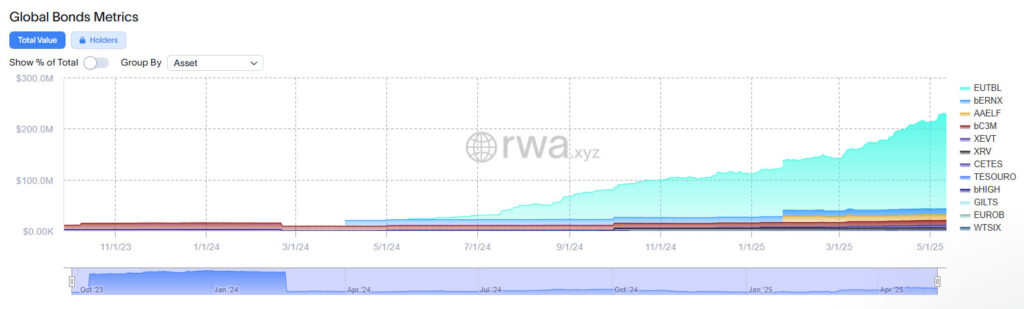

This initiative aligns with a broader trend of tokenized assets gaining traction globally. The value of tokenized bonds has surged recently, with analytics showing a doubling of onchain value since the beginning of the year. As Thailand embraces this digital finance landscape, it continues to explore innovative ways to make investments accessible to all, opening doors that were previously only available to a select few.

Overall, the G-token initiative marks a significant step towards democratizing investment opportunities in Thailand, reflecting a growing global interest in integrating traditional financial products with digital innovation.

Thailand’s Digital Investment Tokens: Key Points

Thailand’s Ministry of Finance is launching a novel investment opportunity aimed at retail investors through digital tokens. Here are the critical aspects of this initiative:

- $150 Million Token Issuance

- The Ministry of Finance plans to issue $150 million worth of digital investment tokens, known as “G-tokens,” within the next two months.

- Accessibility for Retail Investors

- Retail investors can participate in government bond investments starting at just $3, opening up opportunities previously limited to institutional and wealthier investors.

- Higher Returns Than Bank Deposits

- The G-tokens will offer returns that are expected to be higher than the current low interest rates provided by Thai banks (around 1.25% for 12-month fixed deposits).

- Not a Cryptocurrency

- While the G-tokens will utilize blockchain technology, they are not classified as cryptocurrencies and can only be traded on licensed digital asset exchanges.

- Regulatory Framework

- The initiative follows regulatory announcements by Thailand’s securities regulator aimed at creating a tokenized securities trading system for institutional investors.

- Global Trends in Tokenized Bonds

- The market for tokenized bonds globally has been rapidly growing, with a significant increase noted in the value of tokenized US treasures this year alone.

This initiative could potentially impact retail investors by democratizing access to government bonds and providing better investment options in a low-interest-rate environment, fostering greater participation in the digital economy.

Thailand’s G-Tokens: A New Era in Retail Investment

Thailand’s Ministry of Finance is stepping into the digital investment arena with the announcement of the G-tokens, a forward-thinking initiative aimed at democratizing access to government bonds for retail investors. This move not only reflects a growing global trend of digital asset integration but also positions Thailand as a competitive player in the rapidly evolving market of digital finance.

One of the standout advantages of the G-tokens is their accessibility; with a minimal entry point of just $3, they open the doors of government bond investment to a broader audience. Historically, such opportunities have been mainly reserved for institutional and affluent investors. This shift not only encourages financial inclusion but also fosters a more engaged digital economy within Thailand.

However, while the G-tokens attempt to attract retail investors, there are potential drawbacks worth noting. The specifics around yields were not disclosed, which could lead to uncertainty among potential investors, especially when compared to traditional bank offerings. Currently, Thai banks offer a mere 1.25% for fixed deposits. If the yield on these tokens does not significantly exceed this rate, the attractiveness of the investment may wane.

This initiative could significantly benefit retail investors who have been previously sidelined from lucrative investment avenues. Additionally, individuals looking for investments that offer higher returns than bank savings might find G-tokens appealing. Conversely, the limited trading access on licensed digital asset exchanges could pose a challenge for non-Thai citizens living in Thailand, potentially alienating a segment of the investor population interested in participating in this innovative offering.

Interestingly, the G-tokens not only align with global trends in tokenized assets – where the market has seen a substantial uptick, especially in the U.S. bond value on-chain – but they also arrive at a critical moment when governments worldwide are exploring methods to engage retail investors more deeply in national finances.

In conclusion, the launch of G-tokens symbolizes a significant shift in Thailand’s financial landscape, encouraging local participation while also reflecting a broader trend of integrating digital assets in traditional finance. As this initiative unfolds, its success could pave the way for future innovations in the region and beyond.