The U.S. Securities and Exchange Commission (SEC) has recently announced further delays regarding significant cryptocurrency-related applications, leaving the market buzzing with speculation. Specifically, the SEC is holding off on deciding Bitwise’s much-anticipated application to incorporate staking into its Ether exchange-traded fund (ETF), as well as Grayscale’s proposal for an XRP ETF. This extension allows the agency an additional 45 days to review the proposed changes and address various raised concerns.

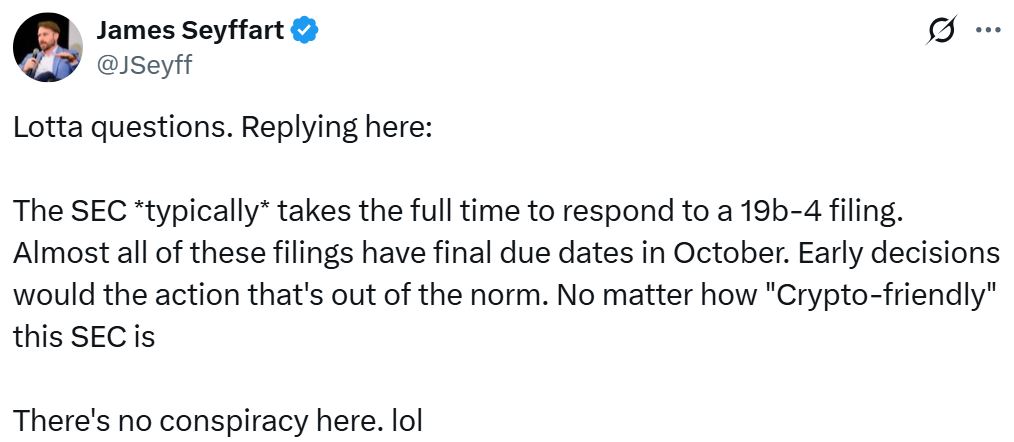

According to a statement released on May 20, the SEC aims to either finalize its decision or defer it by May 22. Furthermore, the agency has also put off verdicts on Grayscale’s XRP tracking ETF and Bitwise’s Solana tracking fund, seeking public feedback as part of its thorough review process to ensure that these proposals align with regulatory standards. Bloomberg ETF analyst James Seyffart highlighted that these delays are not unusual; the SEC typically takes the full duration allowed to respond to such filings, with most decisions on ETF proposals expected to be finalized in October.

“No matter how crypto-friendly this SEC is, there’s no conspiracy here,” Seyffart commented on social media, although he anticipates similar delays for additional spot crypto ETF applications, including those for Litecoin.

As the SEC grapples with an influx of ETF filings, other critical deadlines loom. Grayscale’s Polkadot tracking ETF is set for review by June 11, followed by a decision on 21Shares’ Polkadot ETF on June 24. This influx of applications follows a period of increased regulatory scrutiny under former SEC Chair Gary Gensler, who presided over a notably stringent enforcement policy that resulted in around 100 action items during his tenure. Since Gensler’s resignation in January, the regulatory climate seems to have softened slightly, with several firms previously entangled in legal battles seeing their cases dismissed.

As the landscape evolves, questions surrounding the SEC’s stance on cryptocurrency investment and regulation continue to spur critical discussions among industry watchers and investors alike.

The SEC’s Delays on Crypto ETF Applications

The recent decisions by the US Securities and Exchange Commission (SEC) regarding cryptocurrency ETFs have significant implications for the market and investors. Here are the key points to consider:

- Delays on Applications:

- The SEC has postponed decisions on multiple crypto ETFs including Bitwise’s Ether ETF and Grayscale’s XRP ETF.

- They extended the decision period for Bitwise’s application by 45 days to fully consider issues raised in the proposed rule change.

- Public Comments and Further Analysis:

- The SEC is seeking public input and initiating proceedings for further analysis of proposals to ensure they meet regulatory standards.

- This approach could influence how quickly new crypto products enter the market, affecting potential investor opportunities.

- Analyst Expectations:

- Analyst James Seyffart indicated that delays in ETF approvals are common, with decisions likely extending to October.

- He emphasized that there is no conspiracy behind the delays, suggesting that the SEC’s processes are standard procedure.

- Future Outlook:

- Other pending ETF applications are expected to face similar delays, including applications for Litecoin ETFs.

- Some analysts believe Litecoin has a higher chance of early approval compared to other assets.

- First approvals may not occur until late June or early July, with more expected in the fourth quarter of the year.

- Historical Context:

- The SEC has seen a shift in its regulatory stance post the departure of former chair Gary Gensler, who had a reputation for aggressive regulation.

- This change could signal a more favorable environment for crypto-related investments moving forward.

Considering these developments is essential for investors looking to navigate the evolving crypto landscape, as the regulatory environment can significantly impact market opportunities and risks.

The SEC’s Delays: Implications for Cryptocurrency ETFs

The recent decision by the US Securities and Exchange Commission (SEC) to postpone rulings on multiple cryptocurrency exchange-traded funds (ETFs) has sent ripples through the financial ecosystem. Specifically, Bitwise’s application to integrate staking into its Ether ETF and Grayscale’s XRP ETF bid are among those pushed back. While this delay underscores the SEC’s cautious approach, especially in light of a surge in ETF applications, it also illuminates significant competitive advantages and disadvantages for the parties involved.

Competitive Advantages: For potential investors and institutions eyeing these cryptocurrency ETFs, the delay provides more time for due diligence. Investors can assess the evolving regulatory landscape and market conditions without the pressure of imminent approvals. Furthermore, with analysts like James Seyffart suggesting that early approvals are unlikely, firms might redirect their strategies toward compliance and preparation, reinforcing their infrastructure to meet eventual regulatory requirements.

Competitive Disadvantages: Conversely, the extended timeline could hinder the growth of crypto instruments in the mainstream investment landscape. ETFs like Bitwise’s and Grayscale’s have been anticipated as pivotal vehicles for institutional investment into cryptocurrencies. Their delays may create frustration among investors who had hoped for quicker access to these assets, potentially driving them to alternative investment options outside the regulated ETF framework.

This situation could benefit established firms within the crypto space that have deeper pockets and a longer-term view, as they may seize the opportunity to bolster their operations and establish strong positioning against larger players. On the other hand, newer entrants and smaller firms may face challenges in maintaining investor confidence, especially if they lack the resources to weather a protracted approval waiting game. Thus, while the SEC’s cautious stance aims to ensure regulatory compliance, it simultaneously presents both strategic opportunities and challenges for various stakeholders in the rapidly evolving cryptocurrency market.

Furthermore, with other crypto ETF submissions, such as those for Litecoin, also lingering in a similar state, the marketplace could see a diversion of investor interest. If Litecoin’s ETF proposal gains momentum as analysts predict, it could overshadow the effects of delays on Bitwise or Grayscale, effectively reshaping investor focus and capital allocation in the crypto industry.

As the SEC continues to navigate this complex web of applications and regulatory scrutiny, its decisions will ultimately affect the trajectory of cryptocurrency investment vehicles. Stakeholders would do well to stay vigilant and adaptive to the shifting regulatory landscape, ensuring they can leverage any potential market movements resulting from these delays.