Last week marked a significant event in the cryptocurrency landscape with the Consensus Toronto 2025 conference, a gathering that showcased some of the brightest minds in the digital asset space. For those who couldn’t attend, CoinDesk has stepped in to provide comprehensive coverage that includes insights from global thought leaders across three full days. Discussions range from innovative blockchain applications in entertainment to engaging content targeting the next generation of investors.

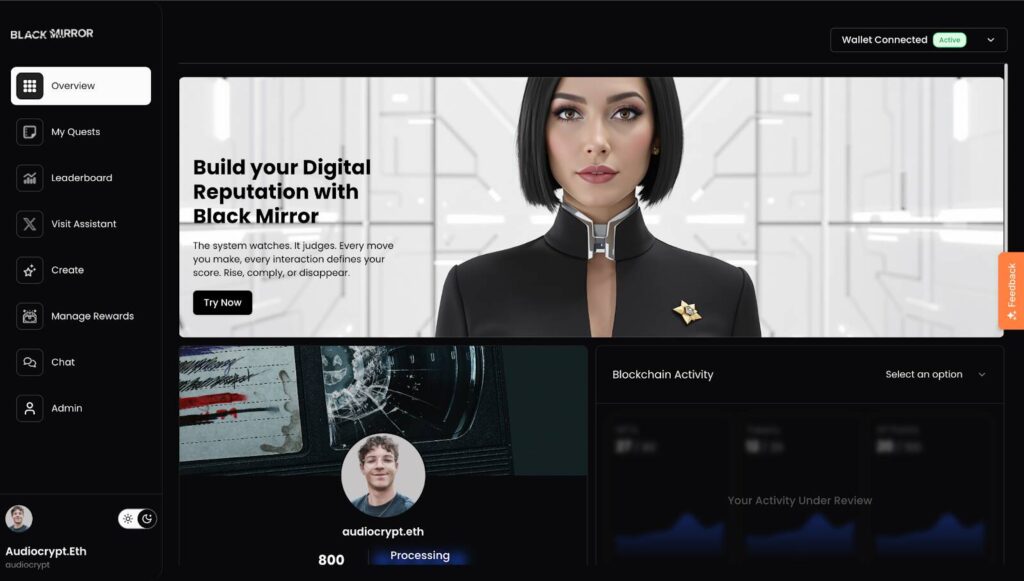

One of the standout features includes a segment on how the popular series Black Mirror is utilizing blockchain technology to enhance fan engagement and content ownership. Shivani Phull from Pixelynx elaborated on this fascinating intersection of storytelling and technology, emphasizing how the series is evolving from traditional passive viewer experiences to interactive participant-driven narratives.

Additionally, a segment titled “Ask an Expert” featured Eric Tomaszewski of Verde Capital Management, who discussed the appeal of blockchain-based investments to a new generation of investors. Highlighting the shift in how ownership is perceived in the age of Web3, he explained that engagement is becoming just as valuable as traditional asset ownership. This new paradigm has the potential to redefine what it means to invest and participate in the digital economy.

While discussions from Black Mirror’s on-chain projects indicate a future where intellectual property can be manipulated and monetized in innovative ways, the implications for content creators and investors alike are profound. Tokens that encourage community interaction and reward engagement are paving the way for a transformation in the entertainment industry, challenging existing revenue models and reimagining ownership rights.

“The future of entertainment lies in embracing this shift through new frameworks that provide clear guardrails for IP usage, that preserve integrity, protect rights and enable value to accrue to fans and creators in a fair and transparent way.” – Shivani Phull, CFO, Pixelynx Inc.

For financial professionals, these discussions underscore the importance of understanding how these transformative trends can influence investment strategies and client engagement. As the landscape continues to evolve, staying informed about these developments is crucial for navigating the ever-changing world of cryptocurrency and digital assets.

Consensus Toronto 2025 Insights

Here are the key takeaways from the Consensus Toronto 2025 event and its implications:

- Blockchain Revolution in Entertainment

- Black Mirror is using blockchain to revolutionize fan engagement and participation in storytelling.

- This shift signifies a move from passive consumption to interactive experiences shaped by audiences, particularly Gen Z and Gen Alpha.

- Traditional IP Models Transforming

- IP holders are faced with the challenge of adapting to generative AI, which can create derivative content.

- Blockchain technology provides solutions for rights verification, community ownership, and tokenized incentives.

- Case Study: Black Mirror’s Token Initiative

- The show has partnered with Pixelynx and KOR Protocol to launch a token that rewards fan engagement.

- This interactively gamifies the fan experience, allowing up to 300,000 participants to earn rewards and exclusive access.

- The New Era of Ownership in Web3

- Ownership in Web3 goes beyond asset holding; it involves participation and influence within digital ecosystems.

- This participatory model offers a form of ‘engagement yield,’ where user activity translates into tangible rewards.

- Future Implications for Financial Advisors

- Financial advisors must adapt to new investment paradigms that consider engagement and behavior over traditional asset metrics.

- The evolving landscape presents unique opportunities and risks that require thoughtful client engagement strategies.

“By making IPs interactive, tokenized and on-chain, rights holders aren’t just experimenting—they’re sketching the blueprint for Storytelling 3.0.” – Shivani Phull, CFO, Pixelynx Inc.

Decoding the Future: Blockchain Innovation at Consensus Toronto 2025

Last week’s Consensus Toronto 2025 showcased the rapid evolution of digital assets, particularly how blockchain is transforming traditional storytelling. Similar events have emerged lately, but what makes this gathering, supported by CoinDesk, stand out among its peers? Let’s dive into the advantages and disadvantages while highlighting potential impacts on various stakeholders.

Competitive Advantages: Consensus Toronto 2025’s focus on interactive content through blockchain, as evidenced by the collaboration between Black Mirror and Pixelynx, highlights a unique approach to engaging with audiences. Other conventions often focus heavily on raw investment opportunities or speculative trends without offering substantial insights into the cultural impact of technological advancement. The ability to listen to industry leaders like Shivani Phull and Eric Tomaszewski brings forth a rich dialogue on how storytelling and intellectual property are being redefined. By addressing a younger audience—Gen Z and Gen Alpha—through participatory storytelling models, this event caters to the demands of today’s digital natives who crave ownership and engagement.

Competitive Disadvantages: While focusing on the integration of blockchain in entertainment and IP rights presents an intriguing narrative, it may alienate traditional investors who are primarily interested in tangible financial gains. For instance, the concept of “digital yield” tied to reputation-based tokens can be complex and could confuse investors unfamiliar with this emerging field. Consequently, financial advisors may face challenges when trying to communicate these new models, risking investor skepticism.

Beneficiaries and Challenges: Financial advisors near Boston, particularly those attending the Grayscale-sponsored Crypto Connect event, could gain a wealth of insights into these innovative paradigms. Understanding blockchain’s role in transforming IP could offer advisors a competitive edge, allowing them to better serve tech-savvy clients seeking new investment opportunities. However, for traditional media executives and IP holders accustomed to established revenue streams, this shift may prompt existential crises. They may grapple with relinquishing control over narratives and adapting to this decentralized environment, which could create friction within established business models.

The discussions and developments following Consensus Toronto 2025 are not just industry news — they represent a crucial juncture for the future of entertainment, finance, and how consumers interact with both. Engaging with these themes presents opportunities but also requires a willingness to adapt and embrace the future of storytelling and investment.