In a significant move in the cryptocurrency realm, Singapore-based artificial intelligence firm Genius Group has resumed its acquisition of Bitcoin, adding 24.5 BTC worth approximately $2.7 million to its corporate treasury. This decision comes after the company faced a temporary ban due to a legal ruling from a US court that restricted its ability to sell shares, raise funds, and invest in Bitcoin using investor contributions. Following a favorable ruling from the US Court of Appeals, Genius Group is now on a path to rebuild shareholder value while advancing its business strategy aimed at understanding the digital economy.

With this latest purchase, Genius Group’s Bitcoin holdings have increased by 40%, bringing the total to 85.5 BTC acquired for around $8.5 million, at an average cost of $99,700 per coin. CEO Roger Hamilton expressed optimism about the company’s future, highlighting its commitment to educating individuals on transformative technologies, including artificial intelligence and Bitcoin. He emphasized that expanding their Bitcoin reserves is central to their long-term vision.

“We are pleased to be able to begin the task of rebuilding shareholder value from the damage caused by the legal actions of third parties, and delivering on our 2025 plan,” Roger Hamilton noted.

Genius Group isn’t alone in its Bitcoin accumulation strategy. The approach mirrors that of MicroStrategy, a leading company in the corporate Bitcoin treasury space, which has been aggressively buying Bitcoin and has amassed a substantial portion of the total supply. Other companies, including a Bahrain-based catering firm and luxury watchmaker Top Win, are also embracing similar strategies, signaling a broader trend among businesses to incorporate Bitcoin into their financial portfolios.

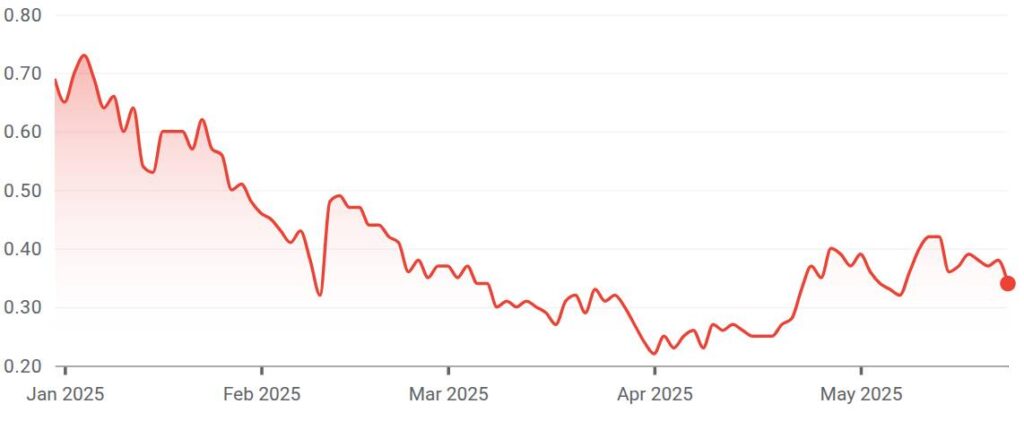

As of now, Genius Group is listed on the New York Stock Exchange with a market cap of $24.34 million. However, its stock has seen a notable decline, trading at $0.34, considerably less than its value at the start of the year. This reflects the challenges faced by the company amid its legal battles and evolving market conditions related to cryptocurrencies.

Genius Group Expands Bitcoin Treasury

Key points regarding the recent developments at Singapore-based Genius Group and their strategic investment in Bitcoin:

- Resumption of Bitcoin Accumulation: Genius Group has announced it is resuming the accumulation of Bitcoin after a favorable ruling by the US Court of Appeals.

- Expansion of Treasury: The company increased its Bitcoin treasury by 40% with the purchase of 24.5 BTC, amounting to approximately $2.7 million.

- Current Holdings: Genius Group now holds a total of 85.5 BTC, acquired for around $8.5 million, at an average price of $99,700 per coin.

- CEO’s Commitment: CEO Roger Hamilton emphasized rebuilding shareholder value and supports the vision for a digital workforce through education on AI, Bitcoin, and community.

- Market Position: Genius Group is listed on the NYSE with a current market cap of $24.34 million and its stock price has significantly dropped, trading under $0.34.

- Trend Following: The firm follows the trend of companies like MicroStrategy, which holds a substantial amount of Bitcoin, influencing others to adopt similar treasury strategies.

- Industry Adoption: Other companies, including a Bahrain-based catering firm and luxury watchmaker Top Win, are also adopting Bitcoin accumulation strategies, reflecting a growing trend in corporate investment in cryptocurrency.

Genius Group is preparing the world for the upcoming digital workforce and economy, making Bitcoin treasury building a key part of their strategic plan.

The expansion of Genius Group’s Bitcoin treasury may impact readers by presenting a view on the growing acceptance of cryptocurrency as a legitimate asset for corporates, potentially influencing personal investment strategies in digital currencies.

Genius Group Expands Bitcoin Treasury: A New Wave in Corporate Crypto Adoption

In a bold move, Singapore’s Genius Group has re-entered the Bitcoin landscape by significantly boosting its corporate treasury. This decision comes after a period of legal constraints that prevented the firm from expanding its cryptocurrency holdings. The favorable court ruling propelling this new acquisition is noteworthy, as it reflects both the volatility of legal battles and the complexities businesses face when venturing into cryptocurrency investments.

Competitive Advantages: Genius Group’s strategy to increase its Bitcoin holdings by 40% mirrors the increasingly popular trend among corporations, inspired by the likes of MicroStrategy. This positioning not only enhances Genius Group’s financial portfolio but also signals confidence in Bitcoin as a long-term asset. With educational initiatives focused on AI and cryptocurrency, the firm aims to equip the next generation with necessary skills for the evolving digital economy. This forward-thinking mindset could attract investors who prioritize technological adaptation and innovation.

Disadvantages and Potential Pitfalls: However, Genius Group’s commitment to accumulating Bitcoin is not without potential risks. Given the company’s stock value has declined significantly this year, the substantial investment in Bitcoin raises questions about its immediate financial stability. The market’s volatile nature poses a risk to shareholder value, especially if Bitcoin experiences drastic price fluctuations. Moreover, the firm still needs to overcome the repercussions of previous legal hurdles, which could create a shadow of uncertainty for potential investors.

The recent rally in Bitcoin adoption among various companies could spell fierce competition for Genius Group. Firms like the Bahrain-based catering company and luxury watchmaker Top Win are also adopting similar treasury strategies, potentially diverting investor attention and funds. While Genius Group is well-positioned within the educational sector linking Bitcoin and AI, competing firms may have a more stable path by starting with less complex business models.

Who Stands to Benefit: Investors keen on leveraging the digital transformation wave may find Genius Group’s increasing Bitcoin treasury strategy appealing, especially those interested in sectors aligning with education and technology. On the flip side, shareholders already jittery from market volatility might see this expansion as a gamble rather than a safeguard for their investments. Concurrently, crypto enthusiasts looking for well-rounded companies that respect innovation may be looking to engage with firms that not only accumulate Bitcoin but also educate on its applications and associated technologies.