A whirlwind of excitement surrounding new cryptocurrency tokens tied to the Trump family has quickly turned into a tumultuous ride for many investors. Just a day after their launch, official memecoins representing U.S. President Donald Trump and First Lady Melania Trump have seen staggering declines, plummeting by as much as 60% in just 24 hours. This sudden drop comes on the heels of heavy profit-taking after the tokens debuted on Monday during the presidential inauguration.

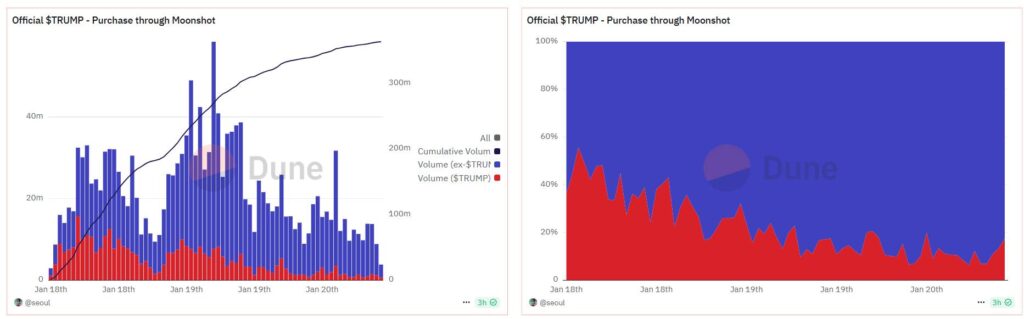

The trading frenzy was not for obscure coins; the Trump-themed tokens, aptly named TRUMP and MELANIA, each drew impressive trading volumes—over billion and .5 billion, respectively—within a single day. In comparison, more established cryptocurrencies like Tron’s TRX and Cardano’s ADA struggled to reach even a fraction of that volume. However, the dreamlike profits began to fade as investors rushed to cash in on their gains, leading to significant liquidation losses, marking around million wiped out for those who had bet on rising prices.

The excitement surrounding these tokens had many expecting President Trump to highlight cryptocurrency in his inaugural speech, particularly with promises of a strategic Bitcoin reserve. However, the absence of any mention led to a sharp drop in Bitcoin’s value, retreating from a high of over 9,000 to just above 1,000 shortly thereafter.

Despite the volatility in the Trump-themed tokens, hope in the cryptocurrency community persists. Analysts are closely monitoring developments in pro-crypto regulations, with attention shifting towards Solana’s SOL token. Some see the launch of $TRUMP on Solana as a significant endorsement, raising expectations for an earlier approval of a potential SOL exchange-traded fund (ETF). Furthermore, experts hint that the launch of such memecoins could attract retail traders, while institutional investors remain keenly aware of the evolving landscape, looking for definitive pro-crypto policies that could reshape the future economy.

Impact of Trump Family Tokens on Investors

The recent surge and subsequent drop in the value of Trump family-themed tokens have created significant implications for investors and the cryptocurrency market as a whole. Here are the key points to consider:

- Steep Losses for Investors

- Trump and Melania tokens down by up to 60% within 24 hours.

- Liquidation losses reaching nearly million for futures traders.

- High Trading Volumes

- TRUMP amassed over billion in trading volume.

- MELANIA saw .5 billion in exchange, indicating significant investor interest.

- Comparative Volumes

- Major tokens like TRX and ADA traded under billion in the same period.

- This reflects a heavy interest in Trump-themed tokens compared to established cryptocurrencies.

- Market Reaction to Trump’s Inaugural Speech

- Expectation of pro-crypto policy announcements led to volatility in Bitcoin prices.

- BTC dropped sharply from above 9,000 to around 1,000 after missing crucial updates.

- Future Market Sentiment

- Traders remain optimistic about potential pro-crypto policies that could benefit institutions and retail investors.

- Launch of Trump’s memecoin on SOL chain seen as a positive endorsement could accelerate ETF approvals.

“The launch of Trump’s memecoin appeals not only to the retail memecoin moonshot masses, but also to major institutions as it solidifies the president’s pro-crypto stance.”

The impact of these developments could be profound as they not only influence individual investor portfolios but also shape the broader cryptocurrency landscape and institutional engagement in the future.

Analyzing the Trump Family Token Trend: Opportunities and Pitfalls in the Crypto Space

The recent surge and subsequent fall of the Trump family-themed tokens highlight both the volatility of the cryptocurrency market and the speculative nature of memecoins. As trading volumes soared— billion for TRUMP and .5 billion for MELANIA within a mere 24-hour window—it became apparent that this phenomenon captured significant investor attention. However, with prices plummeting up to 60% shortly after their launch, the enthusiasm quickly turned sour. This rapid decline offers critical insights into the competitive landscape of memecoins and their associated risks.

One of the primary competitive advantages of the Trump tokens is their ability to attract massive trading volumes, far exceeding those of established tokens like TRX from Tron and ADA from Cardano. The overwhelming interest demonstrates a unique market dynamic fueled by celebrity influence and speculative trading. Investors are drawn not only to the potential for profit but also to the novelty and media buzz surrounding these tokens. This engagement could benefit retail traders looking for high-risk, high-reward opportunities, albeit with the recognition that the volatility may result in steep losses, as seen in the recent drawdown.

However, the disadvantages are equally pronounced. The sharp decline in asset value, coupled with subsequent profit-taking and liquidation losses nearing million, showcases the inherent risks of trading unregulated, sentiment-driven assets. The lack of a pro-crypto mention in Trump’s inaugural address disappointed many traders, contributing to a broader downturn in the market, specifically for Bitcoin, whose price significantly dropped. These factors create a problematic scenario for speculators and trend-followers, who may find themselves caught in the whirlwind of rapid price fluctuations trailed by lack of solid backing or a sustained value proposition.

Additionally, while the Trump tokens appealed to retail investors eager for a memecoin craze, they could create challenges for institutional investors who prioritize stability and regulatory clarity. The excitement surrounding the launch might solidify Trump’s perceived pro-crypto stance, potentially intensifying speculative interest. However, institutions may remain cautious, preferring to wait for confirmed pro-crypto policies rather than entering a market characterized by substantial risk and uncertainty. Ultimately, while the initial hype surrounding the Trump tokens has faded, the underlying sentiment in the crypto community remains optimistic about a pro-crypto future—particularly with anticipations for a Solana ETF, sparking hope among both retail and institutional players.