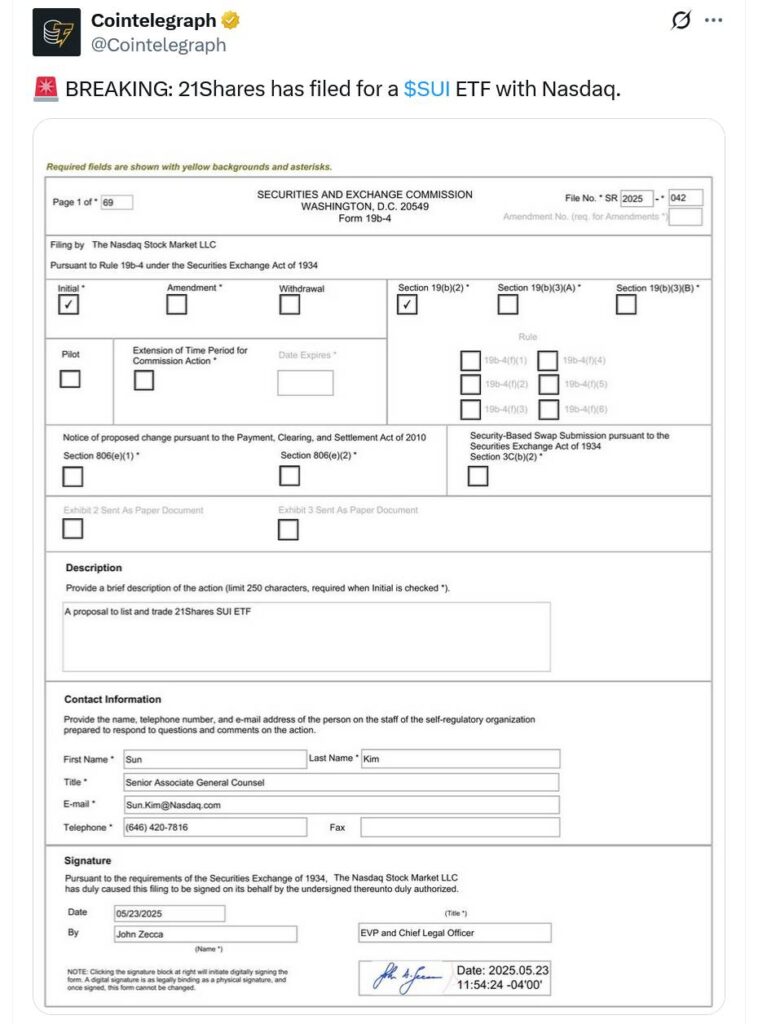

In a significant development for the cryptocurrency sector, Nasdaq has officially filed to allow 21Shares to list a spot Sui exchange-traded fund (ETF) in the United States. This move triggers the review process by the Securities and Exchange Commission (SEC), an essential step for any new investment product. The application, submitted on May 23 under the 19b-4 filing, follows an earlier registration statement by 21Shares on April 30, which sought SEC approval for the trading of the proposed SUI ETF.

The SEC now faces a deadline to make a decision regarding 21Shares’ application, which can range from acceptance to rejection or further delays. With a window of up to 240 days for potential reviews, the final ruling must be rendered by January 18, 2026, underscoring the lengthy and complex nature of regulatory processes in the crypto space.

“The SUI token powers the Sui network and serves multiple functions, from staking and paying gas fees to acting as a governance token.”

Interestingly, 21Shares is not alone in this pursuit; Canary Capital has also filed similar documentation for a spot Sui ETF, creating a competitive atmosphere. The Sui token, which currently ranks as the 13th-largest cryptocurrency by market cap, supports a network that focuses on decentralized applications, stirring comparison with the popular Solana blockchain.

21Shares has already made strides in the European markets with a Sui-related exchange-traded product listed on platforms like Euronext Paris and Euronext Amsterdam. The success of these products has been notable, contributing to a robust $317.2 million in assets under management as of May 26, according to CoinShares. In recent weeks, flows into SUI exchange-traded products have seen an uptick, indicating growing investor interest.

Nasdaq Files for 21Shares Spot Sui ETF

Key points regarding the recent Nasdaq filing and its implications:

- Nasdaq Filing: Nasdaq has initiated the process for 21Shares to list a spot Sui ETF in the US.

- SEC Review Process: The SEC will review the 19b-4 filing, with a decision expected within 45 days but can be delayed up to 240 days.

- Custodians Proposed: BitGo and Coinbase Custody have been proposed to hold SUI on behalf of the trust.

- SUI Token Utility: SUI serves multiple purposes including staking for rewards, paying gas fees, liquidity for applications, and a governance token.

- Market Position: SUI is currently the 13th-largest cryptocurrency, with a $12.3 billion market cap, compared to Solana’s $92 billion market cap.

- European Listings: 21Shares already lists a Sui ETF product in Europe, contributing to $317.2 million in assets under management.

- Recent Inflows: SUI-based exchange-traded products saw an increase of $2.9 million in asset flows recently.

The developments in the Sui ETF space could provide investors with new opportunities in the cryptocurrency market and influence trading strategies.

Competitive Landscape for Sui ETF Listings: The 21Shares Initiative

The recent move by Nasdaq to file for a listing of the 21Shares Sui exchange-traded fund (ETF) marks a significant milestone in the evolving landscape of cryptocurrency investment vehicles. As the SEC begins its review process, comparisons can be drawn with similar initiatives in the market, particularly those from Canary Capital, which is also vying for approval to launch a spot Sui ETF. While both asset managers hold potential advantages, there are crucial differentiators that may affect their market success.

Competitive Advantages: 21Shares, having established itself with successful ETF offerings in Europe, brings a level of credibility and experience that Canary Capital currently lacks. The firm’s existing 21Shares Sui ETP, which boasts approximately $317.2 million in assets under management, showcases a favorable track record that could resonate well with investors looking for stability and familiarity. Moreover, by proposing reputable custodians like BitGo and Coinbase, 21Shares enhances investors’ confidence in the management of their assets.

On the other hand, the discourse surrounding the SUI token itself presents an attractive value proposition for the 21Shares ETF. With its multifaceted utility—staking for rewards, transaction gas fees, governance features—the SUI token holds the potential for diverse applications within a growing decentralized ecosystem, positioning the ETF favorably in comparison to other offerings.

Disadvantages and Challenges: However, despite these strengths, 21Shares faces significant hurdles, particularly the regulatory scrutiny that often accompanies SEC evaluations. The possibility of delays—up to a maximum of 240 days—could hinder momentum, especially in a competitive market where perceptions of crypto assets fluctuate rapidly. Additionally, with SUI’s market capitalization lagging behind giants like Solana, the ETF may struggle to attract diverse institutional investments, limiting its growth potential in comparison to more established cryptocurrencies.

This competitive scenario underscores the potential benefits and pitfalls for various stakeholders. Institutional investors and crypto enthusiasts could find the introduction of Sui ETFs to be a fascinating avenue for diversification, particularly as the demand for innovative crypto products continues to rise. Conversely, any regulatory setbacks could create uncertainty for market players and dissuade hesitant investors, potentially prolonging their engagement with cryptocurrency markets.