In the ever-evolving landscape of cryptocurrency, a recent exchange among market analysts has stirred the pot regarding the current state of altcoins. Michaël van de Poppe, founder of MN Trading Capital, has openly countered widespread claims suggesting that the much-anticipated altcoin season has come to an end. He argues that many altcoins have yet to bloom, as numerous tokens remain close to their local price bottoms.

“I don’t understand why people start claiming that a bear market is around the corner,” van de Poppe wrote in a recent social media post, emphasizing that many tokens are still on the bottom.

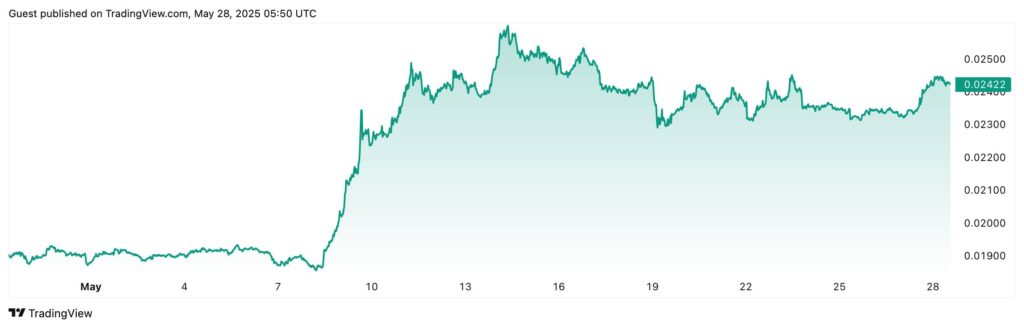

As many cryptocurrencies show faint glimmers of recovery, their values still fall short of the peaks reached earlier this year. Notable players like Solana (SOL) and XRP are finding themselves in the spotlight—despite posting gains of 17.84% and 1.98% over the past month, respectively. Their current values remain significantly lower than their January highs, creating a complex picture for investors and traders alike.

Van de Poppe remains bullish, suggesting that the next 12 to 24 months could unveil opportunities as altcoin gains begin to take off. Other analysts are echoing this sentiment, with crypto trader Davinci Jeremie recently predicting that altcoins will soon “turn into a wildfire.” Meanwhile, the prevailing narrative points to Ethereum’s (ETH) performance as a bellwether for the altcoin season, with the ETH/BTC ratio indicating a potential shift.

“Altseason isn’t just a meme. It’s coming, ladies and gentlemen,” asserted crypto trader Moustache, highlighting the optimism that still pervades the market.

However, caution persists. The Altcoin Season Index remains firmly anchored to Bitcoin, showcasing that market dynamics are still favoring the leading cryptocurrency, as evidenced by its score of 24 out of 100. Furthermore, standout tokens like Fartcoin (FARTCOIN) have notably surged, capturing attention with a 316.72% increase over the past 90 days, which demonstrates significant volatility within this sector.

As crypto enthusiasts continue to watch these developments closely, the debate around the onset of altcoin season illustrates both the potential for growth and the inherent risks within this dynamic market.

Current Perspectives on Altcoin Season

Key points about the ongoing debate surrounding altcoin performance in the crypto market:

- Altcoin Season Claims: There are disagreements among traders about whether the altcoin season has started or is yet to begin.

- Michaël van de Poppe’s Position: The founder of MN Trading Capital asserts that many altcoins are still at their local price bottoms, disputing claims of a bear market.

- Price Movements: Recent altcoin performance, with gains in the past 30 days but still underperforming compared to earlier highs post-market uptrend.

- Examples of Altcoins:

- Solana (SOL): 17.84% increase but down 32% since January.

- XRP (XRP): 1.98% gain, down 29.35% from January’s figures.

- Market Sentiment: Other analysts support van de Poppe’s view, suggesting an impending altcoin rally.

- Ethereum’s Role: Many believe altcoin season will begin following Ethereum’s outperformance relative to Bitcoin.

- Altcoin Season Index: This index indicates a bias towards Bitcoin despite recent altcoin gains.

- Top Gaining Altcoins:

- Fartcoin (FARTCOIN): 316.72% gain.

- Four (FORM): 148.15% gain.

- Virtuals Protocol (VIRTUAL): 107.47% gain.

Investment Caution: The article emphasizes that investment decisions should be approached with caution and thorough research.

Altcoin Season: A Clash of Opinions Among Crypto Traders

The crypto community is abuzz with contrasting views regarding the so-called altcoin season, with Michaël van de Poppe from MN Trading Capital asserting that the anticipated surge has not even begun. His insights highlight a significant contention among traders as he points to the enduring low prices of many altcoins, suggesting that fears of an impending bear market are unfounded. This perspective stands in stark contrast to broader market sentiments, where several analysts predict corrective waves after Bitcoin’s recent peaks.

On the surface, van de Poppe and his supporters argue that the majority of altcoins, despite recent gains, are still hovering well below their previous highs from earlier in the year. For instance, while Solana sees modest growth, it remains down significantly from its all-time high. This situation positions altcoins still poised for potential recovery, offering an edge to those who may be looking for bargains. However, the challenge lies in resisting the overwhelming narrative of Bitcoin’s dominance, as indicated by the persistent low scores on the Altcoin Season Index.

While this might create opportunities for retail investors eager to capitalize on lower prices, it poses a dilemma for others in the market. Traders who have placed faith in Bitcoin’s strength might find themselves hesitant to allocate resources toward altcoins, leading to volatility. Hence, those who stand to benefit from van de Poppe’s outlook might be long-term holders and new investors looking for affordable entry points in an excessively cautious market.

Conversely, traders solely focused on Bitcoin’s performance could face setbacks. As altcoins begin showing signs of recovery, any delay in investment decisions could lead to missed opportunities, particularly if van de Poppe’s predictions come to fruition. Thus, the ongoing debate over the beginning of altseason serves as a critical junction in the market, with profound implications for both cautious traders and altcoin enthusiasts.