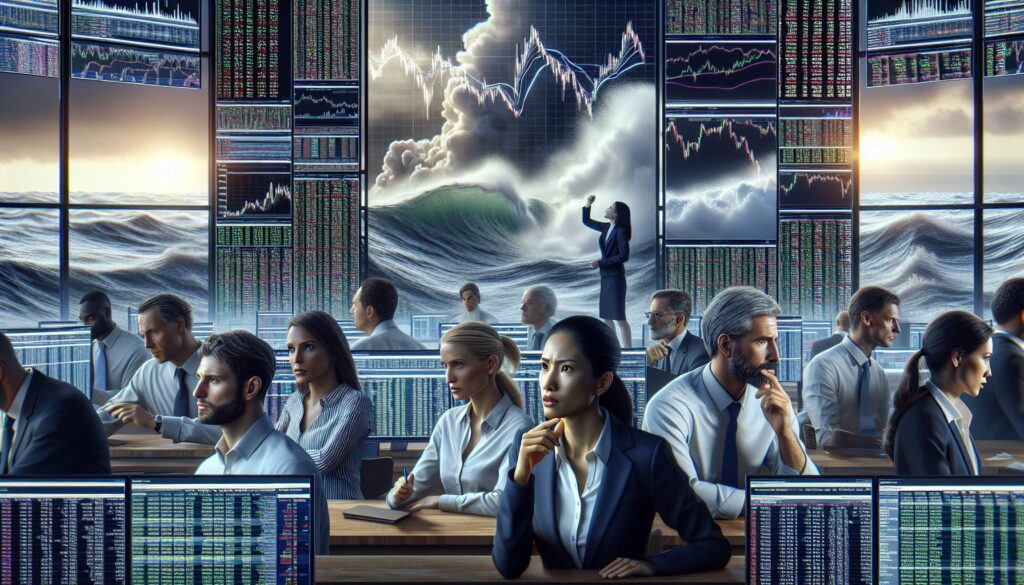

Bitcoin (BTC) is currently on the rise, demonstrating its resilience in the face of geopolitical turbulence in the Middle East. After a brief drop to $99,500, the world’s leading cryptocurrency rebounded sharply, increasing by 2.9% within the hour and now trading at $102,400. Over the past 24 hours, it has maintained a positive trajectory, boasting a 2.5% gain, while the CoinDesk 20 index has similarly edged up by 2.1% in the same timeframe.

This recent volatility in Bitcoin’s price came in the wake of escalating tensions following Iran’s missile strikes on American bases in the Gulf region, a direct response to recent military actions by the U.S. against its nuclear facilities. Notably, the attack on Qatar reportedly resulted in no casualties, which has provided some reassurance to investors.

“Crude getting crushed. Good sign,”

commented Sean Farrell, head of digital asset strategy at Fundstrat, reflecting broader market sentiments amid the chaos.

Despite the military developments, market reactions have been somewhat muted, with gold—often seen as a safe haven—barely moving higher, and crude oil prices experiencing a notable drop of 4%. Nicolai Søndergaard, a research analyst at blockchain analytics firm Nansen, pointed out that typically, such geopolitical uncertainties lead to short-term price dips in volatile assets like cryptocurrencies, but a rebound often follows, depending on the severity of events.

As the situation continues to evolve, investors are observing movements within the market closely. Some indications suggest that strategic investors may be viewing this as a buying opportunity, as evidenced by significant outflows from exchanges. This suggests that while apprehensions exist, the willingness to engage with assets like Bitcoin remains strong.

Bitcoin’s Response to Middle Eastern Developments

The recent developments concerning U.S. and Middle Eastern tensions have significantly impacted Bitcoin’s market behavior. Here are the key points:

- Price Fluctuations:

- Bitcoin briefly dropped to $99,500 but quickly rebounded by 2.9%, currently trading at $102,400.

- Overall, Bitcoin has increased by 2.5% over the last 24 hours.

- Market Trends:

- The CoinDesk 20 index of top cryptocurrencies (excluding stablecoins, memecoins, and exchange coins) rose by 2.1% during the same period.

- Geopolitical Impact:

- Bitcoin’s drop correlated with Iran’s missile strikes in retaliation against U.S. military actions in the Middle East.

- The missile strikes targeted various U.S. bases but resulted in no reported casualties in Qatar.

- Investor Sentiment:

- Despite military actions, investors did not show significant concern, as gold prices saw only minimal increases while crude oil prices fell by 4%.

- Analysts suggest that short-term price dips oftenLead to rebounds, depending on the severity and communication of events.

- Market Behavior:

- Some “smart money” investors appear to be taking a more cautious approach, reflected in notable outflows from exchanges.

- This behavior suggests that opportunistic investors are capitalizing on price dips, indicating a potential for recovery in the market.

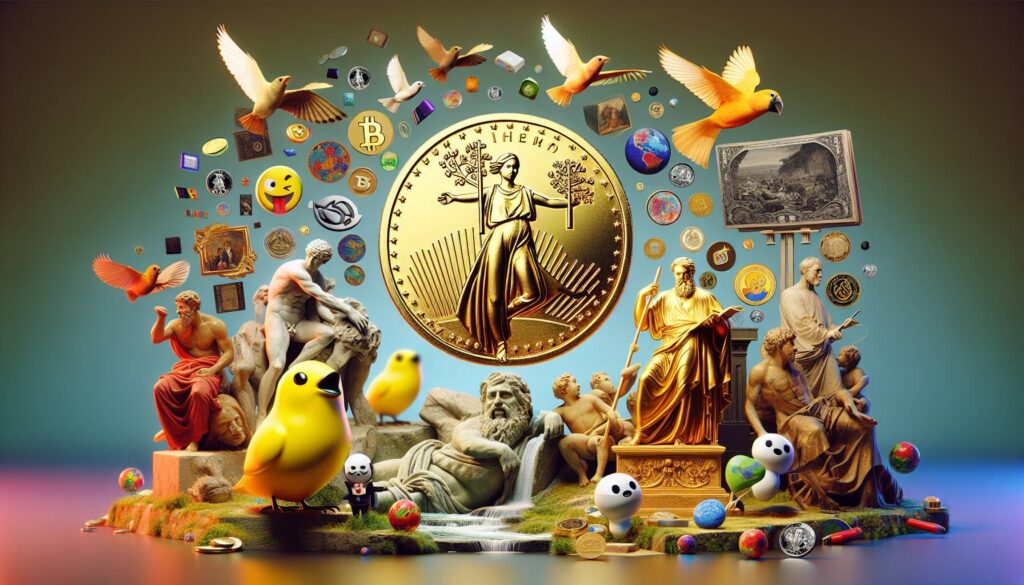

Bitcoin Shows Resilience Amid Middle East Tensions

The recent fluctuations in Bitcoin’s value illustrate the cryptocurrency’s responsiveness to geopolitical events, particularly the escalating tensions in the Middle East. Following a brief decline to $99,500, Bitcoin has rebounded to $102,400, reflecting a 2.9% increase within an hour and a 2.5% rise over 24 hours. In contrast, traditional safe-havens like gold have seen minimal gains, while crude oil prices experienced a significant drop of 4%. This discrepancy highlights Bitcoin’s growing position within financial markets as a possible ‘digital gold’ amidst turmoil.

Competitor Analysis: Bitcoin’s ability to recover swiftly from adverse events presents a competitive advantage over gold and crude oil, which have historically served as safe havens. The negligible response of gold to military actions underscores a potential shift in investor sentiment towards cryptocurrencies. Although Bitcoin’s volatility can be a disadvantage for risk-averse investors, its current appeal to opportunistic buyers seeking to capitalize on price dips is noteworthy. Such behaviors suggest that Bitcoin may attract a new demographic of investors willing to embrace its inherent risks for potential rewards.

This news could especially benefit those within the tech-savvy and younger investor demographic who are looking for alternatives to traditional assets. Conversely, traditional investors and those with a low-risk tolerance may find this new landscape troubling, particularly given the unpredictable nature of Bitcoin. As geopolitical uncertainties persist, those relying on established safe-haven assets may need to reassess their strategies in the face of Bitcoin’s growing resilience and appeal.