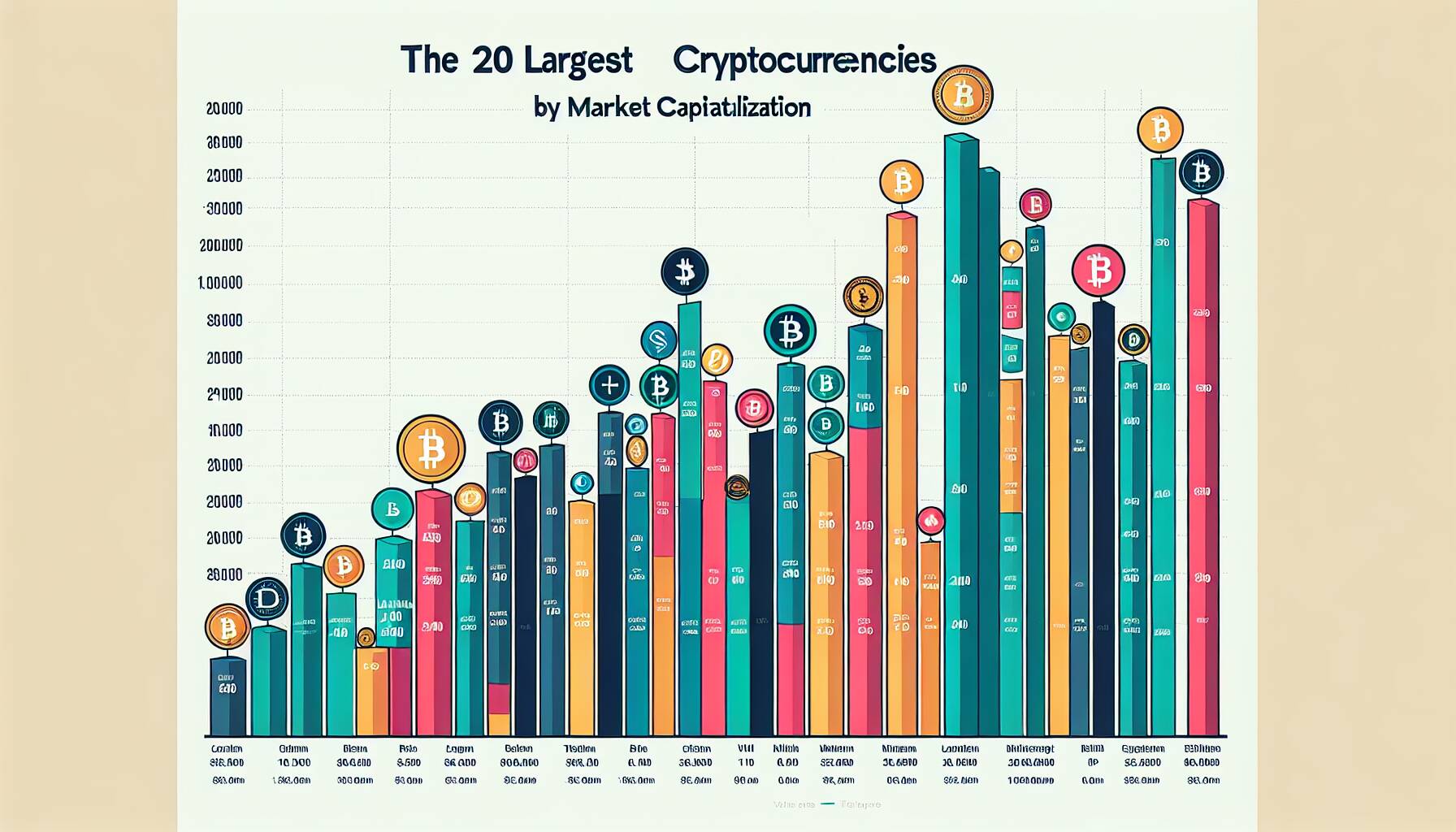

The world of cryptocurrency continues to evolve at a rapid pace, capturing the interest of investors and the general public alike. Recent analysis by Visual Capitalist has shed light on the current landscape of digital currencies, ranking the 20 largest cryptocurrencies by market capitalization. This ranking offers intriguing insights into the shifting dynamics of the crypto market, showcasing not just the powerhouse coins like Bitcoin and Ethereum, but also highlighting emerging players making waves.

“The cryptocurrency market has expanded dramatically, with market cap being a key indicator of its growth and volatility,” observes industry experts.

As more people look to digital assets for investment opportunities, understanding which cryptocurrencies dominate this space is essential. The rankings reveal the financial clout of various coins, providing both seasoned investors and newcomers a snapshot of the most significant players in the industry. With total market capitalization often reflecting future trends, the data from Visual Capitalist equips readers with valuable knowledge about which cryptocurrencies are shaping the future of finance.

From innovative technologies to unique use cases, the cryptocurrencies that make the top of the list often showcase distinct advantages. Analyzing their features, market performance, and community engagement can offer deeper insights into their staying power and potential developments. Observers are keenly watching as the ongoing developments unfold, underscoring the importance of real-time data in navigating this vibrant market.

Ranked: The 20 Largest Cryptocurrencies by Market Cap

Understanding the largest cryptocurrencies by market cap can impact investment decisions, inform trading strategies, and enhance awareness of the digital currency landscape.

- Market Capitalization Insights:

- Ranking provides a clear view of cryptocurrency dominance.

- High market cap can indicate stability and investor confidence.

- Diversity of Options:

- Multiple cryptocurrencies offer varying use cases and technologies.

- Diversification can reduce risk in investment portfolios.

- Emerging Trends:

- Top currencies can set trends in the market.

- Investors can watch for growth opportunities in smaller coins.

- Awareness of Regulatory Environment:

- Understanding key players can highlight regulatory risks.

- Market responses can be influenced by news and compliance changes.

- Technological Innovations:

- Investors should be aware of underlying technology in top coins.

- Innovation can lead to new applications and market growth.

Analysis of the Largest Cryptocurrencies by Market Cap

In the fast-evolving world of cryptocurrencies, the recent ranking of the 20 largest digital assets by market capitalization, highlighted by sources such as Visual Capitalist, presents a fascinating glimpse into the competitive landscape. These rankings not only illustrate the current market dominance of certain cryptocurrencies but also reveal the advantages and drawbacks they face in an increasingly crowded space.

Competitive Advantages: The prominent cryptocurrencies, such as Bitcoin and Ethereum, continue to assert their dominance primarily due to their established networks and robust user bases. These digital currencies benefit from first-mover advantages, widespread recognition, and a significant amount of institutional investment, which enhances their legitimacy and stability. As such, they often attract new investors looking for a reliable entry point into the crypto market.

Moreover, the ranking offers insights into emerging players that might be gaining traction, showcasing how innovation and unique use cases can propel a cryptocurrency into the top tier. For instance, newer projects focused on decentralized finance (DeFi) or non-fungible tokens (NFTs) can leverage their unique offerings to capture market share from established giants.

Competitive Disadvantages: However, the environment remains challenging. High volatility is a notable setback for cryptocurrencies as a whole, causing reluctance among potential investors who prefer stability. Additionally, established leaders can face criticism for scalability issues or environmental concerns related to energy-intensive mining operations, giving room for competitors to promote greener, more sustainable alternatives.

This ranking could particularly benefit retail investors seeking insights into the market’s currents. It provides them with valuable data to make informed decisions about which cryptocurrencies to invest in. Conversely, it could create challenges for lesser-known altcoins that may struggle to gain visibility and credibility in light of the overwhelming presence of major players. These smaller projects must find innovative ways to distinguish themselves in a market crowded with high-profile names.