The landscape of wealth is shifting, with a growing emphasis on digital assets, particularly cryptocurrency, as the new beacon of prosperity. As traditional investments like homes become less accessible, a new generation is turning to Bitcoin and other cryptocurrencies as a means to build wealth.

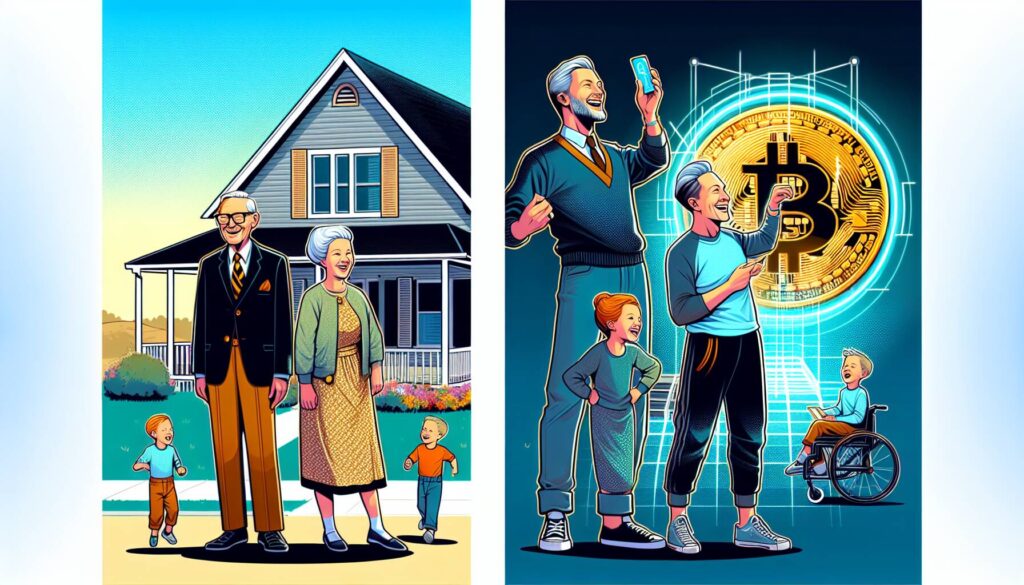

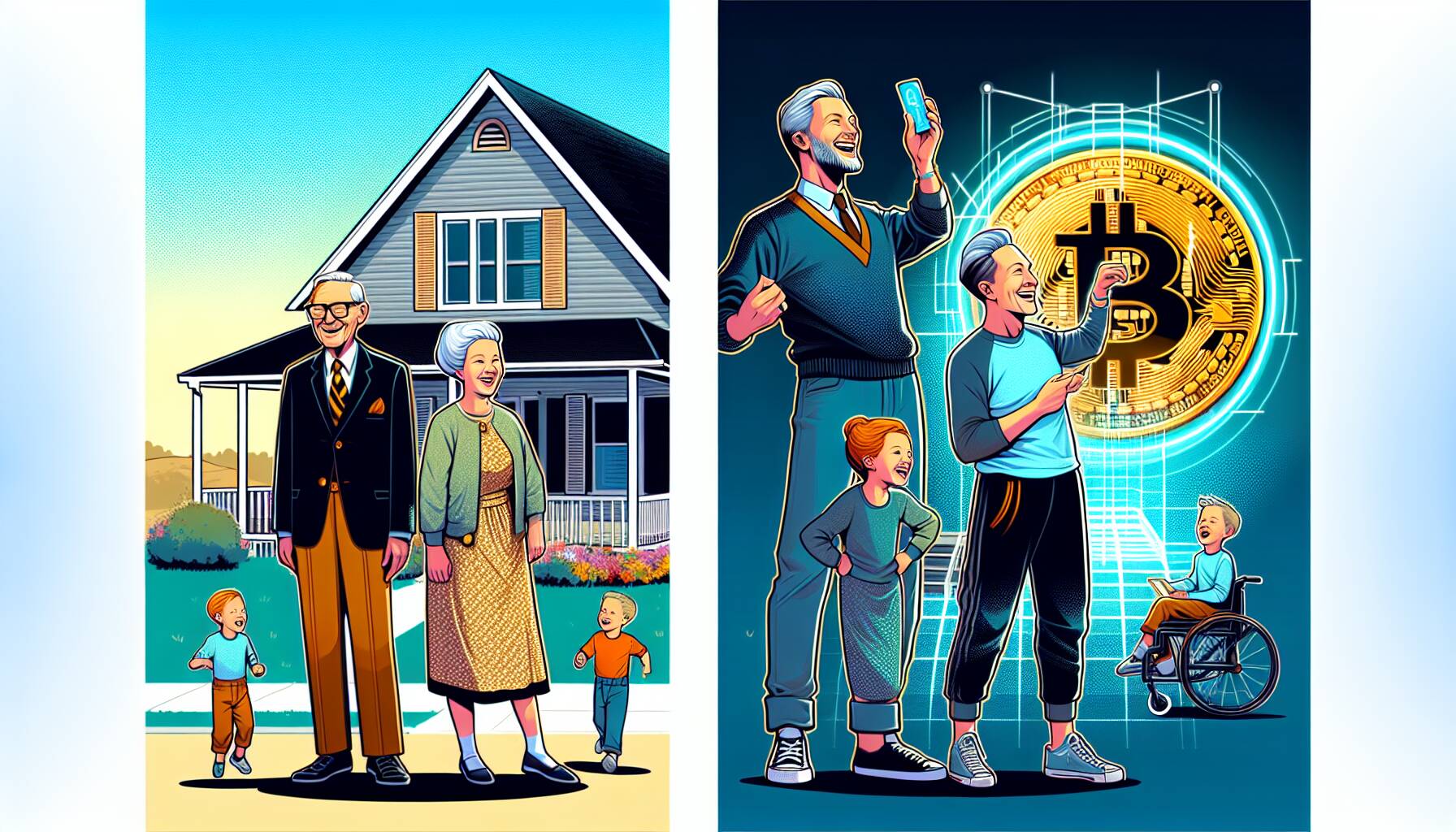

This dynamic is vividly illustrated in a recent piece from Yahoo Finance, which explores the contrasting financial foundations of Baby Boomers and Gen Z. While Boomers often relied on tangible assets like houses valued around $50,000, the digital age is introducing younger generations to the potential of $100,000 or more in Bitcoin. This shift is more than just numbers; it represents evolving attitudes toward money and investment.

The article highlights the belief of a prominent crypto evangelist who emphasizes how digital assets are redefining the concept of the American Dream.

With the rise of cryptocurrency platforms and a growing acceptance of digital currencies, Gen Z is presented with unique opportunities. Research indicates that younger individuals are more inclined to see cryptocurrency not just as a short-term investment but as a fundamental part of their financial future. By embracing these modern assets, Gen Z is crafting a new narrative around wealth accumulation, steeped in innovation and technology.

As the conversation around digital finance continues to evolve, the contrast between established wealth in real estate and the emerging allure of cryptocurrencies forms a fascinating backdrop to the ongoing revolution in personal finance.

Boomers Got $50K Homes, Gen Z Gets $100K Bitcoin

Key points regarding the shift from traditional assets to digital assets:

- Generational Wealth Disparity: Boomers often inherited homes valued at $50K, while Gen Z is navigating a landscape with Bitcoin investments potentially worth $100K.

- Shift in Investment Trends: There is a significant shift from real estate to cryptocurrency as the preferred investment vehicle for younger generations.

- Perception of the American Dream: Digital assets are being seen as the new American Dream, reflecting changing values and economic realities.

- Potential for Financial Freedom: Investments in cryptocurrencies like Bitcoin offer Gen Z the opportunity for substantial financial gains, differing from traditional methods of wealth accumulation.

- Technological Advancement: The rise of digital assets aligns with the increasing adoption of technology in everyday life, influencing how younger generations view finance.

- Market Volatility Risks: While the potential for high returns exists, the unpredictability of the crypto market can pose significant risks for investors.

“The evolution of wealth from tangible assets to digital currencies could reshape financial legacies for generations to come.”

Comparative Analysis: The Shifting American Dream from Homes to Bitcoin

The ongoing debate about the American Dream is undergoing a radical transformation, particularly highlighted by the contrasting financial foundations of Baby Boomers and Generation Z. For many Boomers, owning a home valued at around $50,000 symbolized stability and prosperity. In stark contrast, today’s Gen Z is increasingly embracing digital assets, particularly cryptocurrencies like Bitcoin, with values soaring around $100,000. This fundamental shift reveals a significant competitive advantage for those who adapt to contemporary financial realities.

Market Accessibility and Flexibility: One of the primary advantages of cryptocurrency is its ability to offer greater accessibility to investment opportunities for younger generations. Unlike traditional real estate, which often requires substantial upfront capital and extensive credit histories, Bitcoin can be acquired with relatively low investments and minimal barriers. This democratization of asset ownership could empower many Gen Z individuals who might otherwise struggle to enter the property market.

However, high volatility remains a significant drawback of digital assets. The fluctuating nature of cryptocurrencies presents inherent risks that might deter more conservative investors, particularly those who have experienced the stability of real estate. The unpredictable market dynamics associated with Bitcoin could create financial challenges for less experienced investors, leading to potential losses that could undermine their financial ambitions.

Additionally, traditional homeownership provides a unique sense of community and stability, aspects that digital transactions often lack. For many individuals, these emotional connections to home and place may present a hurdle in fully embracing a digital-centric investment strategy. As such, while Gen Z could significantly benefit from capitalizing on high-return assets like cryptocurrencies, they may also face unique challenges in balancing financial aspirations with the deeper human need for belonging.

This evolution in financial priorities could create problems for Boomers who rely on real estate values for retirement planning, especially if younger generations lean more towards crypto assets rather than traditional home buying. This phenomenon could lead to a significant shift in market dynamics, affecting everything from real estate prices to financial institutions focused on mortgage lending.