As the cryptocurrency market faces turbulent times, many investors are seeking refuge in safe-haven assets to weather the storm. Recent insights from Yahoo Finance shed light on the top investments that are drawing attention amidst the current market slump. With digital currencies experiencing fluctuations, traditional avenues are being revisited as a means of preserving wealth and mitigating risk.

During periods of market uncertainty, safe-haven investments such as gold, stablecoins, and established stocks often become more appealing. These assets are perceived as less volatile compared to cryptocurrencies, which can see dramatic price swings. Investors are strategically diversifying their portfolios, emphasizing stability and security.

“In times of market instability, turning towards safe alternatives can be a prudent approach for many,” said a financial expert referenced in the article.

The article also highlights specific assets that have historically shown resilience during downturns. By examining trends and historical data, investors are better equipped to navigate the ongoing challenges of the crypto landscape. As the market evolves, understanding these safe-haven opportunities can provide clarity for those looking to protect their assets while still engaging with the dynamic world of cryptocurrency.

Top Safe-Haven Investments During a Crypto Market Slump

Investing wisely during uncertain times can help protect your assets. Here are some key safe-haven investments to consider:

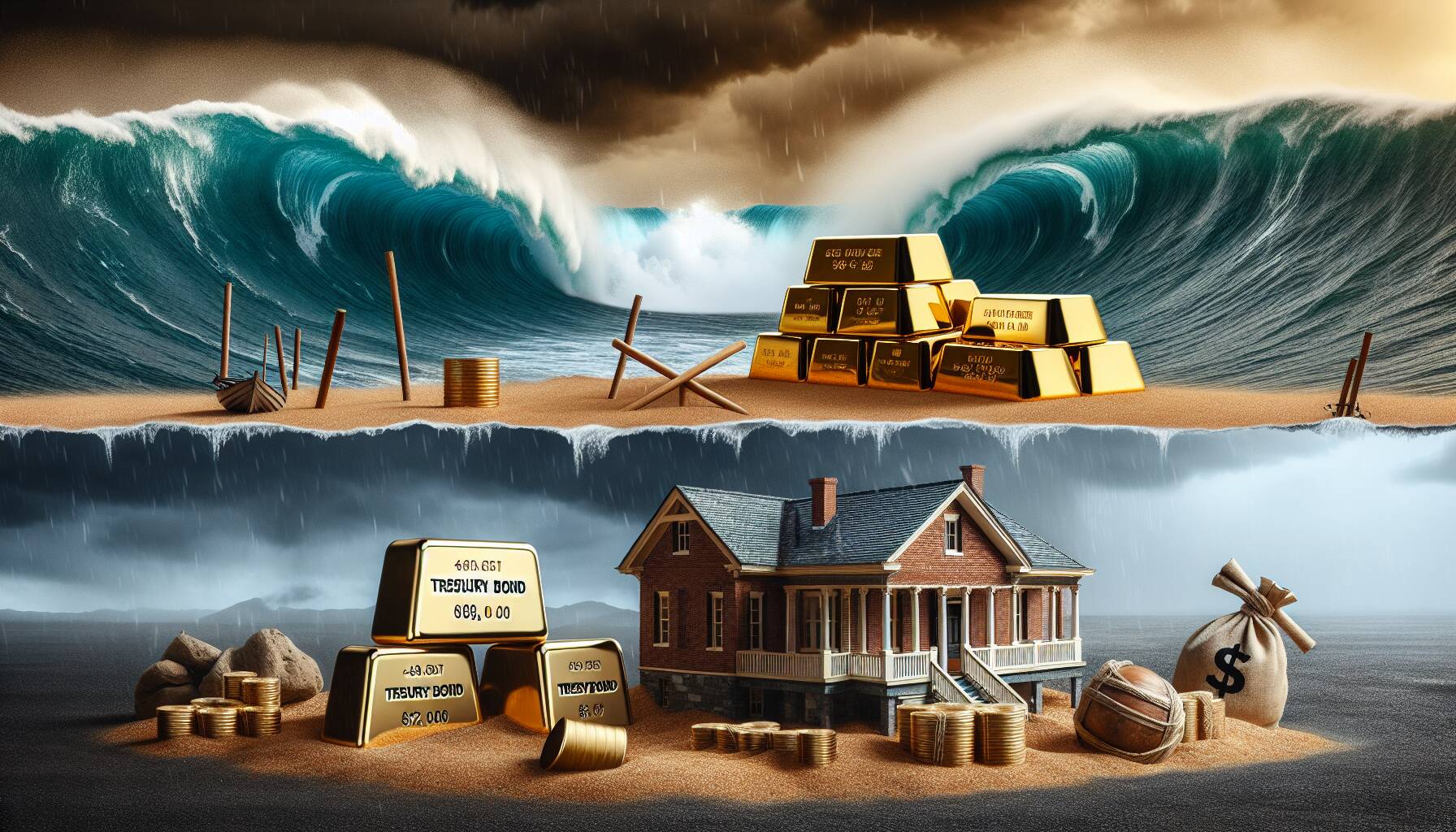

- Gold

- A traditional safe-haven asset, gold often provides stability during economic downturns.

- Investors often flock to gold to hedge against inflation and currency fluctuations.

- Bonds

- Government bonds, especially U.S. Treasuries, are seen as low-risk investments.

- They can provide a steady income stream and help preserve capital.

- Real Estate

- Property can provide steady rental income and tends to appreciate over time.

- Real estate is considered a tangible asset, offering a sense of security.

- Cash Equivalents

- Money market accounts or high-yield savings accounts can offer liquidity and safety.

- These options allow investors to stay flexible and ready to invest when opportunities arise.

- Defensive Stocks

- Investing in companies that provide essential goods and services can reduce risk during market slumps.

- Such stocks tend to be less volatile and continue to perform well even in downturns.

By understanding these safe-haven investments, readers can make informed decisions to safeguard their financial well-being during periods of market instability.

Safe-Haven Investments: Navigating Crypto Market Turbulence

In times when the cryptocurrency market experiences significant downturns, savvy investors often turn their attention to safe-haven assets. Recent insights from Yahoo Finance reveal a variety of options that provide stability in such volatile conditions. These investments include gold, government bonds, and certain real estate sectors, which traditionally attract attention during financial uncertainty.

When comparing these safe-haven options, one of the standout advantages is their historical resilience. Gold, for instance, tends to appreciate when other markets falter, serving as a hedge against inflation and economic turmoil. Conversely, cryptocurrencies, although considered decentralized and innovative, have shown erratic behavior, leaving many experiencing substantial losses during downturns. This inherent volatility can benefit traditional asset classes that offer a sense of security and predictability.

On the downside, while these safe-haven investments have proven to stabilize portfolios, they might not yield the rapid gains that some investors hope for in bullish markets. For those predominantly focused on high-risk, high-reward ventures, like cryptocurrencies, the conservative nature of these alternatives may feel uninspiring. Moreover, potential low-interest rates on bonds or slow-moving real estate markets can deter investors seeking immediate returns.

Target demographics for these insights primarily include long-term investors who prioritize capital preservation over speculative gains. Additionally, risk-averse individuals or institutions looking to diversify their portfolios could find these safe-haven strategies particularly beneficial. Conversely, traders accustomed to the dynamic crypto landscape may face challenges adapting to the fundamentally different strategies required for investing in more stable asset classes. Being aware of this line of demarcation can guide investors in appropriately managing their risk profiles during tricky market phases.