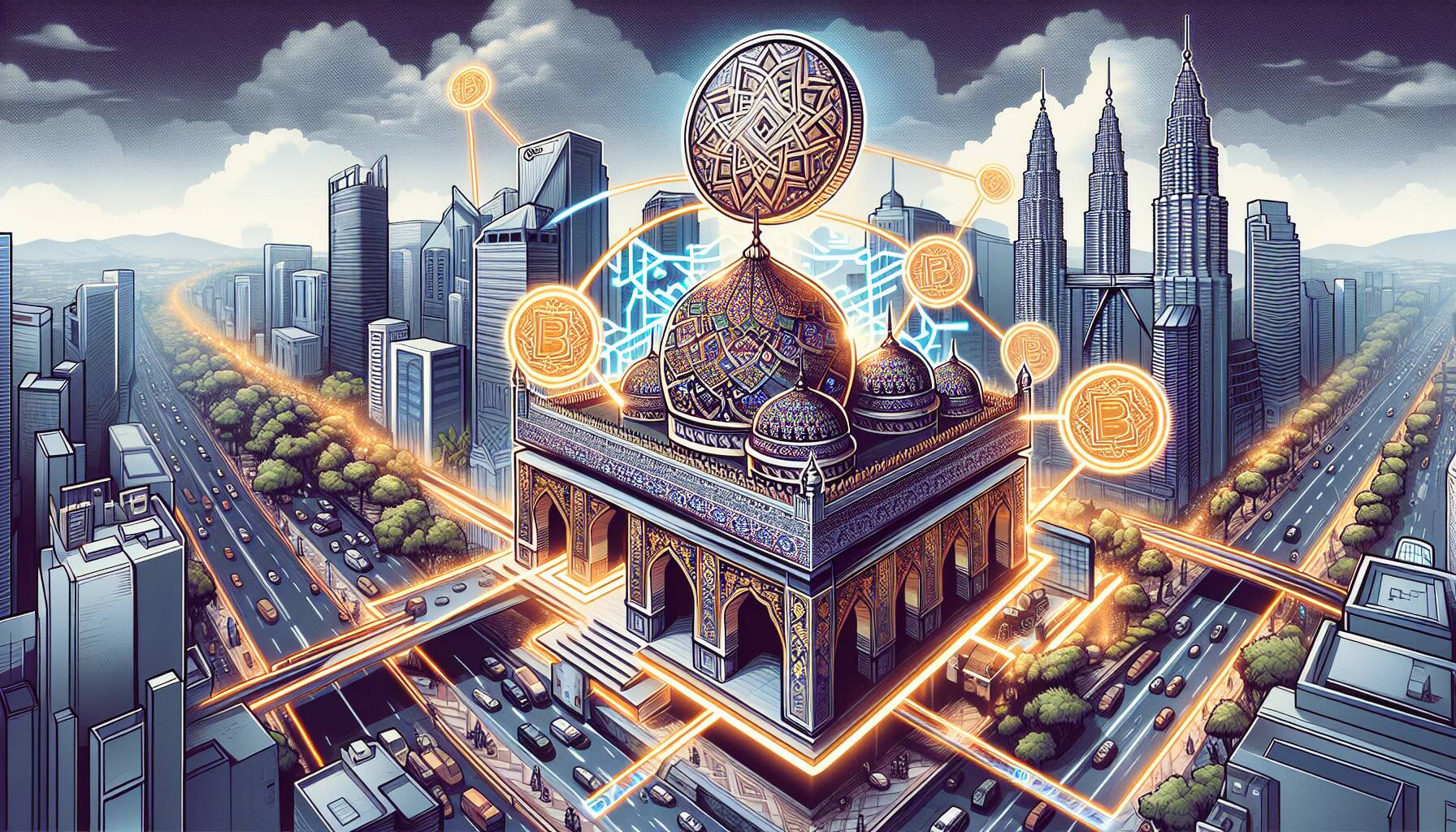

Fasset, a prominent player in the digital asset investment landscape, has recently achieved a significant milestone by obtaining a provisional banking license in Malaysia. This development paves the way for the establishment of what Fasset claims to be the world’s first stablecoin-powered Islamic digital bank, marking an important intersection of traditional finance and innovative fintech.

With this new license, Fasset aims to expand its operations from a digital asset platform to a comprehensive banking service that adheres to Shariah principles. The company plans to offer a range of Shariah-compliant financial products, including savings accounts, investment opportunities in U.S. stocks and gold, as well as financing solutions. Additionally, customers can look forward to using a Visa-linked crypto card for spending, integrating digital assets into everyday transactions.

“This new license combines the credibility of a global banking institution with the innovation of a fintech insurgent,” said CEO Mohammad Raafi Hossain, highlighting the unique position Fasset holds in the evolving financial landscape.

As part of its ambitions, Fasset intends to launch “Own,” an Ethereum Layer 2 network built on Arbitrum, aimed at facilitating the on-chain settlement of regulated real-world assets. This initiative underscores Fasset’s commitment to enhancing its stablecoin infrastructure, which allows users to invest without the risks associated with interest-bearing products, adhering to the Islamic finance principle that forbids interest, known as riba.

The launch of Fasset’s banking services comes at a crucial time, addressing a growing need for financial inclusion within the $5 trillion global Islamic finance industry. Access to halal, asset-backed financial options remains a challenge in many regions, particularly across Asia and Africa, which have significant Muslim populations. Building on its previous success in Dubai, where it secured a license as a Virtual Asset Service Provider, Fasset is already making strides, processing over $6 billion in annual transaction volume across 125 countries.

Fasset’s Provisional Banking License in Malaysia

Key Points:

- Provisional Banking License: Fasset has received a provisional banking license in Malaysia, paving the way for a stablecoin-powered Islamic digital bank.

- Regulated Sandbox: The license places Fasset in a regulated sandbox for Islamic fintech, allowing expansion into full-service banking.

- Shariah-compliant Services: Plans to offer Shariah-compliant savings, financing, and investment services using stablecoins and tokenized assets.

- Diverse Investment Options: Customers can hold deposits, invest in U.S. stocks, gold, and crypto, and utilize a planned Visa-linked crypto card.

- Innovation in Islamic Finance: CEO Mohammad Raafi Hossain emphasized combining the credibility of a banking institution with fintech innovation.

- Own Network Rollout: Introduction of “Own,” an Ethereum Layer 2 network for settling regulated real-world assets on-chain.

- Avoiding Riba: The stablecoin infrastructure helps users avoid interest-bearing products, aligning with Shariah law.

- Financial Inclusion: Aims to address financial inclusion gaps in the $5 trillion global Islamic finance industry, particularly in Muslim-majority regions.

- Global Operations: Fasset also holds a license in Dubai and processes over $6 billion in annual transaction volume across 125 countries.

Fasset’s Groundbreaking Move in Islamic Fintech

Fasset’s recent achievement of securing a provisional banking license in Malaysia marks a significant milestone in the evolving landscape of Islamic finance. This shift positions Fasset at the forefront of a niche market that has often been underserved, particularly regarding digital assets. By introducing a stablecoin-powered Islamic digital bank, Fasset aims to cater specifically to Muslim clientele looking for Shariah-compliant financial products, addressing a unique gap within the $5 trillion Islamic finance industry.

Competitive Advantages: Fasset’s integration of stablecoins within its banking framework could potentially revolutionize how users manage their assets. The ability to offer Shariah-compliant savings, investments, and financing reflects a keen understanding of market needs. Furthermore, leveraging a regulated sandbox for Islamic fintech allows for innovative solutions to be tested safely, providing Fasset an edge over traditional banks that may struggle to adapt to rapid technological changes. The planned rollout of a Visa-linked crypto card enhances customer convenience, allowing effortless transactions globally.

Disadvantages: Despite these advantages, Fasset may face challenges in building trust among conservative investors who are typically wary of new financial technologies. The complexity of integrating blockchain technology in a regulated banking environment could also present operational hurdles. Moreover, Fasset’s reliance on stablecoin infrastructure in a fluctuating cryptocurrency market may face scrutiny, especially amid concerns regarding the broader regulatory landscape affecting digital assets.

This initiative has the potential to benefit not only retail customers seeking compliant financial solutions but also institutional investors eager to diversify within the burgeoning Islamic finance sector. However, traditional banks may perceive Fasset’s entrance as a competitive threat, especially if it attracts a significant customer base seeking modern financial tools that align with their values. Moreover, the lack of awareness and understanding of cryptocurrency among some Muslim populations could create problems, potentially slowing adoption rates. Overall, Fasset’s innovative approach offers a promising avenue within Islamic finance while highlighting the ongoing tension between tradition and modernity in the sector.