The Chainlink (LINK) token experienced significant institutional selling pressure recently, dropping to its lowest price in over a week. Over a 24-hour trading session, LINK fell 4%, hitting a low of $21.30, reversing gains of more than 8% seen just the day before. This decline aligns with a broader downturn in the cryptocurrency market, as evidenced by the CoinDesk 20 Index, which also reported a similar decrease.

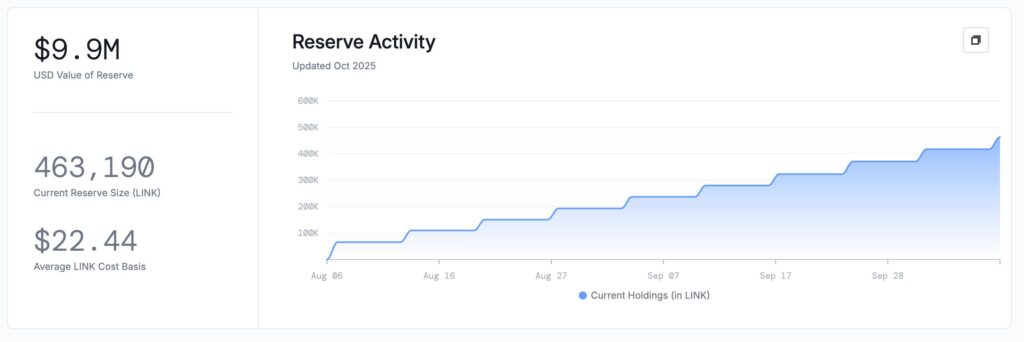

Despite this turmoil, the Chainlink Reserve—a mechanism designed to purchase tokens using earnings from various protocol integrations—continued its activity, acquiring an additional 45,729 LINK tokens valued at nearly $1 million. Currently, the reserve’s holdings approach $10 million; however, the recent price drop places it in a precarious situation, as LINK now trades below its average cost basis of $22.44.

Technical analysis from CoinDesk Research highlighted a bearish trend in investor sentiment, with the token exhibiting volatility of 5%. The trading range shifted to $1.05, with a session low of $21.53 and a peak at $22.68. Notably, significant resistance was identified at $22.68, where trading volume increased sharply, reaching almost 2 million units, while additional resistance surfaced at the $21.92 mark.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Chainlink (LINK) Price Decline Analysis

Key points regarding the recent performance of Chainlink’s native token:

- Substantial Institutional Selling Pressure: The LINK token experienced significant selling pressure, decreasing by 4% to a low of $21.30.

- Market Context: The decline aligns with weaknesses in the broader crypto market, as indicated by the CoinDesk 20 Index also falling.

- Chainlink Reserve Activity: Despite the price drop, the Chainlink Reserve purchased an additional 45,729 LINK tokens, worth nearly $1 million.

- Current Holdings: The Chainlink Reserve now holds nearly $10 million worth of tokens, although it is currently underwater as LINK trades below the average cost basis of $22.44.

- Bearish Momentum: Technical indicators show bearish momentum, suggesting waning investor sentiment and indicating potential further declines.

- Trading Volatility: LINK’s trading range expanded to $1.05, indicating a volatility of 5% between a session low of $21.53 and a peak of $22.68.

- Resistance Levels: Technical analysis identifies resistance at $22.68 and additional resistance at $21.92, complicating short-term recovery prospects.

This information could impact readers by highlighting the risks and volatility inherent in cryptocurrency investments, particularly in relation to institutional trading behaviors and market sentiment.

Chainlink (LINK) Faces Institutional Pressure Amid Market Volatility

The recent dip in Chainlink’s native token, LINK, highlights ongoing challenges within the cryptocurrency landscape, particularly under the influence of institutional selling. While it shed 4% to $21.30, this decline is part of a larger trend marked by a declining wider crypto market, notably reflected in the CoinDesk 20 Index. Investors are left grappling with sentiment that appears to be increasingly bearish, as suggested by key technical indicators that pointed to substantial momentum shifts.

Competitive Advantages: Despite the downturn, Chainlink’s proactive approach through its Reserve – which has recently acquired a significant amount of LINK tokens – demonstrates a strategic maneuver aimed at bolstering its market position. With nearly $10 million in assets held for token purchasing, it showcases a commitment to maintaining liquidity and supporting its ecosystem, potentially instilling confidence among long-term holders.

Competitive Disadvantages: However, the ongoing price struggle and the Reserve now being underwater, due to LINK trading below its average cost basis, creates a precarious situation. This scenario raises concerns about future profitability for the Reserve and could deter potential institutional investors wary of entering a market with low investor sentiment and volatile trading ranges. The resistance levels noted, particularly at $22.68, further complicate recovery efforts as they highlight a challenging barrier for bullish retracement.

This existing volatility could attract opportunistic traders looking for short-term gains, yet it poses a risk for retail investors who might be caught off guard by sudden market shifts. Furthermore, increased institutional activity might squeeze out smaller players, concentrating market influence in the hands of larger, more powerfully positioned firms. Individuals and organizations contemplating entry into the LINK market must weigh these dynamics carefully to avoid potential pitfalls in what currently appears to be a turbulent trading environment.