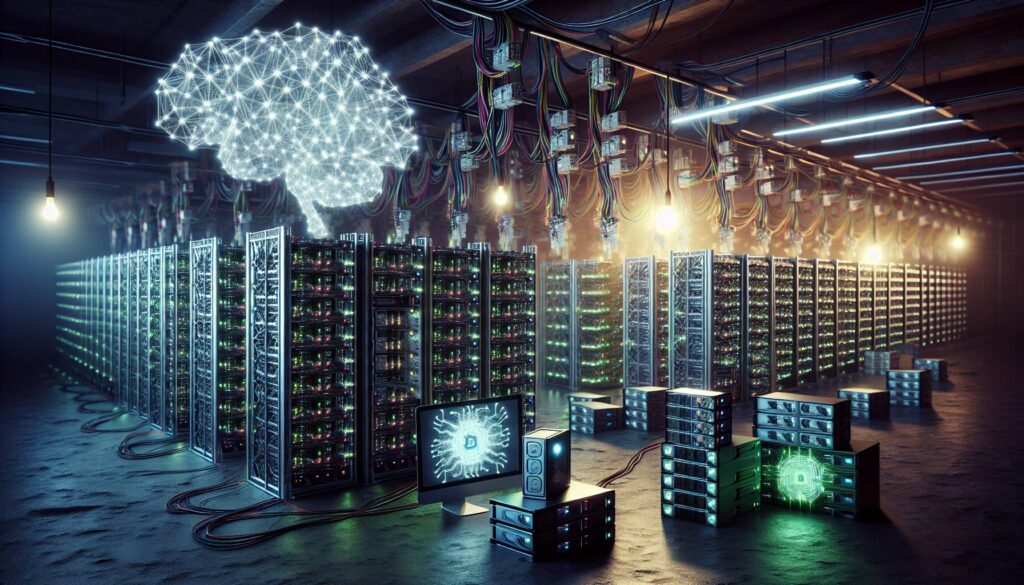

A recent report from Wall Street broker Bernstein highlights the intriguing intersection between the electricity demands of bitcoin miners and the burgeoning needs of artificial intelligence (AI) developers. With the U.S. power grid tightening and demand from AI and digital workloads skyrocketing, access to grid power has become a pivotal factor for the growth of new data centers. In some locations, the wait for interconnection can stretch as long as seven years, posing significant challenges for meeting the rising needs of technology.

According to the report, bitcoin miners, having secured substantial renewable energy contracts in the past, now hold substantial power resources—over 14 gigawatts (GW)—which could greatly benefit AI developers by providing swift access to the necessary energy. Bernstein analysts noted that facilities owned by IREN and Riot Platforms can accelerate deployment time by as much as 75% compared to starting new projects from scratch.

“Miners act as strategic enablers of the AI buildout,” the report states, suggesting that their existing infrastructure positions them well to adapt for high-performance AI workloads.

The urgency for data centers is underscored by reports from Microsoft, which predicts that shortages will continue into 2026 as demand for cloud and AI services outstrips available infrastructure. With bitcoin mining facilities already optimized for high power efficiency and equipped with advanced cooling systems, retrofitting these sites for AI operations is not only faster but also more cost-effective than establishing new data centers from the ground up.

Such developments are fostering optimism within the cryptocurrency sector, indicating that bitcoin miners might successfully leverage their resources to expand into the realm of AI and data center operations. This evolving landscape underlines a dynamic shift, where the synergies between these two sectors could redefine the future of computing capabilities.

Bitcoin Miners and AI Developers: New Synergies from U.S. Power Grid Constraints

Due to the changing dynamics of the U.S. power grid, several key points are emerging that indicate strong relationships between bitcoin miners and AI developers:

- Tightening Power Grid: The increasing demand from AI and digital workloads is limiting access to power, becoming a critical constraint for new data center growth.

- Extended Interconnection Timelines: In some regions, timelines for interconnecting new data centers can take up to seven years.

- Miners’ Power Capacity: Bitcoin miners now control over 14 gigawatts (GW) of renewable power capacity, providing critical infrastructure for AI development.

- Efficient Deployment: Miners can significantly reduce deployment time for new facilities, with sites like IREN and Riot Platforms offering up to 75% faster setups than traditional greenfield projects.

- Ongoing Data Center Demand: Companies like Microsoft anticipate data center shortages will persist through 2026 due to the rapid growth of cloud and AI services.

- Strategic Role of Miners: As “strategic enablers” for AI infrastructure, miners can leverage existing facilities for high-performance computing, allowing for quick retrofitting and cost-effective expansions.

- Investment Potential: Analysts recommend IREN as a top investment choice, predicting significant growth potential due to these industry changes.

This evolving landscape emphasizes the interconnectedness of technology sectors and suggests that readers in both finance and tech industries should consider these trends when planning future investments and developments.

Bitcoin Miners and AI Developers: An Emerging Alliance in the Tightening Power Grid

The recent analysis by Wall Street broker Bernstein sheds light on an intriguing development within the tech landscape: the collaboration between bitcoin miners and AI developers, driven by a tightening U.S. power grid. With the increasing demand for AI and digital workloads putting immense pressure on power resources, the timing couldn’t be more pivotal for these industries to join forces. Miners, having secured renewable energy contracts well in advance, now control a significant amount of the grid’s capacity, offering a compelling solution for AI companies struggling with protracted interconnection timelines.

Competitive Advantages: The prime advantage of this alliance lies in the strategic leverage bitcoin miners possess due to their existing renewable energy contracts. Bernstein’s report highlights that sites owned by companies like IREN and Riot Platforms can dramatically reduce deployment times—up to 75%—compared to traditional greenfield projects. This efficiency positions these miners not just as energy providers but as essential facilitators for the burgeoning AI sector, which requires swift scaling amidst resource constraints. With the anticipated data center shortages extending through 2026, the timing for miners to pivot into high-performance AI workloads is incredibly advantageous.

Disadvantages: However, this strategic pairing may not be without its drawbacks. The dependence on renewable energy sources can present challenges, especially in regions experiencing regulatory hurdles or fluctuating energy prices. Additionally, the integration of AI into existing bitcoin infrastructure may require significant technological upgrades, potentially incurring hefty costs that could offset the initial benefits of faster deployment.

Potential Beneficiaries and Challenges: This collaboration likely serves various stakeholders well, particularly AI startups and established companies seeking immediate access to high-capacity data centers. By leveraging the established infrastructures of bitcoin miners, these firms can accelerate their operations and enhance their competitive edge. Conversely, traditional data center operations could face significant disruptions, as the increased reliance on miners might shift market dynamics, potentially creating barriers for companies that do not adapt quickly to these changes. Overall, while the partnership offers tremendous potential for innovation and efficiency, it also calls into question the future of traditional data center models as the demand for AI continues to swell.