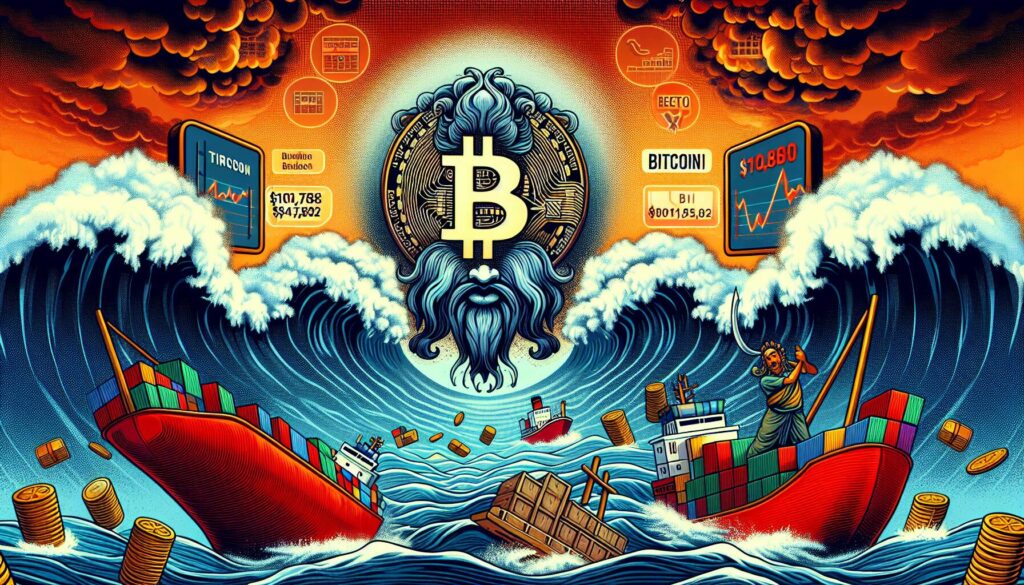

In a dramatic turn of events, Bitcoin has seen a significant downturn, falling to $104,782 amidst escalating tensions in the U.S.-China trade relations. As former President Donald Trump announced a staggering 130% tariff on Chinese goods, the global trade war appears to have reignited with fervor.

The market reacted swiftly, with the Dow Jones Industrial Average plunging almost 900 points, marking the S&P 500’s most pronounced decline since April. Investors are feeling the impact as Trump’s threats extend beyond tariffs, including potential limits on tech exports and a new 100% tariff on Chinese imports.

“China Flexed. Trump Hit Back. So Much for the Thaw.” – The New York Times

This fresh wave of tariffs could have ripple effects across various sectors, and traders are closely monitoring how this will influence both domestic and global economies. As tensions rise, all eyes are on the implications for financial markets and cryptocurrency, especially with Bitcoin’s recent decline amid heightened uncertainty.

Impact of U.S.-China Trade War on Bitcoin and Markets

Key points regarding the current economic situation and its implications:

- Bitcoin Decline: Bitcoin’s value has decreased to $104,782.

- Trade War Escalation: Trump’s announcement of 130% tariffs on China could lead to increased market volatility.

- Market Reactions:

- Dow dropped almost 900 points.

- S&P 500 experienced its largest decline since April.

- Export Threats: Trump has threatened tech export limits and introduced a 100% tariff on Chinese imports.

- Global Economic Impact: The renewed trade war could harm international trade relationships and economic stability.

- Investor Focus: Investors may need to reassess their portfolios in response to increased uncertainty and market fluctuations.

These developments could significantly impact financial markets, affecting investments and economic growth, which directly influences the readers’ financial decisions.

Impact of Trade War Escalation on Bitcoin and Financial Markets

The recent decline of Bitcoin to $104,782 amid heightened U.S.-China trade tensions has alarmed investors. Trump’s announcement of a significant 130% tariff on Chinese imports could have ripple effects across global markets, presenting both competitive advantages and disadvantages for various stakeholders.

Advantages: First and foremost, the announcement provides a sense of urgency for companies to rethink their supply chains and tariffs, which could lead to a surge in domestic production and potential job creation. Additionally, commodities like gold could see a rise in demand as investors look for safe havens amid uncertainty, indirectly benefiting cryptocurrencies like Bitcoin that are often viewed as alternative investments.

Disadvantages: On the flip side, the significant fluctuation in Bitcoin prices illustrates the vulnerability of cryptocurrencies to geopolitical events. Investors in Bitcoin may face increased volatility as markets react to Trump’s tariffs. Furthermore, tech companies, heavily reliant on Chinese manufacturing, could suffer from rising costs, putting pressure on their stock prices and making investors hesitant to take risks in high-volatility markets.

In terms of beneficiaries, domestic manufacturers could gain from a tariff-induced advantage, promoting local production and reducing dependency on imports. However, tech firms that rely on Chinese exports could find themselves in a tight spot, facing decreased profit margins which may stunt growth and innovation.

This trade war escalation not only disrupts financial markets but also reshapes investment priorities. Those looking for stability might pivot towards traditional safe havens, while the crypto community must brace for potential challenges ahead.