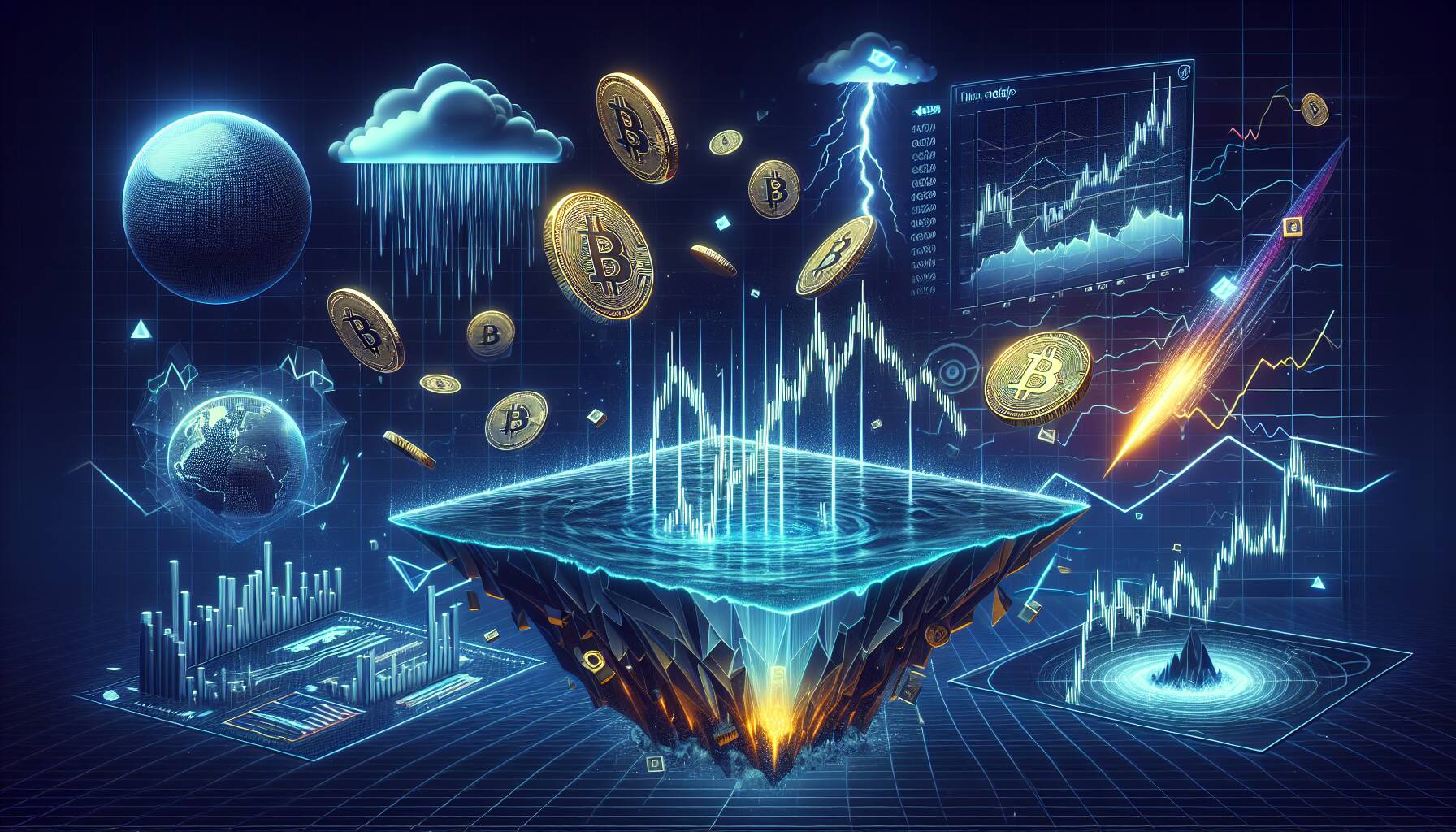

The cryptocurrency market has been navigating a post-October landscape that saw significant upheaval, particularly with the dramatic leverage wipeout that characterized that month. Despite a return to calmer price movements, the underlying market depth for leading cryptocurrencies like Bitcoin and Ether remains notably thin. This thinness in market depth can lead to a more fragile trading environment, which may impact investors and traders alike.

Market experts have noted that a structurally weak trading backdrop can exacerbate volatility, making even minor price changes potentially more impactful. As Bitcoin and Ether attempt to stabilize, the concern remains that any sudden shifts in demand or supply could lead to erratic price swings.

In light of this situation, stakeholders within the cryptocurrency community are closely monitoring market trends, as thin trading conditions often raise questions about liquidity and overall market health. The present environment emphasizes the need for cautious engagement as crypto enthusiasts and investors alike navigate these turbulent waters.

Impact of Market Depth on Bitcoin and Ether Trading

The current state of the cryptocurrency market, particularly with Bitcoin and Ether, poses several important considerations for traders and investors.

- Calmer Prices Post-Wipeout: After October’s market turbulence, prices have stabilized, but this does not guarantee security.

- Thin Market Depth: The structural thinness of market depth for Bitcoin and Ether indicates vulnerability to price swings.

- Increased Volatility Risk: A fragile trading environment may lead to sudden price changes, impacting investment strategies.

- Investor Caution: Traders may need to exercise more caution, as the market can react unpredictably to large buy or sell orders.

Understanding these factors is crucial for informed trading decisions in a potentially unstable market.

Analyzing the Fragile Landscape of Bitcoin and Ether Trading

The recent shifts in the cryptocurrency market, particularly after October’s drastic leverage wipeout, reveal a cautious landscape for both bitcoin and ether. While prices have nudged towards stability, the underlying market depth continues to show significant weakness, indicating a vulnerable trading environment. This scenario is echoed across similar cryptocurrencies, yet the implications vary.

When comparing bitcoin and ether to emerging altcoins, the established giants still hold substantial market capitalization, giving them a perceived advantage in liquidity. However, thinner market depth poses a notable disadvantage; any substantial buy or sell order could create dramatic price swings, instilling fear among traders. On the other hand, smaller altcoins often experience similar volatility but can benefit from heightened interest during bullish trends, as traders seek new opportunities in less saturated markets.

This situation primarily benefits long-term investors who can weather short-term fluctuations and traders with strategies focused on high-volatility trading. Conversely, short-term traders may find themselves at a disadvantage, facing increased risks from the thin liquidity conditions. This fragile environment could spark concerns for less experienced investors, fueling uncertainty and prompting hesitance in making quick trades.

Certain segments of the market could leverage these conditions, particularly proprietary trading firms and institutional investors, who may thrive amidst volatility. Yet, retail traders should tread carefully, as the structural fragility could lead to significant trading losses if they’re not equipped to handle the unexpected. In summary, while the calm after the storm brings some relief, the lack of depth in the bitcoin and ether markets raises flags for many participants navigating this delicate terrain.