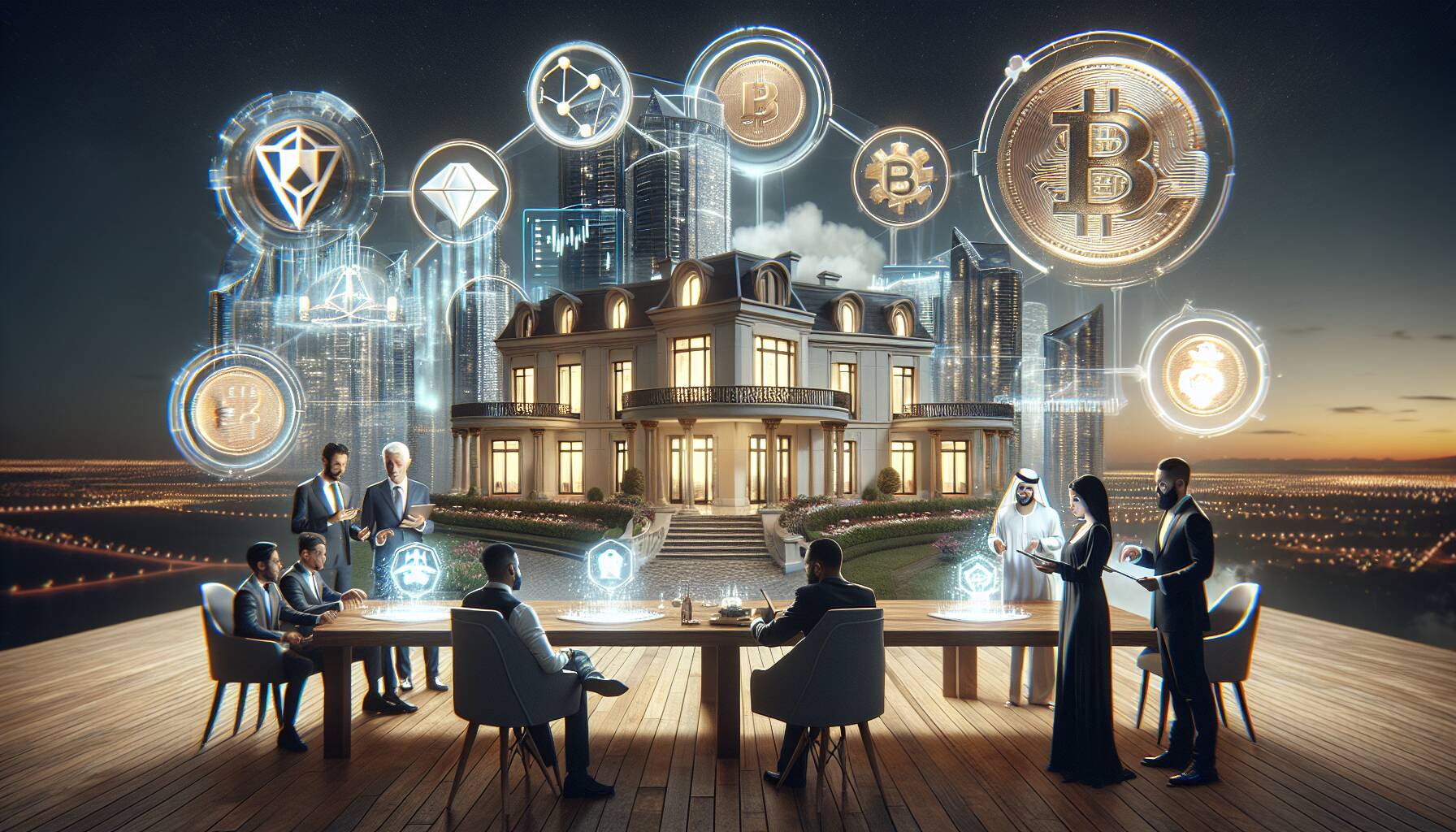

The cryptocurrency industry continues to evolve as traditional assets explore innovative funding avenues. A notable development is the Trump International Hotel Maldives, which is set to undergo a groundbreaking transformation by embracing the world of digital finance. Developed in partnership with Dar Global, this luxury hotel project will implement tokenization, enabling investors to purchase digital shares. This trend marks a significant intersection of real estate and blockchain technology, fostering accessibility and investment opportunities within the cryptocurrency landscape.

Tokenization is attracting attention due to its potential to simplify and democratize investments in high-value assets. By allowing fractional ownership of the hotel, investors from various backgrounds can participate in a project that was previously only available to wealthier individuals. This model not only enhances liquidity but also provides an innovative way for projects like the Trump International Hotel Maldives to attract global interest. As cryptocurrencies continue to reshape industries, the fusion of real estate and blockchain holds promise for the future of investment.

As the allure of luxury properties meets the digital innovation of tokenization, the Trump International Hotel Maldives stands on the frontier of a new investment era.

Trump International Hotel Maldives Tokenization

The Trump International Hotel Maldives offers a unique investment opportunity through the tokenization of its development.

- Tokenization of Real Estate: Investors can buy digital shares in the hotel development.

- Development Partnership: The project is developed in collaboration with Dar Global.

- Accessibility: Lower entry barriers for investors in luxury real estate markets.

- Potential for Returns: Investors may benefit from the hotel’s operation and appreciation in value.

- Innovative Investment Model: Utilizing blockchain technology could enhance transparency and security in transactions.

This investment model may influence readers by providing alternative ways to diversify their portfolios and engage in real estate without traditional limitations.

Tokenization of Luxury: The Trump International Hotel Maldives

The innovative move to tokenize the Trump International Hotel Maldives represents a groundbreaking shift in real estate investment. By collaborating with Dar Global, this project brings luxury hospitality and blockchain technology together, offering investors the opportunity to purchase digital shares in an exotic location. This strategy places it ahead of competitors in the luxury hotel sector, which have yet to leverage tokenization to such an extent.

Competitive Advantages: The Trump International Hotel Maldives stands out for its integration of digital shareholding, making luxury investment more accessible to a wider audience. This tokenization model allows for fractional ownership, drastically lowering the entry barrier compared to traditional real estate investments. The project also benefits from the brand strength and reputation of Trump, attracting interest from affluent investors looking for unique and innovative opportunities. Furthermore, the scenic backdrop of the Maldives adds an allure not easily replicated by other hospitality projects.

Competitive Disadvantages: However, there are inherent risks in associating with the Trump brand, which some investors may find polarizing. Additionally, the regulatory landscape surrounding tokenization and fractional ownership in real estate remains murky, potentially introducing uncertainties for investors regarding legality and security. Competing brands may also seek to capitalize on the hesitation some may have toward the Trump name by promoting traditional luxury experiences that resonate more with a certain demographic.

This project could significantly benefit tech-savvy investors who are eager for innovative investment opportunities, as well as those interested in diversifying their portfolios with luxury assets. Conversely, traditional investors who prefer conventional ownership models may find this tokenized approach confusing or unappealing, potentially alienating a more conservative investor base. The ability to combine cutting-edge technology with luxury real estate may create challenges but also presents a substantial opportunity for those willing to embrace this new investment paradigm.