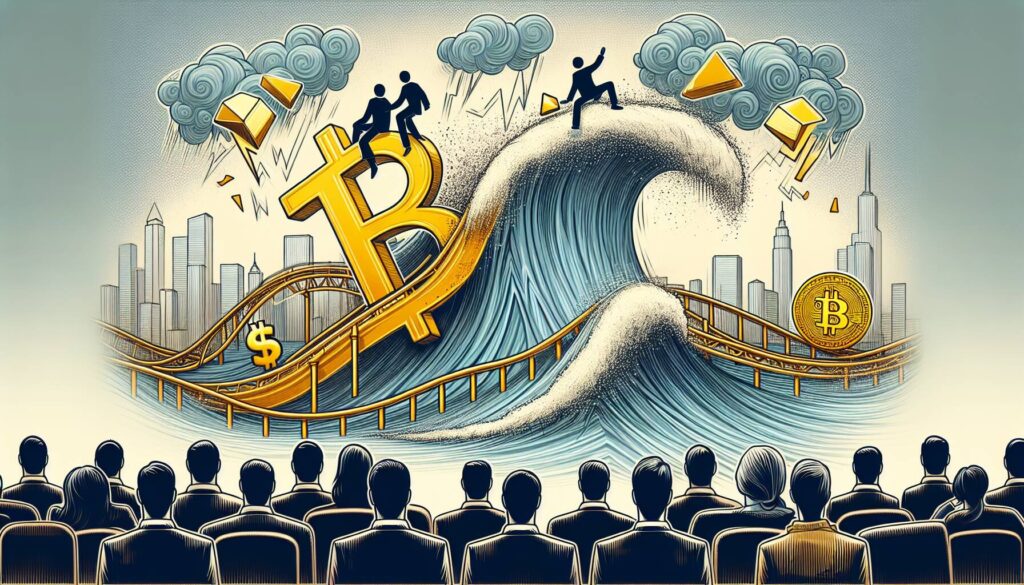

The landscape of finance continues to reshape itself as the world’s largest asset manager unveils a compelling new AI report that could shift perspectives on traditional investments. In a surprising move, the report expresses a bearish outlook on U.S. bonds and the overall economy, signaling potential turbulence ahead for conventional assets.

“The changing tides in the economy might lead investors to seek alternatives,”

the report suggests, making a bold case for the burgeoning cryptocurrency sector. This bearish sentiment towards U.S. bonds contrasts sharply with a bullish projection for cryptocurrency adoption, highlighting a significant shift in investor interest and confidence in digital currencies.

As traditional markets face uncertainty, the asset manager’s findings point to a rising belief in the potential of crypto as a viable investment avenue. The report hints at an accelerated embrace of digital assets among both retail and institutional investors, suggesting that the future of finance may increasingly pivot toward blockchain technology.

In this evolving narrative, it appears that while some assets face scrutiny, others—particularly cryptocurrencies—are gaining footholds in modern portfolios, captivating those looking for innovative solutions in a complex economic landscape.

The Impact of the Latest AI Report on Financial Markets

Key points from the report include:

- Bearish Outlook on U.S. Bonds:

- Indicates potential declines in bond values.

- May lead to increased borrowing costs for individuals and businesses.

- Concern for U.S. Economy:

- Reflects possible economic contraction or slowdown.

- Could affect job stability and consumer confidence.

- Bullish Projection for Crypto Adoption:

- Suggests growing acceptance and usage of cryptocurrencies.

- May present new investment opportunities and innovations.

- Shift in Investment Strategies:

- Investors may reallocate assets away from traditional bonds.

- Encourages diversification into digital assets like cryptocurrencies.

This report could significantly influence readers’ financial decisions, urging them to reconsider their investment strategies and stay informed about market trends.

Comparative Analysis of the Latest AI Report on U.S. Bonds and Crypto Adoption

The recent AI report from the world’s largest asset manager has stirred significant conversation in the financial markets, particularly with its cautious stance on U.S. bonds coupled with an optimistic outlook on cryptocurrency adoption. This distinctive dual perspective sets the report apart from recent assessments published by other major financial institutions, which have tended to favor more conservative strategies in bond markets while adopting a wait-and-see approach towards cryptocurrencies.

One notable competitive advantage of this report lies in its forward-looking interpretation of crypto adoption. As traditional finance seems to struggle with the implications of digital currencies, the asset manager’s bullish projection could resonate well with tech-savvy investors and younger demographics who are keen on diversifying their portfolios with innovative assets. This indicates a potential pivot in investment strategies, appealing to those open to exploring non-conventional routes.

However, the bearish sentiment regarding U.S. bonds highlights a stark disadvantage that may affect traditional bond investors, particularly retirees or conservative portfolio managers seeking stable returns. As inflation concerns and interest rate hikes linger, this negative outlook on bonds could indeed prompt a reassessment of risk management among these groups, posing challenges for those whose financial security relies heavily on fixed-income investments.

The implications of this report are far-reaching. Investors in the cryptocurrency space stand to gain from the positive language surrounding digital assets, suggesting a growing acceptance and normalization of crypto within investment strategies. Conversely, more traditional investors may find themselves in a precarious position, feeling the pressure to adjust their portfolios to align with the shifting economic landscape. Such a divide may foster further volatility in both markets, ultimately affecting investment behaviors in the long run. The report effectively reinforces the significance of adapting to an evolving financial environment where opportunities and challenges coalesce.