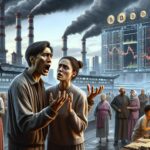

The recent fluctuations in the cryptocurrency market have drawn considerable attention, particularly regarding the performance of BNB, the native token of the Binance exchange. Recent reports suggest that the decline experienced by BNB appears to be technical in nature, rather than linked to any specific negative news related to the coin itself.

This drop in value comes amid a broader downturn affecting the overall cryptocurrency landscape, highlighting the interconnectedness of digital assets. Market analysts often note that such movements can be attributed to technical trading patterns, which include a variety of price signals and trading volumes, rather than individual asset performance.

“The recent shift does not seem to stem from any particular adverse events for BNB, nor any significant operational issues with Binance, but rather from the prevailing market sentiment,”

the statement reflects the growing complexities within the crypto world as traders digest the latest trends and shifts. As BNB and many other cryptocurrencies grapple with this wave of volatility, the focus remains on understanding the underlying factors driving market behavior, ensuring that stakeholders remain well-informed amid the dynamic landscape of digital currency trading.

Understanding the Decline in BNB and Its Market Impact

The recent decline in BNB has raised concerns among investors and enthusiasts in the cryptocurrency space. Below are the key points to understand its implications:

- Technical Decline:

- The drop appears to be a result of technical factors rather than any specific issues related to BNB.

- This suggests that market movements are driven by broader trading patterns rather than project weaknesses.

- Wider Crypto Market Downturn:

- The decline coincides with a general downturn in the cryptocurrency market.

- This correlation indicates that investor sentiment may be cautious across various cryptocurrencies.

- Investor Confidence:

- Technical declines can impact investor confidence, potentially leading to increased volatility.

- Understanding market trends can help investors make more informed decisions regarding their holdings.

- Risk Management:

- Investors should reassess their risk management strategies in light of market fluctuations.

- A broader downturn may necessitate diversification or reallocation of investments.

Analyzing the Recent Decline in BNB Against a Wider Crypto Market Downturn

The recent dip in BNB’s value seems largely technical, indicating a shift in trading patterns rather than stemming from specific adverse developments related to BNB itself. This nuanced downturn aligns closely with broader trends observed across the cryptocurrency market, raising questions about the interconnectedness of digital assets amid fluctuating investor sentiment.

When comparing this situation to other cryptocurrencies, such as Ethereum and Bitcoin, BNB’s decline showcases some unique competitive advantages and disadvantages. BNB, designed primarily for use within the Binance ecosystem, benefits from enhanced usability in trading and transaction fee discounts. However, its close ties to Binance also pose risks; any scrutiny or negative perception of the exchange can quickly reverberate throughout BNB’s value.

Moreover, while Bitcoin remains a market leader with a relatively strong brand presence and a loyal investor base, it is susceptible to market fluctuations as evidenced in recent downturns. On the other hand, Ethereum’s ongoing developments with proof-of-stake and smart contracts could prove advantageous, allowing it to maintain momentum despite market volatility.

Investors who favor stability may find themselves challenged by the technical decline of BNB, as it paints a complex picture of its reliability compared to its peers. Conversely, traders looking for opportunities within a volatile environment may benefit from this scenario if they can capitalize on short-term movements. The broader crypto community, especially those invested in the Binance ecosystem, might face challenges due to an increasingly cautious market, while opportunistic investors could spot potential rebounds or entry points.