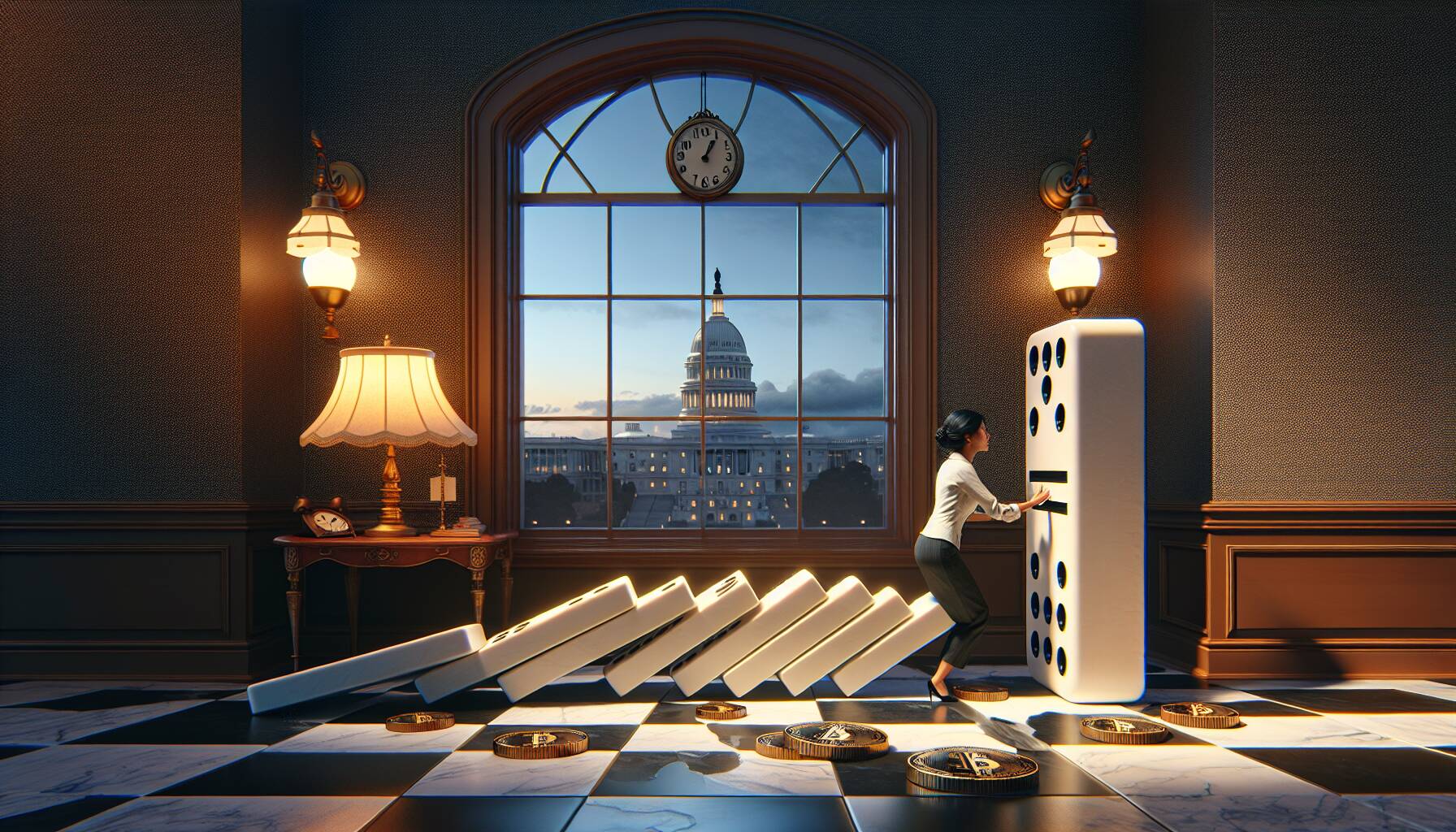

The landscape of cryptocurrency regulation in Washington has hit a significant pause, with momentum for new rules moving at a sluggish pace. As discussions surrounding digital assets continue to dominate headlines, key stakeholders are bracing for a prolonged standstill that may stretch for several weeks.

This unexpected slowdown comes amidst a backdrop of increased scrutiny and debates over how to effectively oversee the rapidly evolving crypto industry. Industry advocates have long called for clearer frameworks, yet the legislative process appears to have stalled, leaving many questions unanswered.

“The delay in regulatory progress reflects the complexities involved in crafting laws that can adequately address the unique challenges presented by cryptocurrencies,”

noted experts who monitor these developments closely. With lawmakers navigating competing priorities, the future of crypto regulation remains uncertain, and businesses operating in this space are left to operate in a gray area without the clarity they seek.

The current situation in Washington underscores the challenges of aligning regulatory frameworks with an industry that is both innovative and volatile. As stakeholders await further movement, the cryptocurrency community will be watching closely for any signs of progress in the coming weeks.

The Current State of Crypto Regulations in Washington

The following points outline the key aspects of the slowdown in new crypto rules and their potential impact on individuals and the market:

- Slowdown in Regulatory Momentum:

The push for new regulations surrounding cryptocurrencies in Washington has significantly decelerated.

- Expected Delay:

No progress on the regulatory front is anticipated for at least several weeks.

- Impact on Market Stability:

Uncertainty around regulations may lead to increased volatility in the cryptocurrency market.

- Implications for Investors:

The lack of clear rules can make it difficult for investors to make informed decisions.

- Influence on Innovation:

Regulatory lag may impact the pace at which new technology and projects can emerge in the crypto space.

This regulatory stasis could signify broader implications for market participants, as well as influence future legislative efforts.

Slowdown in Crypto Regulation: Implications for the Market

The current halt in new cryptocurrency regulations in Washington presents a unique landscape for market participants. As lawmakers take a step back from formulating new guidelines, this pause may afford existing players an advantage. Major cryptocurrencies like Bitcoin and Ethereum could potentially thrive in this environment, as market stability often encourages investment and could lead to increased adoption.

However, this regulatory stagnation also poses significant risks. Emerging projects and startups may struggle without clear rules, causing uncertainty that could dampen innovation in the crypto space. While established cryptocurrencies may enjoy a momentary boost, newer entrants might find it challenging to navigate the market without structured regulatory support.

Investors and traders often seek guidance from regulatory frameworks, and the lack of clarity can lead to hesitance. Institutional investors, who typically require defined rules to engage meaningfully in the market, may temporarily withdraw, fearing potential future repercussions or sanctions without a defined legal context.

Furthermore, this situation could create a double-edged sword for the broader tech industry. Established financial institutions might view this slowdown as an opportunity to solidify their market positions, while new fintech firms that rely on innovative crypto solutions may find themselves at a disadvantage, limiting their potential to disrupt traditional finance.

In summary, while the current delay in regulatory momentum could give well-established cryptocurrencies a blessing in disguise, it also signifies a precarious situation for newer players and institutional investors seeking clarity and innovation in the digital asset landscape.