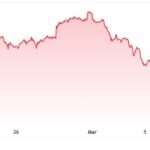

In a remarkable turn of events within the financial landscape, gold has officially claimed the title of the ultimate safe-haven asset, achieving an unprecedented milestone with futures soaring above ,000 an ounce for the first time in history. This surge has occurred amid a backdrop of considerable market turmoil, where the traditional realm of commodities seems to outshine its digital counterpart, Bitcoin, which is experiencing its own set of challenges. Currently, Bitcoin is hovering around ,000, reflecting a decline of 12% so far this year.

This stark contrast in performance underscores a growing perception of gold as a “store of value,” particularly in light of rising inflation expectations and the overall economic uncertainty fueled by geopolitical tensions. With the S&P 500 index recently slipping into correction territory—a fall of more than 10%—investors seem to be flocking to the perceived stability of gold, while Bitcoin ETF inflows have sharply declined, plummeting from billion to about billion in recent weeks, as noted by senior Bloomberg ETF analyst Eric Balchunas.

“The recent rally in gold to new all-time highs likely reflects both increasing inflation expectations and a broader flight to safety,” explains Andre Dragosch, Head of Research at Bitwise in Europe.

The correlation between rising inflation fears, such as those highlighted in the University of Michigan consumer survey—which has shown inflation expectations hitting multi-decade highs—and the recent declines in U.S. equities has fueled a renewed interest in traditional assets like gold. As the global economic landscape shifts rapidly, marked by tariff escalations and political uncertainties, gold’s ascent provides a compelling narrative against the backdrop of Bitcoin’s struggles.

As we delve deeper into the cryptocurrency’s market movements, upcoming events this month will be crucial. From the launch of new protocols to significant changes in decentralized finance (DeFi), the crypto space remains vibrant and dynamic. However, the ongoing trend of traders seeking refuge in gold illustrates a poignant moment for Bitcoin and other digital assets, as their appeal as a safe investment option is put to the test.

Market Update: Gold vs. Bitcoin and Economic Trends

The recent developments in the market highlight the contrasting performance of gold and bitcoin, reflecting broader economic uncertainties. Here are some key points to consider:

- Gold Surpasses ,000: Gold futures have reached an all-time high of ,000 per ounce, indicating its strong position as a safe-haven asset amid market turmoil.

- Bitcoin Struggles: In contrast, bitcoin is down 12% year-to-date, struggling to maintain its status as “digital gold” as it hovers around ,000.

- ETF Outflows: U.S. spot bitcoin ETFs have seen a decrease in net inflows from billion to billion, suggesting waning investor confidence.

These points are particularly relevant to readers as they may impact investment strategies and perceptions of asset stability.

- S&P 500 Correction: The S&P 500 has entered correction territory, falling over 10%, which may lead investors to re-evaluate their stock holdings.

- Geopolitical Tensions: Increasing geopolitical uncertainties, including trade policies and potential recession risks, are affecting market stability and consumer confidence.

- Inflation Expectations: Rising short- and medium-term inflation expectations have contributed to the increased demand for gold, impacting consumer and investment behavior.

Understanding these dynamics can aid readers in making informed financial decisions in an unpredictable market.

“The recent rally in gold to new all-time highs likely reflects both increasing inflation expectations and a broader flight to safety.” – Andre Dragosch

This statement underscores the sentiment that as market conditions worsen, investor behavior tends to shift towards more stable assets like gold.

Gold Soars While Bitcoin Falters: A Comparative Analysis

The recent surge in gold prices, crossing the ,000 mark for the first time, positions it as a robust alternative to traditional safe-haven assets in today’s volatile economic climate. This historic event starkly contrasts with the struggles faced by Bitcoin, affectionately dubbed “digital gold,” which is down to around ,000, reflecting a notable 12% decline this year. The primary advantage of gold in this context lies in its stability and historical precedent as a store of value during market turmoil, attracting investors fleeing from the turbulent stock market.

Gold’s ascendancy highlights its competitive edge over cryptocurrencies, particularly in times of rising inflation, geopolitical tensions, and recession risks. Analysts attribute gold’s high prices to increased inflation expectations and a collective flight to safety amidst declining consumer confidence. In comparison, Bitcoin’s declining ETF inflows—dropping from billion to billion—serve as a cautionary tale amidst fluctuating sentiments surrounding digital assets. This substantial dip in investor interest and the relative youth of cryptocurrency as an asset class may hinder its reputation as a reliable store of value in times like these.

That said, the emerging economic environment poses unique challenges and opportunities for various stakeholder groups. Traditional investors and gold enthusiasts stand to benefit significantly from these current trends, as rising gold prices signal a robust market for bullion and related investment avenues. Conversely, cryptocurrency investors might face increased anxiety as Bitcoin’s performance diverges from gold’s trajectory. This scenario could catalyze a shift in investor sentiment, driving some towards more stable assets like gold.

Moreover, newer investors in the cryptocurrency sector may struggle as they navigate these winds of change. The allure of rapid gains in Bitcoin’s ecosystem could diminish further if current trends persist, leading to tougher market conditions. Already, there’s a growing narrative framing Bitcoin as a complex and risky investment compared to the reliability of gold, challenging its perceived status. This divergence ultimately rewards traditional investors while casting uncertainty on the future of digital currencies in the investment landscape.

In a world rife with uncertainty due to geopolitical strife and economic instability, gold emerges as the favored refuge, further emphasizing its perennial status as a secure asset. Investors will need to navigate these treacherous waters carefully, weighing the merits of historical assets against the potential growth of emerging market technologies.