In today’s cryptocurrency news, significant developments are unfolding across the globe that could reshape the industry landscape. Pavel Durov, the founder of the popular messaging platform Telegram, has officially left France, moving to Dubai after receiving the green light from a French court. This move brings Durov to a city renowned for its business-friendly policies and light regulations, creating a potentially impactful scenario for his future endeavors.

On March 13, reports indicated that Durov had secured permission to depart France, and he was seen leaving with authorities’ approval, as confirmed by unnamed sources. This relocation hints at the ongoing globalization of cryptocurrency interests, as more tech leaders seek environments that foster innovation.

In another noteworthy development, David Sacks, prominent venture capitalist and co-founder of Craft Ventures, has divested over 0 million worth of investments in cryptocurrency and related stocks before stepping into a significant role within the White House. According to a recent memorandum, Sacks’s actions were part of a preemptive move to mitigate any potential conflicts of interest tied to his impending role as the White House’s AI and crypto czar. This position will likely influence the future legal framework governing the cryptocurrency industry, as Sacks aims to establish a more organized and regulated environment.

The memorandum detailed that Sacks had divested all “liquid cryptocurrency” from his portfolio, which notably included assets like Bitcoin, Ethereum, and Solana. These strategic decisions underscore a shift towards greater governance in a space often criticized for a lack of regulations.

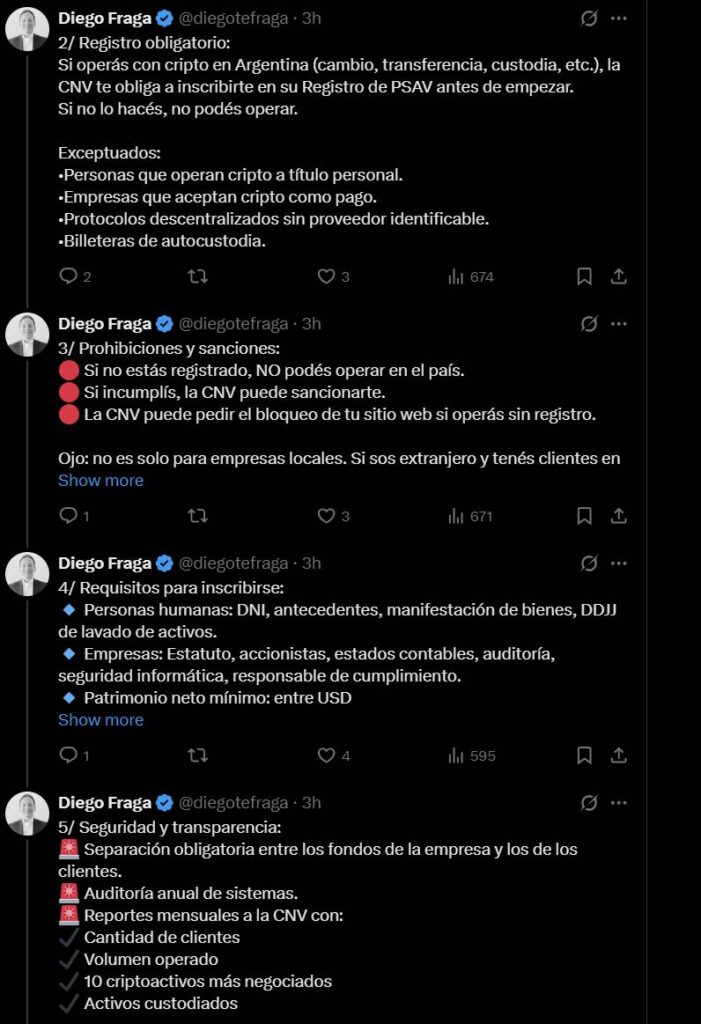

Lastly, in South America, Argentina is making strides in regulating its cryptocurrency sector. The country’s securities regulator has finalized rules governing virtual asset service providers (VASPs), aimed at enhancing transparency and user protection within the digital asset ecosystem. These regulations impose requirements on VASPs concerning registration, cybersecurity, and money laundering prevention, marking a significant step towards a more secure and stable crypto market in Argentina.

Legal experts highlight the importance of these regulations, which include mandatory audits and the separation of company and client funds. The aim is to bolster user trust and market integrity in a sector that continues to expand rapidly.

Key Updates in the Crypto World

Below are the significant developments in the crypto sphere that may influence both investors and users in the coming months.

- Pavel Durov’s Relocation:

- Durov, founder of Telegram, has moved from France to Dubai after receiving court approval.

- Dubai is recognized for its favorable business conditions and lack of extradition treaties.

- This move may influence crypto businesses in Dubai, attracting more entrepreneurs to the region.

- David Sacks’ Portfolio Divestment:

- David Sacks sold over 0 million in crypto and related stocks before assuming his role as the White House AI and crypto czar.

- This divestment was to minimize potential conflicts of interest as he helps shape the legal framework for the crypto industry.

- His actions may set a precedent for other investors and government officials regarding transparency and ethical standards in crypto investments.

- New Regulations in Argentina:

- Argentina’s National Securities Commission has enacted rules for virtual asset service providers (VASPs).

- The regulations include codes of conduct, cybersecurity measures, and money laundering prevention protocols.

- The aim is to enhance transparency and user protection within the crypto ecosystem in Argentina.

- Noncompliance could result in business registration revocation or legal action against unregistered operations.

These developments reflect a growing trend towards regulation and oversight in the crypto industry, which may enhance investor confidence and secure the integrity of digital asset markets.

Latest Developments in Crypto: Impacts of Regulatory Changes and Strategic Moves

The crypto landscape is continuously evolving, with significant shifts driven by influential figures and regulatory bodies shaping the future of the industry. Recent news highlights key moves by Pavel Durov, David Sacks, and Argentina’s regulatory framework for virtual asset service providers (VASPs). Each of these developments carries both competitive advantages and potential pitfalls that can reshape market dynamics.

Pavel Durov’s Relocation to Dubai has captured attention due to its implications for privacy and business opportunities. Durov’s departure from France to Dubai signals a strategic pivot towards a more favorable environment for crypto-based ventures. Dubai’s robust infrastructure and cryptocurrency-friendly policies can attract tech entrepreneurs and investors seeking innovation without the constraints seen in more regulated markets. However, his exit from France may raise questions about compliance and the ethical implications of relocating to a jurisdiction with loose regulations. As a result, businesses operating under stringent EU regulations might find themselves at a disadvantage compared to those in Dubai’s more relaxed landscape.

David Sacks’ Divestment Before Entering Government exemplifies the delicate balance between public service and private investment. By selling off over 0 million in crypto and related stocks, Sacks mitigates potential conflicts of interest as he steps into his role as the White House AI and crypto czar. This move bodes well for maintaining the integrity of his position and aims to foster an unbiased approach to crypto regulation in the U.S. However, critics might argue that such divestments raise questions about transparency and whether the timing was entirely fortuitous. This situation could either bolster investor confidence in government roles or alienate some stakeholders who feel underrepresented.

Argentina’s New Regulations for VASPs represent a pivotal shift in how the country will handle cryptocurrency transactions moving forward. By instituting comprehensive regulations, Argentina aims to promote transparency and protect users in an industry often fraught with risks. These measures can bolster public trust in cryptocurrencies and stimulate growth in the sector. However, the strict compliance requirements could create barriers for new startups and smaller players who may struggle to meet the financial and operational demands imposed by the new rules. It remains to be seen how established enterprises will respond; they may welcome the competitive edge that compliance grants or view it as an overreach that stifles innovation.

In summary, these recent events present unique opportunities and challenges for investors, crypto startups, and regulatory agencies. Durov’s move could inspire further capital inflow towards Dubai, while Sacks’ divestment might prompt more government employees to reevaluate their investments. Argentina’s approach could either protect consumers and elevate the market or hinder emerging players struggling to keep pace with compliance demands.