Ethereum’s native token, Ether (ETH), is currently experiencing a period of consolidation below the ,000 mark, a threshold that many traders consider to be psychologically significant. Following a drop below this range on March 10, Ether is now trading at its lowest price since October 2023, causing concern among investors about its recovery prospects.

Recent market movements have seen Ether lose some of its market value relative to other major altcoins, notably with XRP reaching a significant high against ETH for the first time in five years.

As traders assess whether Ether can reclaim lost ground or if a further drop below ,900 could trigger a wave of selling, data from IntoTheBlock reveals that a substantial accumulation of 3.56 million ETH occurred between ,900 and ,843, with a collective value of approximately .65 billion. This suggests a critical support level in that range, potentially acting as a bullish reversal zone for the cryptocurrency.

However, slipping beneath the ,843 line could escalate capitulation fears among investors, a sentiment marked by selling at a loss during significant market downturns.

Notably, the percentage of Ethereum addresses currently in profit has fallen to its lowest since the start of the decade—hovering just below 46%—lifting concerns about market momentum. Historically, such low profitability often signals a price bottom for Ethereum, suggesting that the substantial accumulation coupled with a decline in profitable addresses could hint at a possible rebound ahead.

In a commentary from Hitesh Malviya, founder of DYOR crypto, he pointed out that the burgeoning sector of real-world assets (RWAs) has recently surged, showing a 50.9% growth over the last 30 days and an impressive 850% increase over the past year, with Ethereum claiming a significant market presence.

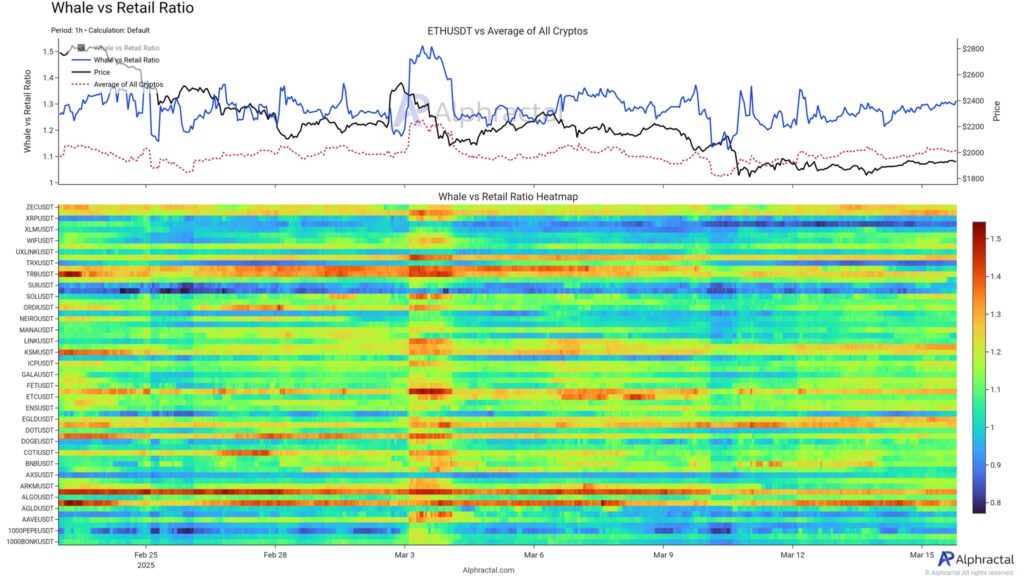

Amidst these fluctuations, a recent analysis from Alphractal indicates that the current long/short ratio for Ether reflects a balanced but wary market, with predominant long positions taken by larger investors while retail traders appear to be unwinding their leveraged bets.

This cautious market sentiment could lead to low volatility and diminished interest in leveraged trading, fostering an environment where many traders might become increasingly impatient as they navigate these uncertain waters. The overall outlook suggests that while challenges remain, there are critical factors at play that could influence Ethereum’s path forward.

Ethereum Price Analysis and Market Sentiment

The current state of Ethereum’s native token, Ether (ETH), presents important insights for traders and investors. Below are key points that are relevant to understanding ETH’s price movements and potential future trends:

- Current Price Range:

- Ether is consolidating under ,000, a psychological level for traders.

- As of March 10, ETH price has dropped under this range, reaching its lowest since October 2023.

- Market Comparisons:

- XRP has seen a significant rise compared to ETH, reaching its highest level against ETH in five years on March 15.

- Support Levels:

- Key support identified between ,900 and ,843, where significant accumulation has occurred.

- Failure to maintain above these levels may lead to increased capitulation fears among investors.

- Capitulation Risks:

- Capitulation refers to panic selling during a market downturn, which could occur if ETH drops below ,843.

- A prolonged period under this level increases the risk of deeper corrections and lower market confidence.

- Profitability Concerns:

- The percentage of Ethereum addresses in profit has dropped to under 46%, a historical indicator of potential price bottoms.

- This low profitability, coupled with high accumulation, may act as a bullish signal for future price recovery.

- Market Sentiment Analysis:

- Long/Short Ratio: The current ratio at 1.3 suggests a balanced, yet cautious market.

- Larger investors are more likely to take long positions, while smaller investors are reducing risk through deleveraging.

- This trend indicates low volatility and a cautious outlook on market movements.

- Industry Trends:

- Real-world assets (RWAs) are on the rise, with a notable 50.9% increase in growth over the past month.

- Ethereum and ZKsync hold more than 80% of the RWA market share, signaling potential growth and investment interest.

This overview highlights the intricate dynamics influencing Ethereum’s price and market sentiment, which may impact investment strategies and decision-making for traders.

Ethereum Price Struggles: An Analysis of Market Sentiment and Potential Implications

Ethereum, with its native token Ether (ETH), is currently facing a significant consolidation phase just under the ,000 mark, a threshold that traders identify as psychologically pivotal. The recent price dips, particularly the slide below ,900, have sparked discussions about whether this leading altcoin can regain its previous value or if investors may decide to capitulate if selling intensifies.

In comparison to other altcoins, Ethereum is losing ground, notably against XRP, which has reached a five-year high relative to ETH. This competitive disadvantage raises concerns for Ethereum investors as it highlights a potential shift in market dynamics. If ETH continues to slide and loses key support levels, such as the critical range between ,900 and ,843, it may trigger increased selling pressure. The situation is exacerbated by the declining percentage of profitable addresses, which has dropped to a low since early 2022, indicating that many small holders are currently in negative territory, further diminishing confidence.

For investors holding large amounts of ETH, the accumulation of 3.56 million tokens in the ,900 to ,843 range could represent a potential safety net if prices remain stable in that corridor. However, if ETH breaches the ,843 support level, it could engender widespread panic, as historical trends suggest that falling below such key levels often leads to significant capitulation in the cryptocurrency market. Traders might face a tumultuous period if they are unable to endure the uncertainty that may follow.

Interestingly, there’s a contrasting sentiment reflected in the growing interest around real-world assets (RWAs) that have gained traction recently. With a remarkable 50.9% increase in this sector over just 30 days, Ethereum’s position in the RWA space, which now holds 80% of the market, could create opportunities despite current price challenges. This niche market could represent a strategic advantage for long-term holders who lean into the integration of RWAs within Ethereum’s ecosystem.

Moreover, the long/short ratio analysis indicates a cautious atmosphere among traders, revealing that while large investors are leaning towards bullish bets, smaller investors are deleveraging. This trend, characterized by lower volatility and a dip in interest surrounding leveraged trades, may indeed benefit seasoned investors prepared for potential rebounds, but it could present challenges for less experienced traders who might be craving swift market action.

In essence, Ethereum’s journey remains complex, where the interplay between accumulation zones, psychological price barriers, and shifting market interests could dictate the future trajectory of ETH. While growing sectors like RWAs offer promising prospects, the immediate risks of capitulation amid price contractions could present significant hurdles for less resilient investors.