The cryptocurrency landscape is poised for a notable shift with the upcoming launch of the first Solana futures exchange-traded fund (ETF). This event is being closely watched by industry experts and investors alike, as it could lay the groundwork for a future Solana spot ETF, which many in the crypto community consider the “next logical step” for trading products linked to digital currencies.

Scheduled for debut on March 20, Volatility Shares is set to introduce two new Solana ETFs: the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT). According to Ryan Lee, chief analyst at Bitget Research, this initial introduction may significantly enhance the institutional adoption of the Solana (SOL) token by providing a regulated investment vehicle that could attract substantial capital influx.

“The launch of the first Solana ETFs in the US could significantly boost Solana’s market position by increasing demand and liquidity for SOL, potentially narrowing the gap with Ethereum’s market cap,” said Lee.

While the optimism surrounding these futures ETFs is palpable, there are also voices of caution. Some industry participants express concern that these products may face a tepid reception, reminiscent of the modest inflows seen with the recent Ethereum spot ETFs. Bloomberg’s senior ETF analyst, Eric Balchunas, suggests that the futures ETF may not draw significant investor interest compared to the popularity of Bitcoin ETFs.

Despite potential inflow disappointments, the launch of the Solana futures ETF could solidify Solana’s credibility as one of the leading cryptocurrencies. This legitimacy is further underscored by U.S. President Donald Trump’s announcement, which included Solana as part of a strategic reserve alongside other notable cryptocurrencies like Cardano and XRP.

“We can expect moderate inflows into the futures ETF – spot ETF is generally a better instrument for getting exposure and that will be the major milestone,” commented Anmol Singh, co-founder of Bullet, a decentralized exchange focusing on Solana.

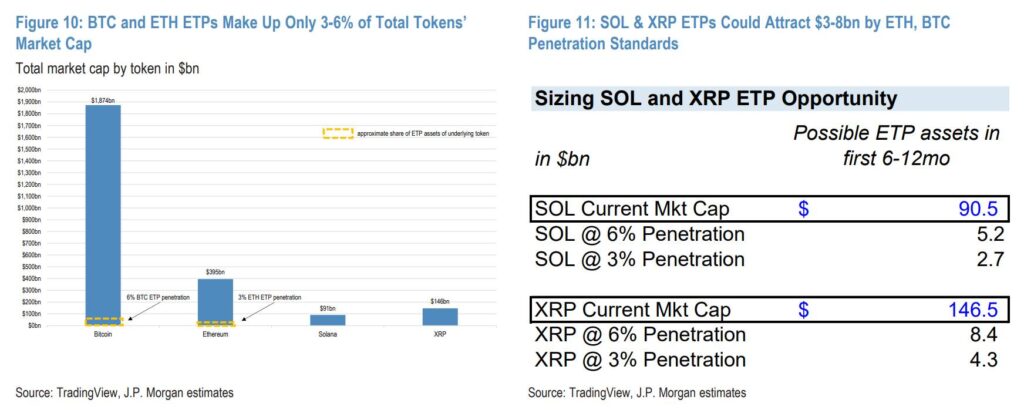

Looking forward, some analysts project that should a spot Solana ETF gain approval, it could attract between billion to billion in assets within its first six months. This potential influx underlines the growing interest in Solana and its competitive position within the broader cryptocurrency market, particularly against Ethereum.

As the crypto community eagerly anticipates these developments, the month of March could mark a pivotal moment for Solana, opening up new avenues for investment and reinforcing its status among cryptocurrency leaders.

Impact of the First Solana Futures ETF Launch

The debut of the Solana futures exchange-traded funds (ETFs) represents a pivotal moment in the cryptocurrency market. Below are the key takeaways from this development and its potential implications for investors and the broader crypto ecosystem.

- Launch of Solana Futures ETFs:

- The Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT) are set to launch on March 20.

- Institutional Adoption Potential:

- Analysts predict that the introduction of these ETFs could drive significant institutional investments in Solana (SOL), enhancing its market credibility.

- Ryan Lee from Bitget Research notes that this could advance Solana’s position and liquidity, potentially narrowing the gap with Ethereum’s market capitalization.

- Regulatory Validation:

- The SEC’s approval of Solana ETFs adds legitimacy to the cryptocurrency, which can foster more confidence among investors.

- U.S. President Donald Trump’s Working Group on Digital Assets’ inclusion of Solana in the crypto strategic reserve boosts its recognition.

- Concerns Over Initial Inflows:

- There is skepticism regarding the volume of investments that these futures ETFs will initially attract, similar to those seen with the spot ether ETF, which underperformed.

- Analyst Eric Balchunas from Bloomberg warns that investor disappointment could arise if inflows to the futures ETFs are lackluster.

- Spot ETF Outlook:

- The successful launch of futures ETFs might pave the way for a subsequent spot ETF, which typically draws higher investor interest and capital.

- JPMorgan analysts anticipate that a potential spot Solana ETF could attract between billion to billion in net assets within the first six months.

- Adoption Timeline Considerations:

- The approval process for further ETF products by the SEC is historically prolonged, which could delay the introduction of a spot Solana ETF until 2026.

- Continued awareness and market dynamics might drive adoption rates for both SOL and XRP in parallel.

“Solana ETFs are in motion creating the possible avenues for more wide-scale adoption.” – Anmol Singh, co-founder of Bullet

The Launch of Solana Futures ETFs: A Strategic Shift in Crypto Trading

The introduction of Solana futures ETFs by Volatility Shares presents a pivotal moment in the crypto market, positioning itself as a strong competitor, particularly against established assets like Ethereum. As the crypto industry begins to embrace these financial instruments, the dual launch of the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT) could not only enhance institutional interest but also redefine investment strategies in the crypto domain. The key takeaway for crypto investors and enthusiasts is that while the futures ETFs may bolster Solana’s stature, they are not without their challenges.

Competitive Advantages: The launch of these futures ETFs could serve as a powerful catalyst for broader institutional adoption of Solana (SOL). According to market analysts like Ryan Lee, these products could increase demand and liquidity for SOL, potentially allowing it to close the valuation gap with Ethereum. With the U.S. government showing interest in Solana by including it in their strategic reserve, the ETFs could further legitimize Solana in the eyes of institutional investors who have previously been hesitant towards cryptocurrencies.

Furthermore, the future possibility of a spot Solana ETF could turn this moment into a watershed for capital influx, potentially attracting billions in new investments. Analysts project that a spot ETF could draw between billion to billion within its initial months, offering a stark contrast to the tepid reception experienced by Ethereum spot ETFs. This anticipated surge in capital could significantly strengthen Solana’s market presence.

Competitive Disadvantages: However, the enthusiasm isn’t universal. Skepticism looms regarding the potential for disappointing inflows, drawing comparisons to the recent performance of Ether’s futures products, which did not meet expectations. Industry insiders like Bloomberg’s Eric Balchunas predict that Solana futures ETFs may suffer similar fates unless a compelling case for their necessity is made. The history of capital inflows into crypto spot ETFs casts doubt on whether futures can deliver robust performance without the backing of substantial investor confidence.

Additionally, the entrenched position of Ethereum poses significant challenges for Solana’s market growth. The existing infrastructure and community surrounding Ethereum represent formidable barriers to entry that Solana must navigate carefully. If Solana fails to deliver the expected returns on its futures ETFs, it might encounter investor disillusionment, thereby delaying broader adoption.

The ramifications of this launch stretch beyond mere market dynamics. Retail investors eager for exposure to burgeoning cryptocurrencies could find opportunity in Solana’s offerings. Conversely, traditional investors already invested heavily in Bitcoin or Ethereum might perceive these ETFs as a distraction, diluting their focus and potentially leading to over-leveraged positions in a volatile market.

As Solana navigates this pivotal juncture, the cryptocurrency community will be watching closely. The outcomes of these futures ETFs could significantly impact the future landscape of crypto investing, making it crucial for investors to remain informed and vigilant in the evolving scenario.