The cryptocurrency sector is abuzz with anticipation as it prepares to launch the first-ever Solana futures exchange-traded fund (ETF) on March 20. This pivotal move by Volatility Shares, with its Solana ETF (SOLZ) and the 2X Solana ETF (SOLT), is being heralded as a potential game-changer for the crypto market. Industry insiders view this development as a significant step towards the introduction of a spot ETF for Solana, further legitimizing its place within the competitive landscape of digital assets.

Ryan Lee, chief analyst at Bitget Research, underscores the importance of this launch, suggesting that it may attract substantial institutional investment in the Solana token (SOL). He notes that the availability of a regulated investment vehicle could enhance Solana’s appeal, driving demand and liquidity, while simultaneously narrowing the market cap gap with Ethereum.

“The launch of the first Solana ETFs in the US could significantly boost Solana’s market position,” said Lee in a recent interview with Cointelegraph.

However, experts like Eric Balchunas, a senior ETF analyst at Bloomberg, express cautious optimism. They caution that while the futures ETF might not deliver significant initial inflows, it nonetheless serves to validate Solana’s status in the crypto space. It follows a similar pattern observed with recent spot Ether ETF launches which struggled to generate substantial investment compared to their Bitcoin counterparts.

Anmol Singh, co-founder of the Solana-native perpetual futures decentralized exchange Bullet, shares perspectives on the potential growth of Solana ETFs. He believes that the introduction of these futures products is just the beginning and emphasizes that the long-awaited spot ETF could yield even more substantial investor interest.

“Solana ETFs are in motion creating the possible avenues for more wide-scale adoption,” Singh noted.

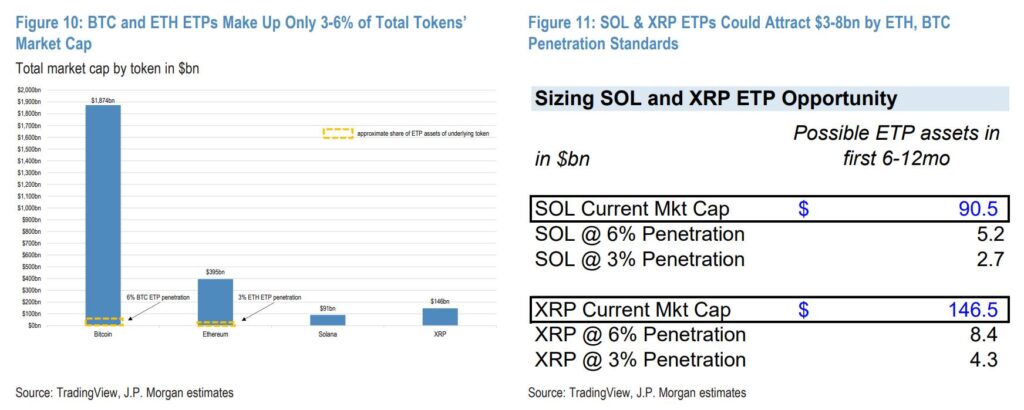

Reports from JPMorgan suggest that a spot Solana ETF could garner an impressive billion to billion in net assets within its first six months. However, analysts predict that the pathway to approval for a spot ETF could be protracted, extending possibly into 2026.

Impact of the First Solana Futures ETF on the Crypto Landscape

The introduction of the first Solana futures exchange-traded fund (ETF) marks a significant milestone in the crypto industry. Here are the key points regarding this development and its potential impact:

- Launch Date: The Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT) are set to launch on March 20.

- Institutional Adoption:

- The futures ETF is expected to significantly boost institutional adoption of the Solana (SOL) token.

- Ryan Lee, chief analyst at Bitget Research, anticipates an increase in demand and liquidity for SOL, potentially narrowing the market cap gap with Ethereum.

- Regulated Investment Vehicle:

- The existence of a regulated ETF could attract billions in capital, reinforcing Solana’s competitiveness against established cryptocurrencies like Ethereum.

- Investor confidence may grow as this product legitimizes Solana in the eyes of traditional finance.

- Concerns of Disappointment:

- Industry experts are worried that the Solana futures ETF might not yield significant inflows, similar to the experience with the spot Ether ETF.

- Potential underperformance could dampen expectations for future crypto ETFs.

- Future Spot ETF Prospects:

- Analysts suggest that the futures ETF could pave the way for a potential spot Solana ETF, which is often considered a better instrument for exposure.

- A spot ETF could attract significant net assets, estimated between billion to billion within the first six months, surpassing Ether ETF adoption rates.

- Long-Term Timeline:

- Considering the SEC’s historical review timelines, the approval of a spot ETF may not come until 2026.

- This creates uncertainty around the immediate impact of the futures ETF on prices and market sentiment.

- Government Recognition:

- The inclusion of Solana in the US crypto strategic reserve by the Working Group on Digital Assets could enhance its legitimacy.

- This recognition may stimulate increased interest and investment in the Solana ecosystem.

“Solana ETFs are in motion creating the possible avenues for more wide-scale adoption.” – Anmol Singh, co-founder of Bullet

Breaking Ground: The First Solana Futures ETF Signals a New Era for Crypto Investment

The crypto landscape is evolving as the first Solana futures exchange-traded funds (ETFs) prepare to launch, creating a buzz about their potential impact on the market. Volatility Shares is taking the bold step of offering two new products: the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT). This momentous occasion not only positions Solana in the ETFs arena but may also lead to the eventual approval of a spot ETF, positioning Solana as a serious contender against Ethereum.

Competitive Advantages: The introduction of these futures ETFs can potentially enhance Solana’s visibility and legitimacy in the cryptocurrency market. By offering a regulated investment vehicle, these products could attract institutional investors seeking exposure to digital assets without the complexities of direct cryptocurrency ownership. Analysts like Ryan Lee from Bitget Research emphasize that increased institutional involvement could enhance liquidity and demand for SOL, with the potential to nearly close the gap with Ethereum’s market capitalization.

Furthermore, alongside the endorsement from the U.S. government’s Working Group on Digital Assets, Solana is receiving a significant credibility boost. Such recognition could lead to a broader acceptance of Solana as a staple in crypto portfolios.

Competitive Disadvantages: Despite the promising outlook, skeptics warn of a potential shortfall in investor enthusiasm, drawing parallels with the lackluster performance of the spot Ether ETF launch. Eric Balchunas from Bloomberg suggests that if inflows do not meet expectations, it could lead to disappointment amongst investors and detract from the overall momentum that Solana aims to build. Additionally, the entrenched position of Ethereum remains a formidable challenge that could inhibit Solana from achieving its full potential, even with the new ETFs.

This evolving narrative presents a dichotomy for different stakeholders. Institutional investors looking for regulated, structured products may find substantial benefits in these new ETFs, diversifying their portfolios and exposing themselves to Solana’s growth potential. On the other hand, retail investors, particularly those who anticipated rapid adoption similar to Bitcoin’s trajectory, might find the initial waves of Solana ETF performance underwhelming if inflows do not align with optimistic forecasts. The uncertainty surrounding the timeline for spot ETF approvals, which could extend into 2026, may further complicate expectations for both groups.

In summary, while the first Solana futures ETF presents exciting opportunities for institutional adoption and adds legitimacy to Solana’s standing, the market remains fraught with unpredictability. As stakeholders navigate this complex landscape, the success of these financial instruments will hinge on their ability to foster genuine investor confidence and catalyze broader market movements.