The world of cryptocurrency is buzzing with discussion about an enigmatic phenomenon known as ‘altcoin season.’ Traditionally, this term has signified a brief period where the majority of altcoins, or alternative cryptocurrencies to Bitcoin, outperform Bitcoin itself, following a significant rally in its price. Past patterns from 2015 to 2022 typically reflected these cycles, yet the current market remains uncertain about whether we are witnessing a true altcoin season now.

According to the Blockchain Center, altcoin season occurs when 75% of the top 50 altcoins show better performance than Bitcoin over a rolling 90-day period. Recent data hinted at potential altcoin seasons in early 2024, yet the uptrends have been fleeting and failed to secure a definitive status. Analysts have speculated that factors such as the rise of memecoins and the increasing presence of institutional investment products are reshaping the dynamics within the altcoin market.

“The reason we’ve seen no major ‘altseason’ across majors is because the speculative capital that would’ve once poured into top 200 assets instead decided to jump the gun and flood into on-chain low caps instead.” – Miles Deutscher

As cryptocurrency continues to evolve, many now argue that the term ‘altcoin’ itself oversimplifies a diverse range of assets, each possessing unique functions and market potential. For instance, while some altcoins have thrived, others — particularly those involving memecoins — have struggled significantly. Political influences in the U.S., including endorsements from notable figures, have further complicated the landscape, igniting interest yet leading to swift declines for some new tokens.

The entry of institutional investors into the crypto sphere, marked by the launch of spot Bitcoin ETFs, has also been a gamechanger, drawing substantial capital away from more speculative altcoin investments. Analyst insights suggest that while these investment products have attracted billions, they may indirectly discourage investments in less established altcoins. However, others argue that rather than a zero-sum game, the influx of capital might simply be broadening the entire cryptocurrency market.

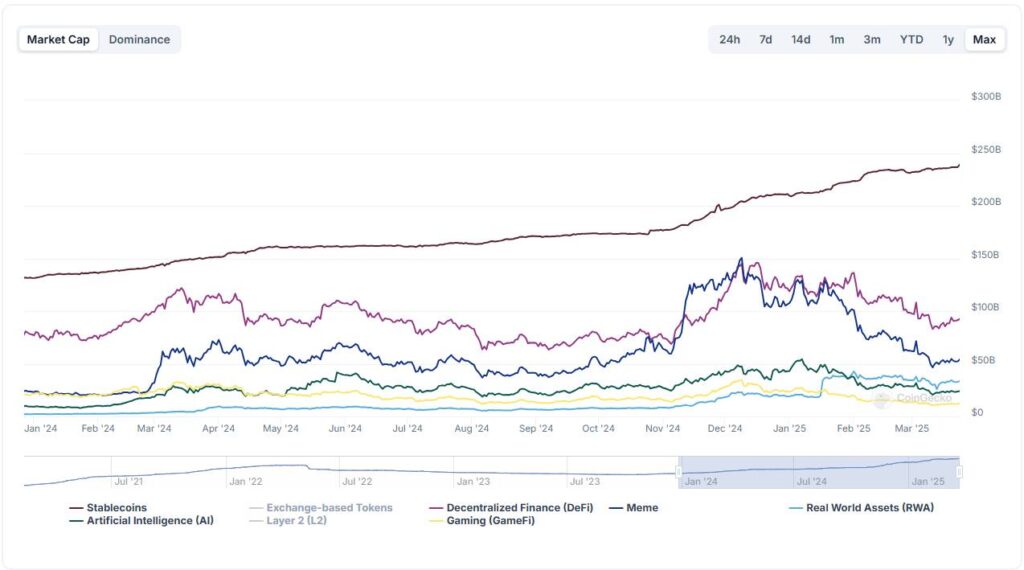

Another key revelation is the nuanced shifts in altcoin categories; each now serves distinct sectors such as decentralized finance (DeFi), gaming, and real-world asset enablement. For instance, while Ethereum remains a cornerstone for DeFi, Solana has emerged as a leader in memecoins, showcasing how specialized narratives can drive investor capital. This diversification hints at a maturing market where understanding individual asset classes may soon be more critical than clinging to generalized terms like ‘altseason.’

Understanding Altcoin Season in Cryptocurrency

The concept of an “altcoin season” is often misunderstood and can deeply impact how investors navigate the cryptocurrency market. Here are the key points to consider:

- Definition of Altcoin Season: An altcoin season is identified as a period when 75% of the top 50 altcoins outperform Bitcoin over a 90-day timeframe.

- Historical Patterns: The altcoin season has been historically observed following Bitcoin price rallies, notably in cycles from 2015-2018 and 2019-2022.

- Current Status: Recent upticks in altcoin performance have not been sustained long enough to signify a new altcoin season.

- Impact of Memecoins:

- Speculative investments have shifted towards memecoins, draining liquidity and impacting the performance of traditional altcoins.

- Many retail investors have faced significant losses by entering memecoins during later stages of their rallies.

- Institutional Influence:

- The entry of institutional investors and the popularity of spot Bitcoin ETFs have diverted capital from altcoins, impacting their overall strength.

- ETF structures provide easier access to investors but may reduce interest in speculative altcoin investments.

- Diverse Nature of Altcoins:

- Altcoins are no longer a homogenous category; they encompass various tokens with different functions, value structures, and investment profiles.

- This evolution suggests the necessity for investing decisions to be made based on specific asset narratives rather than a broad altcoin label.

- Maturation of the Crypto Market: The divergence in performance metrics indicates that altcoins are now responding to unique ecosystem activities, marking a shift in how the market functions.

“Investors must be vigilant and adaptable, as the traditional markers of altcoin performance are evolving.” – Anonymous

Understanding these elements of altcoin season can influence readers’ investment strategies, helping them to navigate the complexities of the crypto market, make informed decisions, and manage risks effectively.

The Evolution of Altcoin Seasons: A Comparative Analysis

The notion of an “altcoin season” is undergoing a fascinating transformation in the current crypto landscape. Traditionally characterized by periods where altcoins collectively outperform Bitcoin, this paradigm is now being challenged as market dynamics shift. Analysts are dissecting the reasons behind the lack of a pronounced altcoin season in the recent cycle, revealing both competitive advantages and disadvantages for investors navigating this complex terrain.

Competitive Advantages: One of the most compelling shifts in the crypto space is the influence of institutional investors. The introduction of spot Bitcoin ETFs has ushered in significant capital inflows, totaling around 9 billion. This robust surge not only brings added legitimacy to the crypto market but also provides a framework of security and accessibility previously unattainable for retail investors. These ETFs represent a stable entry point for those looking to invest in digital assets, potentially expanding the market and introducing new players to the previously volatile altcoin sector.

The diversification of crypto assets into specialized categories is another competitive edge. As the market matures, the fluidity of altcoins reveals a nuanced landscape. From blockchain-native coins to governance tokens and real-world asset protocols, the evolution suggests that savvy investors can now benefit from focusing on specific market narratives rather than treating all altcoins as a homogenous group. This shift allows for more informed investment strategies, catering to varied risk appetites and developmental visions.

Disadvantages: However, this shift can also create significant pitfalls, particularly for retail investors. The explosion of memecoins and speculative investments has siphoned liquidity away from more established altcoins. The narrative that early financiers in these more illiquid markets have garnered massive returns while traditional altcoins lag underscores a disconnect in perceived value. Moreover, recent attention-grabbing memecoins like TRUMP and MELANIA tokens have showcased how quickly sentiment can turn, resulting in steep losses that mirror some of the most volatile periods in the past. This reality can deter reluctant investors, creating a hesitation that stifles market enthusiasm and growth potential.

The flood of choices in the market could also overwhelm potential investors. With new assets emerging regularly, discerning which altcoins offer true value can become an intricate and daunting task. This may exacerbate the volatility experienced during periods of speculation, particularly when novice investors dive into illiquid markets without a comprehensive understanding of the landscape.

For institutional players, the rise of specialized altcoin categories and the dominance of established ETFs could spark challenges as they seek to differentiate their portfolios. While many altcoins are already facing competition from larger, recognized tokens, institutions may need to adopt more sophisticated strategies to effectively engage with this evolving crypto ecosystem.

Overall, while the current trends yield opportunities for both retail and institutional investors, they also highlight the critical importance of understanding the individual narratives and underlying mechanics at play in the ever-changing world of altcoins. The landscape is shifting, and those who adapt swiftly will likely find themselves best positioned to capitalize on future developments.