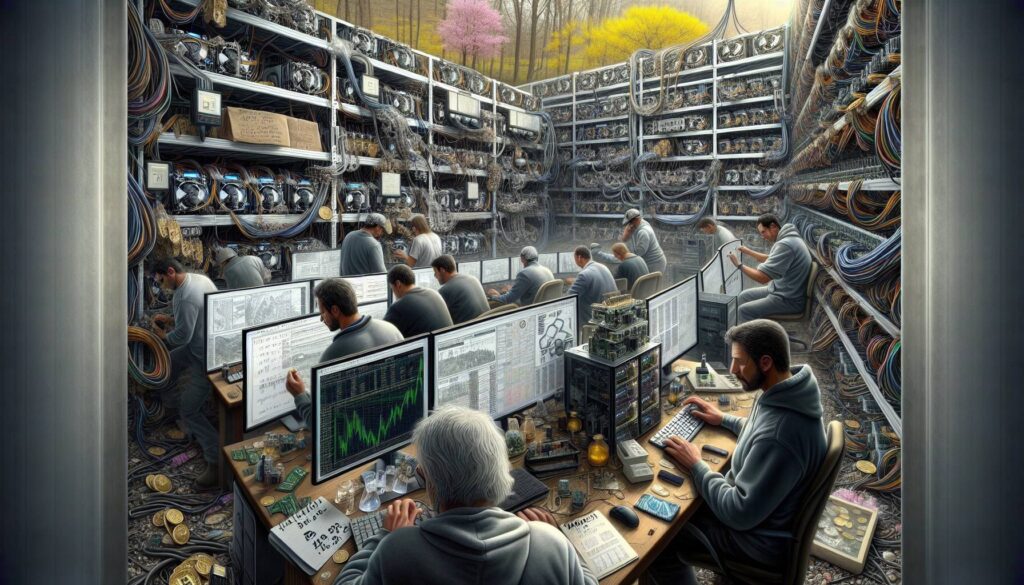

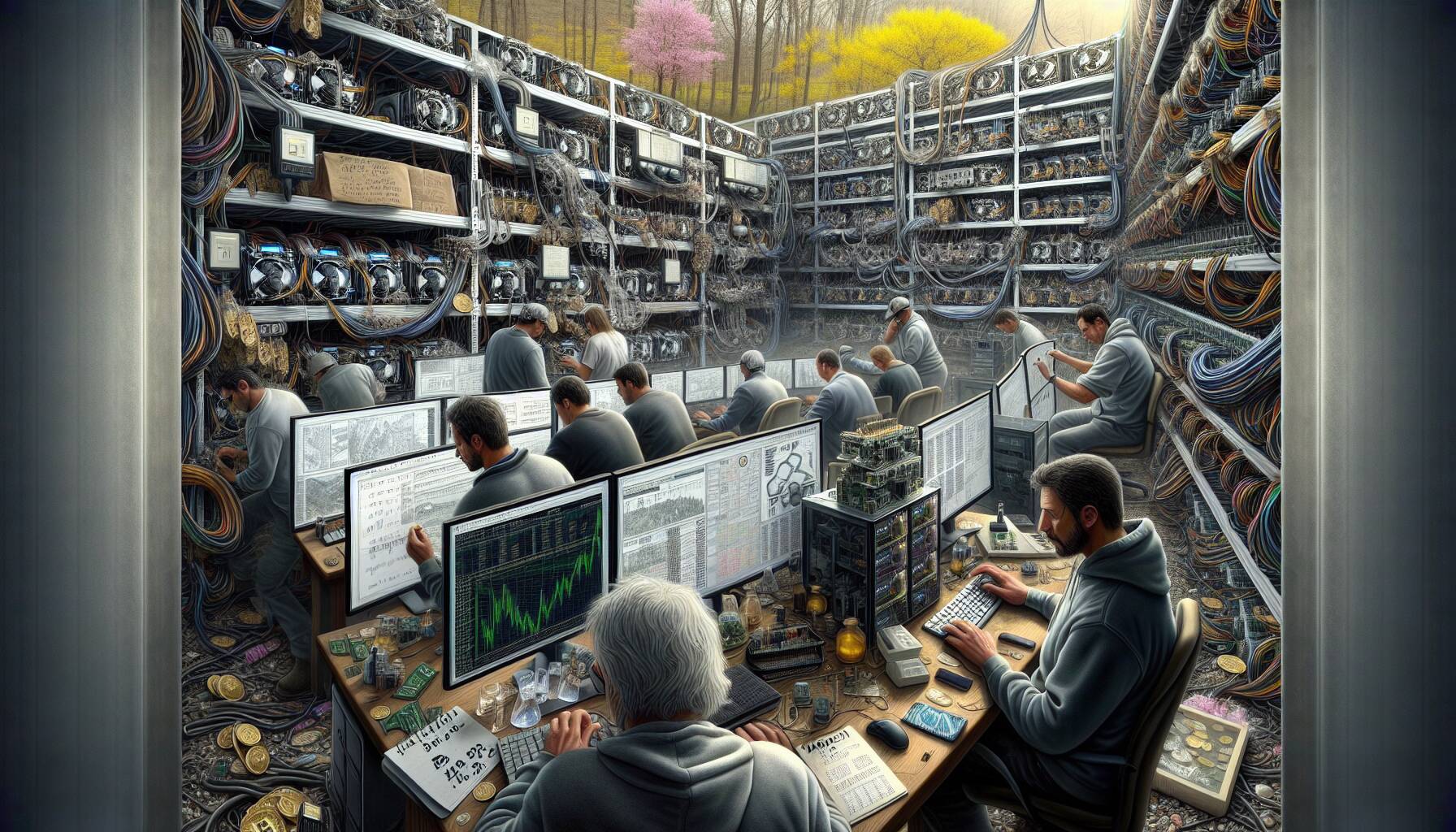

The latest report from JPMorgan highlights a challenging month for U.S.-listed bitcoin miners, revealing a substantial 25% drop in their total market capitalization during March. This downturn marks the third-worst monthly performance recorded for these companies, indicating the struggles many are facing in the current market landscape. Interestingly, only one miner, Stronghold Digital Mining, managed to outperform bitcoin itself, which underscores a wider trend of declining profitability in the sector.

According to JPMorgan analysts Reginald Smith and Charles Pearce, the prevailing valuations are now at their lowest levels in relation to the bitcoin block reward since the collapse of the FTX exchange in late 2023. This nearly unprecedented position reflects broader economic pressures that have affected the whole mining industry.

The report also indicated a slight rise in the average network hashrate to 816 exahashes per second (EH/s) during March, suggesting heightened competition in bitcoin mining. Hasrate is a key indicator as it demonstrates the total computational power applied to mining and processing transactions, essentially hinting at the mining difficulty miners face.

However, the economic outlook for miners remains bleak, with both mining revenue and profitability experiencing significant declines. The estimated average earnings for miners in March fell to ,300 per EH/s in daily block reward revenue, which is a 13% decrease from February. Furthermore, daily gross profits took a notable hit, plunging 22% month-over-month to ,000 per EH/s.

“We note valuations today are at the lowest levels relative to the block reward since the collapse of FTX in the Fall of 2023,” analysts wrote.

Stronghold Digital Mining stood out with a comparatively minor 2% decline, while Cipher Mining faced a staggering 45% drop, showcasing the volatile nature of the market. As bitcoin continues to fluctuate, these developments shed light on the ongoing struggles within the mining sector and its complex relationship with the cryptocurrency market at large.

Market Trends in Bitcoin Mining: March 2023 Performance

This article outlines significant developments in the U.S. bitcoin mining sector, highlighting the performance of various companies and the broader implications for investors and stakeholders.

- Market Cap Decline:

- The total market cap of 14 U.S.-listed bitcoin miners dropped 25% in March.

- This marks the third-worst monthly performance on record for these mining companies.

- Stronghold Digital Mining (SDIG):

- Only SDIG managed to outperform bitcoin with a 2% decline in March.

- This contrasts sharply with the broader sector, indicating unique resilience or strategic advantage.

- Performance of HPC vs. Pure-Play Miners:

- Miners with high-performance computing (HPC) exposure continued to underperform compared to pure-play miners for a second consecutive month.

- This trend suggests a potential reconsideration for investors focused on HPC assets versus dedicated bitcoin miners.

- Valuations at Historical Lows:

- Current valuations of bitcoin miners are reported to be at their lowest relative to block rewards since the collapse of FTX in Fall 2023.

- Investors may see this as a critical buying opportunity or a potential risk factor in a volatile market.

- Network Hashrate Increase:

- The average network hashrate inched higher to 816 exahashes per second (EH/s), indicating an increasing level of competition in bitcoin mining.

- A higher hashrate can lead to greater mining difficulty and thus impact profitability.

- Decrease in Mining Profitability:

- Mining revenue and profitability both fell, with average earnings dropping to ,300 per EH/s in March, a 13% decrease from February.

- This decline in profitability could affect miners’ operations and investment in future technology.

- Daily Block Reward Gross Profit:

- Daily block reward gross profit dropped by 22% month-on-month to ,000 per EH/s.

- This decline signifies challenges for miners and could limit further investments in infrastructure or scaling activities.

- Sector Underperformance:

- Cipher Mining (CIFR) saw a significant slump of 45%, reiterating the volatility within the mining sector.

- Investors might reconsider their portfolios in light of such drastic performance variations among miners.

As the dynamics of the bitcoin mining sector continue to evolve, stakeholders need to stay informed about these key trends that may directly impact investment strategies and operational decisions.

The Decline of U.S. Bitcoin Miners: A Critical Look at Performance Trends

Recent insights from JPMorgan reveal a troubling picture for the U.S.-listed bitcoin miners, as their total market capitalization plummeted by 25% in March. This performance ranks among the worst recorded, highlighting the ongoing challenges within the cryptocurrency mining sector. While the industry grapples with sustainability, Stronghold Digital Mining (SDIG) managed to differentiate itself, exhibiting a mere 2% dip, effectively standing out as a resilient player amidst the turmoil. In contrast, companies like Cipher Mining (CIFR) faced a staggering 45% decline, indicating significant vulnerabilities within their operational models.

One notable trend drawn from JPMorgan’s analysis is the underperformance of high-performance computing (HPC) miners in comparison to pure-play counterparts. This situation raises concerns for investors who may be attracted to the HPC narrative, suggesting that diversification into such models may not yield the anticipated advantages amidst a contracting market. As mining revenue and profitability continue to dwindle—averaging ,300 per EH/s in March—skillful jockeying for efficiency and cost management will become even more critical.

The persistent threats of decreased block rewards and heightened competition, evidenced by the average network hashrate creeping up to 816 EH/s, could present both challenges and opportunities. Lower valuations relative to the block reward could be an attractive entry point for savvy investors looking for a bargain in a beleaguered sector. However, this environment also poses significant risks—particularly for more vulnerable operations like Cipher Mining, which may not have the financial bandwidth to weather extended downturns.

Overall, the current landscape presents a dual-edged sword: forward-thinking miners can seize opportunities for market positioning during this downturn, while less robust firms might find themselves at a severe disadvantage. The ongoing volatility in the bitcoin marketplace, as highlighted by the significant market shake-up, serves as both a cautionary tale and a potential playground for investors willing to navigate the choppy waters of cryptocurrency mining.