In a significant development for the cryptocurrency landscape, the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) has officially removed Tornado Cash from its sanctions list. This decision comes on the heels of a ruling by a Fifth Circuit Court of Appeals panel, which determined that OFAC lacked the authority to sanction the smart contracts associated with this popular crypto mixer. The delisting, which took place last month, appears to be a proactive move by OFAC following the court’s decision and leaves the fate of developer Roman Semenov still shrouded in uncertainty, as he remains listed among Specially Designated Nationals.

The initial sanctions against Tornado Cash had sparked widespread debate within the cryptocurrency sector regarding the limits of governmental influence over decentralized technologies. The fifth Circuit’s ruling not only prompted a notable uptick in the price of the TORN token but also fueled optimism about the legal use of mixers within the crypto ecosystem. As the regulatory landscape continues to evolve, the delisting signals a potential shift in how U.S. authorities may approach similar technologies in the future.

Peter Van Valkenburgh, director at Coin Center, remarked on the implications of the delisting, noting, “They could have waited for the court to invalidate the sanctions or they could have delisted them themselves, and they delisted themselves.”

This situation developed in part due to a lawsuit initiated by a coalition of developers, supported by crypto exchange Coinbase, challenging the original sanctions. The legal battle highlighted the complexities of applying traditional asset controls to innovative and decentralized platforms. While Tornado Cash’s smart contracts are no longer sanctioned, questions linger regarding the future designation of the platform and its developers, particularly in connection with ongoing legal proceedings against Roman Storm, another notable figure tied to the mixer.

As the dust settles, industry observers are keenly watching how this case will unfold and whether it might pave the way for more clarity on the United States’ regulatory stance towards decentralized finance and cryptocurrency innovation.

Tornado Cash Delisting: Implications for Cryptocurrency and Regulation

The recent developments regarding Tornado Cash have significant implications for the cryptocurrency landscape. Here are the key points:

- Delisting from OFAC: Tornado Cash has been removed from the sanctions list by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), following a Fifth Circuit Court of Appeals ruling stating that smart contracts could not be sanctioned.

- Impact on the Crypto Industry: The delisting has raised hopes within the cryptocurrency community that legal uses of mixers may not be easily blocked by the government, possibly influencing future regulations and innovations.

- Current Legal Cases: Developer Roman Semenov remains on OFAC’s Specially Designated Nationals list, while the criminal case against another developer, Roman Storm, continues, suggesting ongoing legal complexities for individuals involved.

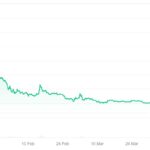

- Market Reactions: Following the court ruling, there was a notable rally in the price of the TORN token, highlighting the market’s sensitivity to regulatory news.

- Potential Future Actions by OFAC: There are uncertainties surrounding whether Tornado Cash can be re-designated in the future, as the government may need to prove that it can’t be sanctioned again.

- Legal Precedents: The outcome of this case could set important precedents for how the U.S. government regulates cryptocurrencies and smart contracts moving forward.

“The Fifth Circuit ruling sparked a rally in the TORN token’s price and raised hopes that it would be more difficult for the U.S. government to block legal uses of mixers.”

These developments may impact readers by shaping the regulatory landscape for cryptocurrencies, influencing investment opportunities, and affecting the future of privacy-focused projects in the blockchain space.

Analyzing the Impact of Tornado Cash’s Delisting from the OFAC Sanctions List

The recent decision by the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) to delist Tornado Cash presents a complex landscape within the cryptocurrency sector, particularly around the regulatory frameworks governing decentralized finance. This development comes in the wake of a pivotal Fifth Circuit Court ruling that effectively declared that smart contracts could not be sanctioned, igniting discussions about the future of regulatory measures in the rapidly evolving crypto space.

Competitive Advantages: The delisting of Tornado Cash is a significant boon for proponents of decentralized finance and privacy-enhancing technologies. It allows for the renewed use of Tornado Cash’s services without fear of federal penalties, supporting the narrative that legitimate use cases for mixers can coexist with regulatory oversight. This outcome could potentially foster greater investor confidence and stimulate innovation within the crypto mixer niche, paving the way for other similar platforms that have faced scrutiny. The rise in the TORN token’s value is a testament to the optimism surrounding this sector following the court’s intervention.

Furthermore, the response from the industry has been largely positive, with various stakeholders, including developers and exchanges, likely benefiting from a more relaxed regulatory environment. Increased legal clarity may foster more robust project development aligned with users’ privacy needs without the constant threat of governmental sanctions.

Competitive Disadvantages: However, the delisting does not come without its complications. The fact that developer Roman Semenov remains on the Specially Designated Nationals list indicates ongoing scrutiny and the potential for separate legal jeopardy that could dampen the enthusiasm around Tornado Cash. This ambiguity can create a chilling effect not just on developers involved with Tornado Cash, but also on cryptocurrency projects that handle similar technology.

Additionally, other jurisdictions, sensing the lack of consensus within U.S. regulatory bodies, might pursue more stringent measures, causing developers and investors to reconsider where to base their operations. This could create a fragmented global regulatory environment that complicates inroads for crypto technologies in the international market.

Potential Beneficiaries and Adverse Effects: The delisting is likely to benefit individual cryptocurrency users and developers who thrive on privacy and decentralization principles. Startups creating innovative solutions leveraging mixers can now operate with more confidence, potentially leading to a revitalization in the sector. Conversely, it may pose challenges for regulatory agencies struggling to maintain oversight in a landscape that seems increasingly resistant to centralized control, which could lead to future confrontations over compliance and operational legitimacy.

The reverberations of this decision are also significant for individuals like Roman Storm, whose ongoing legal challenges may be colored by the government’s determination to uphold oversight mechanisms in cryptocurrency usage. While Tornado Cash operates freely, the outcomes of these individual cases will heavily influence public perception and legal precedents for the cryptocurrency sector as a whole.