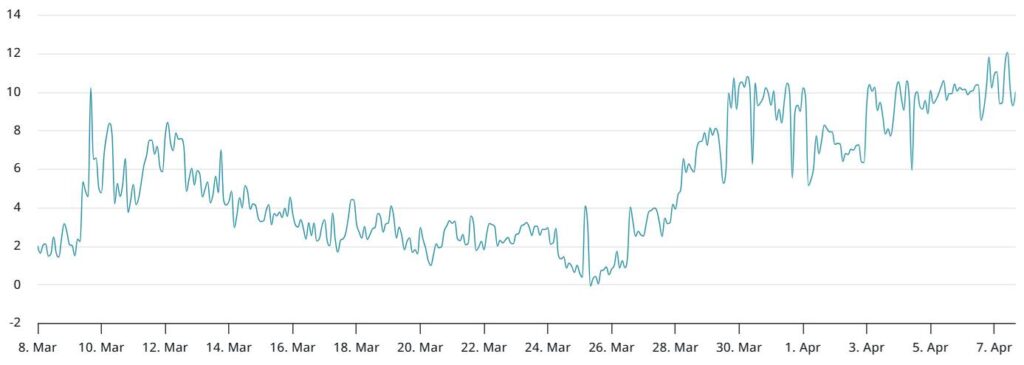

In a dramatic turn of events on April 7, the price of Ether (ETH) plummeted to $1,410, marking the lowest level since March 2023. This sharp decline, driven by a combination of market pressures and global economic concerns, resulted in liquidations of leveraged ETH futures exceeding $370 million within just two days, as reported by CoinGlass. However, in a somewhat encouraging rebound, Ether has since regained momentum, climbing back above the $1,500 threshold, coinciding with the S&P 500 index’s resurgence above the psychological 5,000 mark.

Over the past month, Ether has not fared well against the overall cryptocurrency market, underperforming by 14%. Despite these challenges, professionals in the trading community are approaching the situation with caution rather than despair, as suggested by Ethereum’s derivatives data and on-chain metrics. While there are indications that Ether has not yet hit its price bottom, the reduced inclination for bearish positions below $1,600 offers a glimmer of hope for bullish investors.

“It is too soon to say what will be the appropriate path for monetary policy,” stated Fed Chair Jerome Powell, signifying the cautious stance of regulators amid growing economic uncertainty.

The backdrop to Ether’s recent volatility includes increased global trade tensions that may signal an impending economic recession, impacting interest in riskier assets like cryptocurrencies. Compounding this, uncertainty surrounding the U.S. Federal Reserve’s monetary policy decisions has created apprehension in the market, particularly following President Trump’s calls for interest rate cuts. However, Powell’s caution suggests that any favourable changes for cryptocurrency markets could be delayed.

Adding to Ether’s troubles, the Ethereum developers recently announced a delay in the anticipated Pectra upgrade, pushing its mainnet launch to May 7 without clear reasons for the postponement. This comes even as a significant upgrade to the Hoodi testnet was successfully implemented in late March, showcasing the ongoing evolution within the Ethereum ecosystem.

Despite the negative sentiment surrounding Ether, derivatives data reveals a level of resilience in the market. While a bearish sentiment is present, it lacks the level of panic typically associated with sharp downturns. The current options skew indicates that traders are not overwhelmingly inclined towards sell positions. Furthermore, Ethereum’s total value locked (TVL) hit an all-time high of 30.2 million ETH, marking a 22% increase over the past month and outpacing growth seen in other networks like Solana and BNB Chain.

As the cryptocurrency landscape continues to navigate through a tumultuous macroeconomic environment, understanding these dynamics, particularly in the context of Ether’s derivatives market and its TVL growth, may provide insight into potential price movements ahead.

Ether Price Movements and Market Insights

The recent developments in Ether’s price and the overall cryptocurrency market reveal significant insights that may impact investors and traders.

- Significant Price Drop:

- Ether (ETH) price fell to $1,410 on April 7, marking the lowest since March 2023.

- This decline triggered liquidations of leveraged ETH futures worth over $370 million in just two days.

- Market Recovery:

- Despite the dip, Ether managed to recover above $1,500 as the S&P 500 reclaimed its psychological 5,000 support level.

- Over the past 30 days, Ether has underperformed the broader cryptocurrency market by 14%.

- Bullish Sentiment Among Traders:

- Professional traders have not turned bearish, indicated by Ethereum’s derivatives data and onchain metrics.

- The reduced demand for bearish positions below $1,600 offers reassurances for bullish investors.

- Economic Influences:

- Investors are concerned about worsening macroeconomic conditions that may lead to an economic recession.

- This uncertainty affects the cryptocurrency market’s growth, impacting the appeal of risk-on assets, including cryptocurrencies.

- Upcoming Ethereum Upgrade:

- Ethereum developers delayed the Pectra upgrade originally set for April, now targeting May 7 for the mainnet launch.

- This delay adds pressure to ETH’s price and may affect investor confidence going forward.

- Onchain Resilience:

- The total value locked (TVL) on Ethereum reached a record high of 30.2 million ETH, a 22% increase from the previous month.

- Despite external challenges, the growth in TVL suggests underlying strength in the Ethereum ecosystem.

The analysis of these factors suggests that while Ether faces challenges, its core metrics indicate potential resilience and market recovery in the long term.

Understanding Ether’s Market Position Amidst Wider Crypto Trends

The recent decline in Ether’s price to $1,410, marking its most significant drop since March 2023, has resulted in liquidations exceeding $370 million in leveraged ETH futures. This sharp volatility is not isolated; similar sentiments have echoed throughout the cryptocurrency market. While Ether initially struggled to maintain its footing, bouncing back to $1,500 alongside a recovering S&P 500 index, it has still underperformed the broader market by 14% over the past month, reflecting a challenging landscape for crypto investors.

Competitive Advantages: Despite the hurdles, some aspects of Ether’s performance and market data demonstrate resilience. The increase in Ether’s monthly futures premium to 4%, even though it remains shy of the neutral 5% threshold, suggests that traders are cautiously optimistic. The lack of extreme bearish sentiment, signified by the relatively stable 30-day options skew at 10%, indicates that fears of a market collapse aren’t fully taking root. Investors can take solace in Ethereum’s total value locked (TVL), which recently hit an all-time high of 30.2 million ETH, showcasing the network’s ongoing strength compared to competitors like Solana and BNB Chain.

Competitive Disadvantages: However, the negative impact of escalating global economic tensions, particularly trade issues, poses significant worry for Ether’s future. Potential concerns over interest rates and reduced investor confidence could limit interest in riskier assets, including cryptocurrencies. The recent decision by Ethereum developers to postpone the Pectra upgrade adds another layer of uncertainty. Such delays can erode investor confidence and deter new capital inflows, especially when similar projects in the space are advancing steadily.

The interplay of market conditions presents both opportunities and risks. Traders who heavily rely on leveraged positions might find themselves vulnerable during such volatile periods, leading to increased liquidations—an aspect that has already been evidenced with the recent ETH futures scenario. Conversely, long-term investors focusing on fundamentals, such as Ethereum’s growing TVL, could find that now might be a strategic entry point amidst potential market corrections.

As global economic factors continue to influence crypto valuations, Ether’s current positioning could benefit long-term investors while presenting challenges for speculative traders. Those contemplating entry into Ether should weigh these dynamics carefully, recognizing that while there may be bullish indicators, the broader macroeconomic climate could remain a determining factor for the foreseeable future.