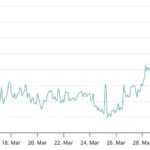

The cryptocurrency market is experiencing a significant shake-up as Bitcoin’s price takes a nosedive, currently hovering around the $78,000 mark. This dramatic shift has alarmed investors and analysts alike, coming at a time when global economic uncertainties are causing ripples across various financial sectors.

According to reports, Wall Street is bracing itself for what many are calling an “existential threat” to Bitcoin and the broader cryptocurrency landscape. Such concerns have emerged amid a series of market fluctuations that have led to a widespread decline in crypto valuations, prompting a re-evaluation of investment strategies.

“Bitcoin and other cryptocurrencies see prices fall amid global market turmoil,” noted AP News, highlighting the interplay between traditional finance and the increasingly volatile world of digital assets.

As we enter 2025, crypto stocks have also felt the pressure, with many seeing significant drops as Bitcoin hits one of its lowest points to date this year. Investors are left wondering how deeper market corrections could impact their portfolios moving forward.

With these developments, the stage is set for a period of reflection and analysis within the cryptocurrency industry. Stakeholders are closely monitoring the situation, poised to respond to any potential game-changers that may emerge from this unprecedented scenario.

Impact of Recent Bitcoin Price Fluctuations

The recent drop in Bitcoin and cryptocurrency prices has significant implications for investors and the broader financial market. Here are the key points to consider:

- Bitcoin Price Decline: Bitcoin prices have fallen to about $78,000, marking a significant drop.

- Market Sentiment: The decline is driven by global market turmoil, influencing investor confidence.

- Potential Existential Threat: Experts warn that this downturn could pose a serious threat to Bitcoin and other cryptocurrencies.

- Impact on Crypto Stocks: Stocks of companies in the cryptocurrency sector are experiencing declines as well.

- Future Price Predictions: Analysts speculate on further price adjustments, potentially leading to a new low by 2025.

Understanding these points may help readers navigate their investment strategies and adjust their portfolios according to market trends.

Bitcoin’s Rollercoaster: A Comparative Analysis of Recent Market Trends

The recent downturn in Bitcoin’s price, which was reported to have plummeted to around $78,000, has captured the attention of market analysts and investors alike. This price drop comes amidst a backdrop of global market upheaval, as highlighted by multiple news outlets like The Verge and the Wall Street Journal, marking a significant moment in the crypto landscape.

Comparatively, while Forbes pointed out the so-called ‘existential threat’ that such fluctuations pose to Bitcoin and the broader cryptocurrency market, AP News and Yahoo Finance emphasized the slipping value of US crypto stocks in conjunction with Bitcoin’s decline. This convergence of insights suggests an overarching sentiment within the market: the current instability could deter potential new investors and shake the confidence of existing holders.

One competitive advantage of this news cycle is the heightened visibility it brings to Bitcoin and other cryptocurrencies. The increased coverage may attract interest from retail investors curious about navigating these turbulent waters. On the flip side, the consistency of such negative reports can foster a sense of fear and uncertainty among more cautious stakeholders who may prefer to stay clear of assets perceived as volatile.

This news could significantly benefit seasoned investors who thrive on market fluctuations and volatility, as they could seize opportunities to buy at lower prices. However, for novices or those with a low-risk tolerance, this fluctuation may represent a challenge, as they grapple with the idea of entering a market that appears unstable. Moreover, institutional investors may reevaluate their strategies, potentially leading to a more cautious approach to crypto asset allocations in their portfolios.

In essence, while the current narrative surrounding Bitcoin presents both potential opportunities and challenges, its overall impact on various investor demographics will continue to evolve as they navigate the complexities of this volatile market.