In a captivating commentary that resonates with many observers, Dave Portnoy, a prominent figure in the financial world, posed a thought-provoking question regarding Bitcoin’s behavior in relation to traditional markets. He asked, “If Bitcoin’s supposed to be independent of the dollar, why does it trade just like the stock market?” This inquiry strikes at the heart of a growing debate regarding the true nature of Bitcoin and its role in the modern economic landscape.

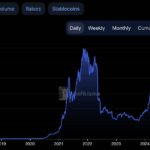

Recent analyses indicate a notable trend: Bitcoin, once thought to be a refuge from traditional market volatility, has shown significant correlation with the S&P 500. This decoupling from equities, emphasized in reports from Yahoo Finance and Seeking Alpha, could suggest shifts in investor confidence and market dynamics amid global economic uncertainty.

Bitcoin’s round-the-clock liquidity makes it a unique player during tumultuous times. While this feature offers traders the ability to react swiftly to market changes, it also introduces complexities that could amplify volatility. Furthermore, Michael Saylor, a well-known advocate for Bitcoin, underscores the importance of understanding these short-term correlations, stressing that perceptions of Bitcoin as a safe haven may need reevaluation.

“Selling Bitcoin on recession fears may be a flawed strategy,” an expert noted, highlighting how the current market sentiments reflect broader economic challenges.

As discussions around Bitcoin’s place in today’s financial ecosystem continue to evolve, understanding its relationship with traditional assets like stocks becomes increasingly crucial. Analysts are watching carefully, as shifts in this dynamic could reshape the landscape for digital assets in the face of emerging economic trends and investor behavior.

Understanding Bitcoin’s Market Dynamics

In light of recent discussions around Bitcoin’s correlation with traditional markets, here are the key takeaways:

- Decoupling from the S&P 500:

- Bitcoin’s recent trading patterns suggest it may be moving independently from traditional stock markets.

- This potential decoupling could indicate Bitcoin’s evolving role as a safe-haven asset.

- Liquidity Impact:

- Bitcoin operates 24/7, offering continuous trading and liquidity, which can be advantageous yet risky during market downturns.

- Investors might face increased volatility due to constant market access.

- Correlation with Stock Market:

- Experts like Michael Saylor point out that while Bitcoin may exhibit short-term correlations with stocks, its long-term value proposition remains distinct.

- This suggests that investors need to rethink their strategy when comparing cryptocurrencies to traditional assets.

- Recession Fears and Selling Behavior:

- The tendency to sell Bitcoin during economic uncertainty may overlook its fundamental properties as a digital asset.

- This behavior could undermine the rationale for holding Bitcoin as a hedge against traditional market risks.

Dave Portnoy questions the independence of Bitcoin from the dollar, highlighting a common skepticism among investors about its reliability as a non-correlated asset.

These points emphasize the ongoing debate surrounding Bitcoin’s role in modern finance and its implications for individual investors navigating uncertain markets.

Bitcoin’s Market Behavior: Insights and Implications

In the ever-evolving landscape of cryptocurrency, recent observations have sparked considerable debate. Notably, Dave Portnoy’s statement poses a compelling question: if Bitcoin claims to operate independently from traditional currencies like the dollar, why does it exhibit similar trading patterns to the stock market? His commentary resonates amid reports of Bitcoin’s decoupling from the S&P 500, suggesting a potential shift in market dynamics.

The contrasting views presented in media outlets highlight both the advantages and disadvantages of Bitcoin’s recent behavior. For instance, Yahoo Finance reports on Bitcoin’s apparent ability to move away from stock market correlations. This could signal a maturation of the cryptocurrency, appealing to long-term investors seeking stability in a decentralized asset class. However, such decoupling can also create confusion among short-term traders accustomed to associating Bitcoin’s value with traditional equities.

Moreover, the continuous 24/7 trading of Bitcoin adds another layer to this narrative. According to Cointelegraph, this liquidity can be both a boon and a bane during times of global market turmoil. While investors can react instantaneously to news, the same liquidity can lead to volatility, challenging those who prefer steadier trading environments typical of traditional securities. Thus, those heavily invested in cryptocurrencies might face increased risk, especially during a downturn.

On a more strategic note, Michael Saylor’s insights shed light on the short-term correlation between Bitcoin and traditional markets, prompting a reconsideration for investors who may lean towards digital assets out of fear of recession. With platforms like Binance discussing the flawed mindset of selling Bitcoin amid recession fears, it becomes evident that there’s a demographic of investors who could suffer significantly from rash decisions driven by market panic.

As the discussion unfolds around Bitcoin’s role in the contemporary financial ecosystem, both seasoned investors and newcomers need to be vigilant. The ongoing debate over Bitcoin’s independence from more conventional assets will shape investment strategies and risk assessment going forward. Those seeking to invest without getting swept into the traditional markets’ volatility might find Bitcoin’s potential valuable, yet they’d also do well to remain cautious of its unpredictable nature during economic fluctuations.