In the ever-evolving landscape of cryptocurrencies and blockchain technology, the topic of tokenized real-world assets (RWAs) is attracting significant attention. Recently, Standard Chartered Bank and Synpulse projected that the total market for RWAs could exceed a staggering $30 trillion by the year 2034. This optimistic forecast was buoyed by discussions at the Paris Blockchain Week 2025, where key figures in the industry gathered to share insights and predictions about the future of tokenization.

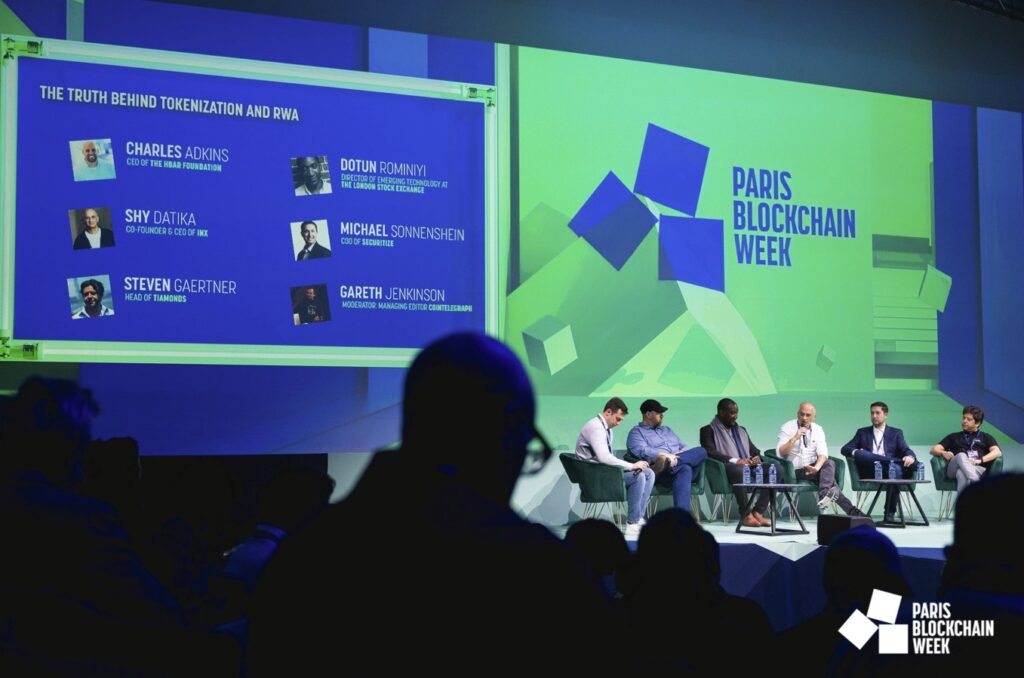

The panel, moderated by Cointelegraph’s managing editor Gareth Jenkinson, featured a distinguished lineup including Charles Adkins from Hedera, Dotun Rominiyi of the London Stock Exchange, and Securitize’s COO Michael Sonnenshein. While many participants echoed the ambitious $30 trillion figure, Sonnenshein took a more cautious stance, suggesting that although RWAs have potential, the predicted numbers might be overly optimistic.

“Just because it can be tokenized doesn’t mean that it should be,” Sonnenshein remarked, emphasizing the effectiveness of existing systems for trading traditional assets.

Despite his skepticism regarding the $30 trillion target, Sonnenshein noted that the tokenization movement is far from fading away. He foresees a surge of investors viewing their digital wallets not merely as tools for speculative trading, but as integral components of their investment portfolios.

The discussion also touched on the viability of tokenizing real estate. While certain jurisdictions, like the United Arab Emirates, are actively exploring this avenue—evidenced by a notable $1 billion deal involving local developer Damac—the panel was divided. Sonnenshein expressed reservation about real estate as the primary focus for tokenization, stating that while blockchain could bring efficiency to transactions, it may not effectively represent ownership in the real estate market.

“What the on-chain economy is demanding are more liquid assets,” he added, pointing to the need for assets that provide quicker access and easier trading.

As the conversation surrounding RWAs continues to evolve, the future of tokenization remains a hot topic, with varying opinions on its ultimate trajectory and applicability across different sectors. Investors and industry observers alike are keenly watching how these developments unfold in the coming years.

Tokenized Real-World Assets: Future Prospects and Skepticism

The exploration of blockchain-based finance and the potential of tokenized real-world assets (RWAs) could significantly impact various industries and the way individuals perceive investment. Here are the key points surrounding this topic:

- Growth Projection:

- Industry leaders forecast that RWAs may surpass $30 trillion by the 2030s.

- Standard Chartered Bank and Synpulse predict this milestone could be reached by 2034.

- Panel Discussions:

- Executives from relevant sectors convened at Paris Blockchain Week 2025 to discuss the future of RWAs.

- Despite widespread support for the $30 trillion estimate, differing opinions emerged, notably from Securitize COO Michael Sonnenshein.

- Skepticism about Projections:

- Sonnenshein advocates for a more conservative view, suggesting that just because assets can be tokenized doesn’t necessarily mean they should be.

- He emphasizes the existing effective systems for traditional assets and takes a cautious stance on the $30 trillion figure.

- Tokenization’s Future:

- Regardless of the projections, there is a strong sentiment that the space will continue to attract more investors.

- Investors may begin to view their digital wallets as houses for investments, similar to traditional brokerage accounts.

- Real Estate Tokenization Concerns:

- Sonnenshein raises doubts about the viability of tokenization in real estate, stating it may not effectively represent ownership.

- While recognizing potential efficiencies blockchain can bring, he argues that current market demands lean towards more liquid assets.

“Just because it can be tokenized doesn’t mean that it should be.” — Michael Sonnenshein

These insights suggest a cautious but optimistic outlook towards RWAs, indicating that while the potential for growth is significant, challenges and systemic efficiencies must be evaluated to ensure meaningful adoption and sustainability in this evolving landscape.

Tokenized Real-World Assets: A Comparative Insight

The emergence of tokenized real-world assets (RWAs) has sparked a lively debate among financial institutions and industry leaders, highlighting both optimism and skepticism regarding its future market potential. Advocates, like Standard Chartered Bank and Synpulse, have forecasted RWAs achieving astonishing valuations above $30 trillion by the 2030s, suggesting a new wave of financial innovation. However, contrasting perspectives, particularly from figures such as Securitize’s Michael Sonnenshein, reveal a more cautious outlook. This juxtaposition provides insight into the competitive landscape of blockchain finance.

Competitive Advantages: The bullish forecasts surrounding RWAs mainly stem from their potential to democratize investments, making traditionally illiquid assets more accessible to everyday investors. With robust backing from major financial players, there’s a strong narrative that RWAs could rejuvenate investment strategies, allowing investors to diversify their portfolios with greater ease. Additionally, events such as the Paris Blockchain Week fortify this outlook by gathering key stakeholders in the tokenization ecosystem, fostering innovation and collaboration among various market participants.

Competitive Disadvantages: On the flip side, the skepticism expressed by some industry experts sheds light on significant hurdles. Sonnenshein’s argument against the inevitability of reaching the $30 trillion mark emphasizes existing systems that work effectively in traditional finance. His perspective challenges the notion that all assets should be tokenized, thus raising questions about market demand and the scalability of RWAs. Concerns over the integration of tokenization in specific sectors, particularly real estate, further complicate the narrative, where practicality and acceptance are still under scrutiny.

This divergence in viewpoints could either benefit or create challenges for various stakeholders. Financial institutions positioning themselves at the forefront of this technology may gain substantial leverage over traditional competitors by adopting RWAs, thus attracting a burgeoning segment of tech-savvy investors. On the other hand, firms that dismiss the necessity of tokenization could miss out on potential market growth, leaving them vulnerable to competitors who are adapting to evolving investment preferences.

In summary, as the debate surrounding tokenized RWAs unfolds, the financial landscape stands at a pivotal juncture. The success or stagnation of this innovation will, in part, depend on whether proponents can address the concerns voiced by skeptics while continuing to leverage blockchain’s potential to transform asset ownership and investment strategies.