In a notable development within the cryptocurrency landscape, TRUMP tokenholders are bracing for potential losses as a significant event looms on April 18. This date marks the first vesting unlock, set to release a whopping 40 million tokens—valued at approximately $309 million—into circulation at a staggering 90% discount from their peak price. As these tokens account for 20% of the current circulating supply, market analysts warn of heightened volatility as this previously locked portion enters the market.

According to CoinGecko, the TRUMP token has recently fluctuated between $7.46 and $7.83 in the past 24 hours as anticipation grows around this unlock event.

Launched just days before President Donald Trump’s inauguration, the TRUMP token has seen its value plummet by 89.5%, from an all-time high of $73.43 recorded on January 19. The aftermath of this initial excitement has been harsh, with over 800,000 wallets reportedly suffering a staggering $2 billion in collective losses, as noted by the blockchain analytics firm Chainalysis.

However, it is important to recognize that these losses are only realized upon sale; tokenholders won’t see actual losses until they decide to liquidate their holdings.

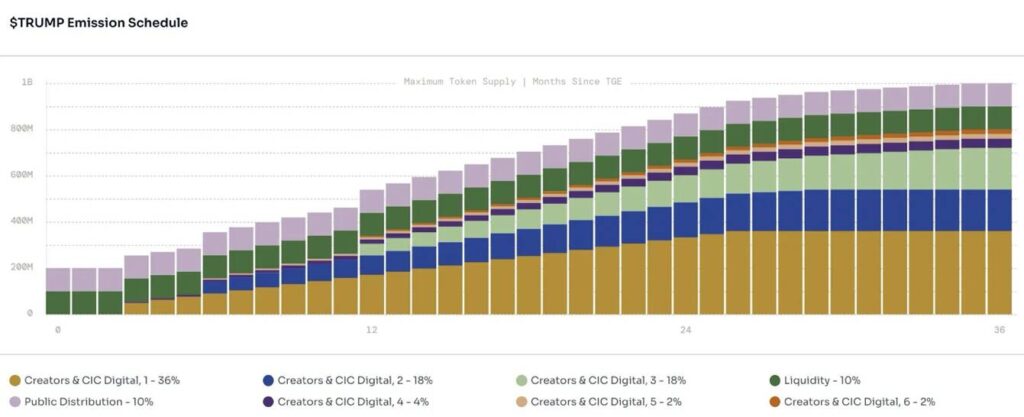

Anchoring the supply of the TRUMP token are two organizations closely associated with Trump’s business operations—CIC Digital LLC and Fight Fight Fight LLC—which together control a significant 80% of the token supply. Reportedly, CIC Digital was placed in a trust around the time of Trump’s financial disclosures to the US Federal Election Commission, reinforcing its business ties to the former president’s ventures. Meanwhile, Fight Fight Fight LLC shares its roots with Trump’s notable slogan, marking its connection to the political landscape.

The upcoming unlock on April 18 is characterized as a “cliff,” indicating a large, one-off release rather than a gradual distribution. Following this event, smaller daily unlocks are scheduled, potentially allowing for a more controlled market reaction, with around 493,000 tokens set to be released daily from April 19 to 21.

The broader implications of this event also raise questions about conflict of interest and insider trading as the cryptocurrency scene continues to evolve alongside political upheavals.

Impact of TRUMP Token Unlock on Tokenholders

The upcoming unlock event for the TRUMP token carries several key implications for tokenholders and the broader cryptocurrency market.

- First Vesting Unlock: On April 18, 40 million TRUMP tokens will be unlocked, estimated to be worth approximately $309 million.

- Price Impact: Tokens will be released at a 90% discount from their peak value, possibly leading to fresh market volatility and impacting current token prices.

- Current Supply: The unlocked tokens account for 20% of the current circulating supply of TRUMP tokens, which may intensify price fluctuations.

- Token Value Decline: TRUMP token has fallen 89.5% from its all-time high of $73.43, with many holders facing significant unrealized losses.

- Realization of Losses: Losses are only realized upon selling, meaning tokenholders may choose to hold their tokens despite falling prices.

“Over 800,000 wallets report approximately $2 billion in losses, highlighting the financial risks associated with the TRUMP token.”

- Ownership Concentration: 80% of the TRUMP token supply is held by two organizations, CIC Digital LLC and Fight Fight Fight LLC, both associated with Donald Trump’s business interests.

- Future Unlock Events: Following the April 18 cliff unlock, a steadier pace of smaller daily unlocks will occur, further influencing the token market dynamics.

- Conflict of Interest Concerns: Trump’s association with the TRUMP token raises potential questions regarding conflict of interest and insider trading within the cryptocurrency space.

Understanding these points can help readers gauge the potential for financial impact, the viability of their investments, and the stresses of managing volatile assets in a rapidly evolving market.

TRUMP Token’s Volatile Unveiling: Opportunities and Challenges Amid Market Uncertainty

The recent unlock event for TRUMP tokenholders has certainly created ripples in the cryptocurrency waters, introducing a substantial 40 million tokens into circulation, with an alarming 90% reduction in value compared to earlier highs. This release, equivalent to approximately $309 million, represents a pivotal turning point, marking the first vesting unlock since its debut. As a considerable portion—20%—of the circulating supply becomes accessible to the market, potential volatility looms, raising questions about future pricing and holder sentiment.

In comparison to other tokens that have faced steep declines or volatility during similar unlock events, such as those associated with Dogecoin or Shiba Inu, the TRUMP token stands out with its unique branding linked to a polarizing figure in American politics. The marketing strategy and connections to Donald Trump’s persona initially garnered significant interest, evidenced by its dizzying peak at $73.43. However, with current valuations hovering between $7.46 and $7.83, the stark contrast highlights substantial unrealized losses for tokenholders. Notably, more than 800,000 wallets have absorbed over $2 billion in estimated losses—a figure that positions TRUMP alongside other cryptocurrencies that have witnessed harsh retractions.

The primary competitive advantage for the TRUMP token lies in its affiliation with Trump and the potential for resurgence driven by political events, social media campaigns, and targeted marketing strategies. In a landscape where memes and narratives often fuel crypto movements, the sheer brand recognition could catalyze a revival, enticing a new crop of speculative investors. However, this also opens the door to significant disadvantages, notably the risk of exploitation linked to insider trading or conflicts of interest. The fact that 80% of the total supply is controlled by entities connected to Trump raises eyebrows and opens the possibility for market manipulation, a concern that is heightened amidst scrutiny from regulatory bodies.

This situation can benefit speculative traders looking to capitalize on the high volatility surrounding the TRUMP token post-unlock. Yet, it could create hurdles for long-term investors and average holders, who may find themselves caught in an unpredictable cycle of buying and selling, desperate to mitigate losses as new tokens flood the market. Furthermore, those aligned with traditional financial methodologies might view this ecosystem as excessively risky, potentially alienating a segment of investors already wary of the crypto space.

Overall, while the TRUMP token possesses attributes that could drive renewed interest and activity, the unlocking event introduces a precarious balance. Those with a vested interest must navigate the turbulent waters carefully, weighing their options in a market overtly sensitive to the developments surrounding the larger-than-life figure who inspired this digital asset.