The current landscape of Bitcoin investment is experiencing a significant transformation as capital flows shift towards institutional channels such as exchange-traded funds (ETFs). Historically viewed as a volatile and speculative asset, Bitcoin’s status seems to be evolving into a more structured financial instrument, with a remarkable influx of investments following the approval of spot Bitcoin ETFs in the United States in January 2024.

As highlighted by Bloomberg’s senior ETF analyst, Eric Balchunas, there has been a notable surge in leveraged long ETFs alongside traditional safe havens like gold and cash. This indicates a complex narrative surrounding Bitcoin, where investors are weighing its potential as either a speculative vehicle or a digital counterpart to gold. Daily inflows into Bitcoin ETFs have reached record levels, with more than $912 million flowing into the market in just one day by April 2025. Such figures signal a robust institutional interest that differs markedly from the bullish frenzies of previous years.

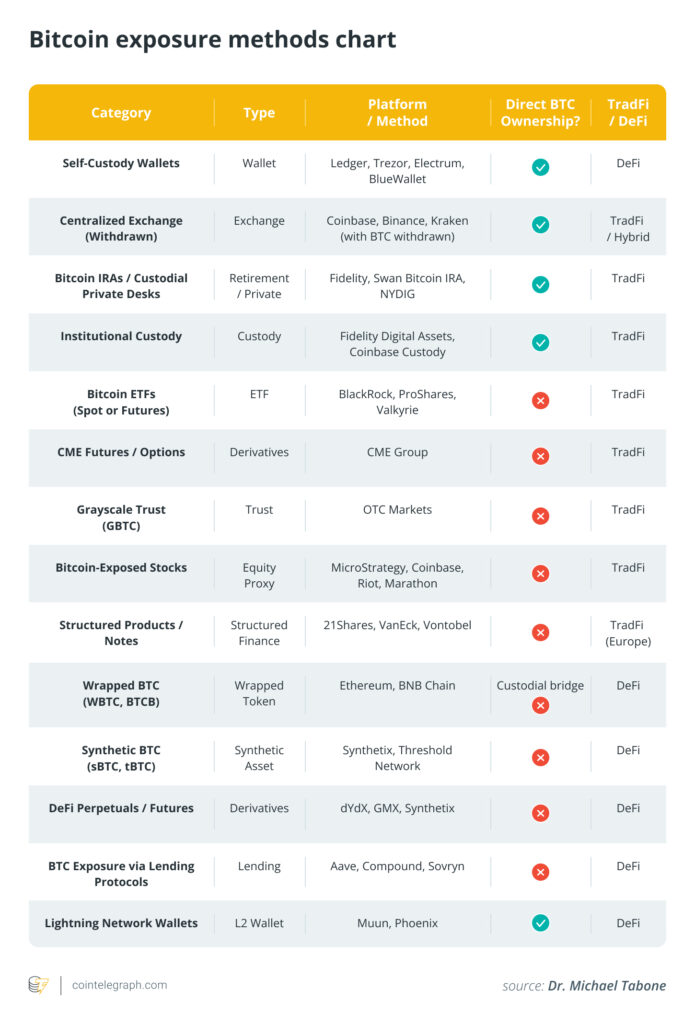

“Bitcoin, in 2025, is no longer a monolithic asset. It is a spectrum of exposure.”

This period of rich capital absorption represents a shift away from the sheer chaos typically associated with Bitcoin’s past cycles. Investors are gravitating towards structured products, leading to a scenario where liquidity is abundant yet more measured. The introduction of ETFs appears to have fragmented investor behavior, with many opting for the stability and oversight that comes with institutional-grade products. Consequently, the once-popular ‘altseason’ trend—where Bitcoin’s growth would spill over into altcoins—has so far stalled in 2025, as funds are increasingly channeled into ETFs instead of riskier alternatives.

Moreover, macroeconomic factors have played a significant role in shaping these investment patterns. Rising inflation concerns have spurred passive accumulation behaviors similar to those observed during gold’s ETF boom post-2008, driving investors toward Bitcoin as a hedge. This evolving market dynamic indicates a calculated approach among high-net-worth investors and sovereign wealth funds, as they prefer Bitcoin as a standardized asset rather than diving into the unpredictable waters of lesser-known cryptocurrencies.

The possible approval of ETF proposals for Ethereum and Solana may further institutionalize these trends and could reshape how capital is distributed within the cryptocurrency ecosystem. As market participants embrace this new era of refined distribution, the interplay between Bitcoin, its ETFs, and the broader economic indicators will continue to shape the landscape of digital assets.

The Evolution of Bitcoin Investment: Institutional Growth and ETF Dynamics

As capital flows into Bitcoin through institutional channels, the market landscape is continually reshaped, influencing both investor sentiment and trading behavior. Here are the key aspects of this evolving situation:

- Shift from Raw Bitcoin to Institutional Products:

The capital intended for spot Bitcoin is increasingly directed toward institutional tools such as ETFs and structured products.

- ETFs as Market Sentiment Barometers:

Spot Bitcoin ETFs have become critical indicators of investor sentiment, evidenced by significant net inflows and outflows reflecting market reactions.

- Record inflow of $912 million on April 23, 2025, highlighting a resurgence in optimism.

- Volatile inflows, with an average of $31.8 million daily, suggest a cautious investor approach.

- Changing Narrative of Bitcoin:

Bitcoin’s identity is now multifaceted, perceived variably as ‘digital gold’ or a speculative asset, depending on investor perspectives.

- Impact on Altcoin Market:

The rise of Bitcoin ETFs appears to restrict capital from flowing into altcoins, leading to an absence of typical ‘altseason’ cycles.

- Increased Liquidity with Fragmented Exposure:

ETF liquidity enhances stability but reduces volatility that once spurred speculation in the crypto market.

- Macro Economic Influences:

Market dynamics are increasingly tied to macroeconomic indicators, with ETF inflows responding to economic news rather than crypto-specific signals.

Bitcoin continues to be a speculative investment; however, it is undergoing a transformation that could redefine investment strategies and behaviors in the crypto landscape.

This evolution holds implications for retail investors, as the dynamics favor institutional strategies over speculative trading, potentially influencing the overall market growth and accessibility of cryptocurrencies.

The Evolution of Bitcoin’s Institutional Landscape: A Comparative Insight

The landscape of Bitcoin investing is undergoing a transformative shift, notably with the rise of spot exchange-traded funds (ETFs) that have become pivotal in attracting institutional funds. Unlike past instances of grueling volatility tied to retail hype, the current influx into Bitcoin ETFs signifies a more calculated strategy among serious investors. This is markedly different from prior years, where speculative trading was the heartbeat of the crypto market.

Competitive Advantages: The recent approval of multiple Bitcoin ETFs in the U.S. has created a sophisticated ecosystem that allows for refined investor positioning. The notable inflows—$912 million in a single day—highlight a sustained, bullish sentiment that is indicative of institutional trust. Products like BlackRock’s iShares Bitcoin Trust have been hailed as industry benchmarks, reflecting a growing acceptance of Bitcoin as a legitimate asset class. This newfound stability appeals to traditional institutional investors, who generally favor predictable risk profiles over chaotic trading environments.

In contrast to earlier speculative runs that characterized both Bitcoin and altcoin markets, today’s landscape is sculpted by a diversified approach to exposure. Investors can now choose from a myriad of financial instruments, from leveraged long ETFs to wrapped Bitcoin products, allowing them to tailor their risk appetite better. This mushrooming of options is particularly advantageous for fund managers looking to attract more conservative capital that is wary of direct ownership volatility.

Competitive Disadvantages: However, the sophistication of this current market structure does present challenges. A significant downside of the Bitcoin ETF surge is the evident stifling of altcoin speculation. Capital that in previous cycles would have flowed into various altcoins now finds a comfortable home within ETFs, sidelining smaller cryptocurrencies. This shift could diminish investment opportunities in innovative blockchain projects, limiting diversity in the crypto investment landscape. The absence of a classic altseason in 2025 is a stark reminder of how institutional funds prioritize long-term holdings over speculative assets.

Moreover, the less frenetic pace of capital flows may result in diminished retail enthusiasm. With institutional capital dictating market dynamics, retail investors might feel alienated, leading to a loss of the communal excitement that once propelled Bitcoin’s price surges. This could create problems for newer investors who thrive on market volatility and speculative rallies.

Potential Beneficiaries and Challenges: The newfound appeal of Bitcoin ETFs favors institutional investors and large fund managers seeking stability over chaos, positioning them to benefit from long-term exposure to Bitcoin’s growth. On the flip side, smaller retail traders and altcoin investors might find themselves at a disadvantage as the market prioritizes risk management over speculative trading gains. Additionally, should ETFs for Ether and Solana be approved, while they may catalyze institutional interest in these assets, it remains to be seen whether they will replicate the previous waves of retail trading enthusiasm or merely institutionalize existing trends.

The ethos of Bitcoin continues to evolve; what was once an emblem of freedom and decentralization is now navigating the corridors of institutional finance. Understanding this paradigm shift will be crucial for investors at all levels who wish to thrive in this new age of crypto investment.