Aave, a leading player in the decentralized finance (DeFi) landscape, has recently made headlines following a significant governance decision by its tokenholders. On April 9, Aave announced that more than 99% of its AAVE tokenholders approved a governance proposal to initiate a buyback program for AAVE tokens. This marks a pivotal shift in the protocol’s tokenomics as it seeks to invest $4 million into repurchasing its governance tokens, a move designed to bolster the value and stability of the AAVE token.

The buybacks are positioned as just the initial phase of a larger strategy to acquire $1 million worth of AAVE tokens each week over the next six months. The swift passage of this proposal underscores a robust demand among tokenholders for mechanisms that enhance value retention in the ever-evolving DeFi space. Aave’s overarching goal, as outlined in the proposal, is to sustainably increase the acquisition of AAVE tokens from the open market while distributing them to the Ecosystem Reserve.

“The goal is to sustainably increase AAVE acquisition from the open market and distribute it to the Ecosystem Reserve,” the proposal stated.

This announcement triggered a notable surge in the price of AAVE tokens, with an increase of over 13% following the news, bringing the protocol’s market capitalization to approximately $2.1 billion, as noted by CoinGecko. Such movements in the market reflect a growing trend among DeFi protocols to implement buyback programs, driven partly by increased pressure from tokenholders demanding a stake in protocol revenues.

In a broader context, the trend of buybacks is gaining traction among various projects in the DeFi ecosystem, with initiatives from platforms such as Ethena and Ether.fi aiming to provide tokenholders with enhanced value accrual mechanisms. This aligns with a shift in the regulatory climate, spurred by a more favorable stance toward DeFi from the U.S. government. As Aave moves forward with its ambitious plans, it sets a noteworthy precedent for other DeFi protocols, signaling a commitment to maximizing value for tokenholders.

Aave Token Buyback Proposal Approved

The recent approval of Aave’s buyback proposal presents significant developments in the decentralized finance (DeFi) landscape. Here are the key points:

- Overwhelming Approval: The buyback proposal received more than 99% support from AAVE tokenholders, indicating strong community backing.

- Initial Buyback Budget: Aave will initially purchase $4 million in AAVE tokens, aiming to repurchase $1 million weekly over six months.

- Market Reaction: Following the proposal, the AAVE token’s price increased by more than 13%, boosting the protocol’s market capitalization to over $2.1 billion.

- Impact on Ecosystem: The buyback is intended to sustainably increase AAVE acquisition and support the Ecosystem Reserve for future initiatives.

- Part of a Broader Tokenomics Revamp: The proposal is part of a larger strategy that includes new revenue allocations and safety features for tokenholders.

- DeFi Trends: Aave’s approach mirrors growing trends among DeFi protocols to implement buyback mechanisms, reflecting tokenholder demands and market pressures.

- Regulatory Environment: The U.S. regulatory landscape is becoming more favorable for DeFi, potentially driving innovations and buyback initiatives across various projects.

Related Developments: Other DeFi projects like Maple Finance and Ether.fi are also exploring buyback strategies, highlighting an industry-wide shift towards enhancing tokenholder value.

Understanding these developments can help readers recognize their potential impact on investment decisions within the DeFi space, especially regarding the value and stability of tokens like AAVE.

Aave’s Strategic Buyback Proposal: A Game Changer in the DeFi Arena

Aave’s recent governance proposal, where an overwhelming majority of tokenholders approved a $4 million buyback strategy, marks a notable shift in the decentralized finance landscape. This strategy not only seeks to stabilize the AAVE token but also represents a growing trend among DeFi protocols to prioritize tokenholder interests. With similar initiatives emerging from other platforms like Ethena and Maple Finance, Aave’s approach stands out for several reasons.

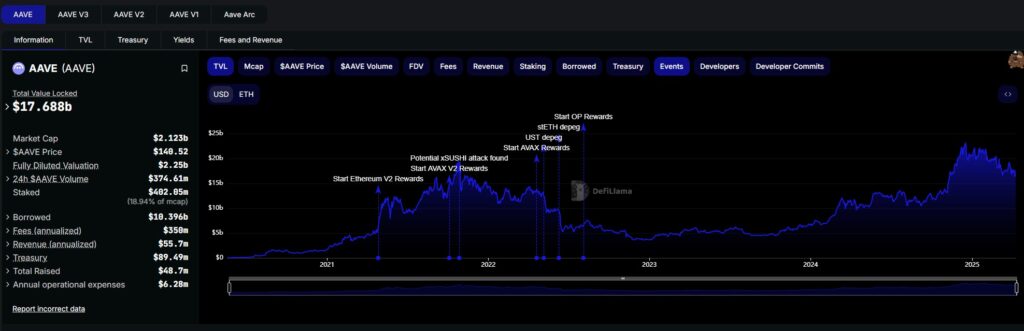

Competitive Advantages: The overwhelmingly positive response from AAVE tokenholders—over 99% approval—indicates a strong community backing and shared vision for the protocol’s future. By committing to a systematic repurchase of $1 million in AAVE tokens weekly for six months, Aave aims to enhance token demand and bolster its Ecosystem Reserve, potentially leading to increased value for its stakeholders. Furthermore, with Aave holding the title of the most popular DeFi protocol in terms of total value locked (TVL) exceeding $17.5 billion, this buyback could further cement its market position.

In contrast, initiatives like Ethena and Maple Finance, which are also exploring token buybacks, could create significant competition. However, their smaller market capitalization compared to Aave may limit the immediate impact of their strategies. Aave’s robust fee generation of approximately $350 million annually gives it a financial cushion to sustain these buybacks without severely affecting its operational capabilities.

Potential Disadvantages: While Aave’s strategy may be appealing, it also comes with inherent risks. The aggressive buyback plan requires careful financial management, and any market volatility could hinder Aave’s objectives. Additionally, as more DeFi protocols adopt similar mechanisms, Aave might face difficulty standing out, especially if other projects successfully enhance their tokenomics systems or attract investor interest with even more lucrative models.

This new initiative could greatly benefit long-term AAVE tokenholders looking for price appreciation and increased community engagement. On the other hand, it could create challenges for those invested in competing DeFi projects that have yet to implement similar buyback strategies. The growing trend toward tokenholder value sharing within DeFi highlights the need for all protocols to innovate continuously or risk losing traction in an increasingly competitive marketplace.

All eyes will be on Aave as it navigates this new phase—what happens next could redefine not only its own trajectory but potentially the entire DeFi schema as we know it.