A recent report from Swiss bank Sygnum suggests that the world of altcoins could be on the cusp of a significant revival in the second quarter of 2025. According to their investment outlook, improved regulations surrounding digital assets are laying a robust groundwork for a possible surge in the altcoin sector. Sygnum highlights that the positive developments in regulation have not yet been reflected in market prices, indicating potential opportunities ahead.

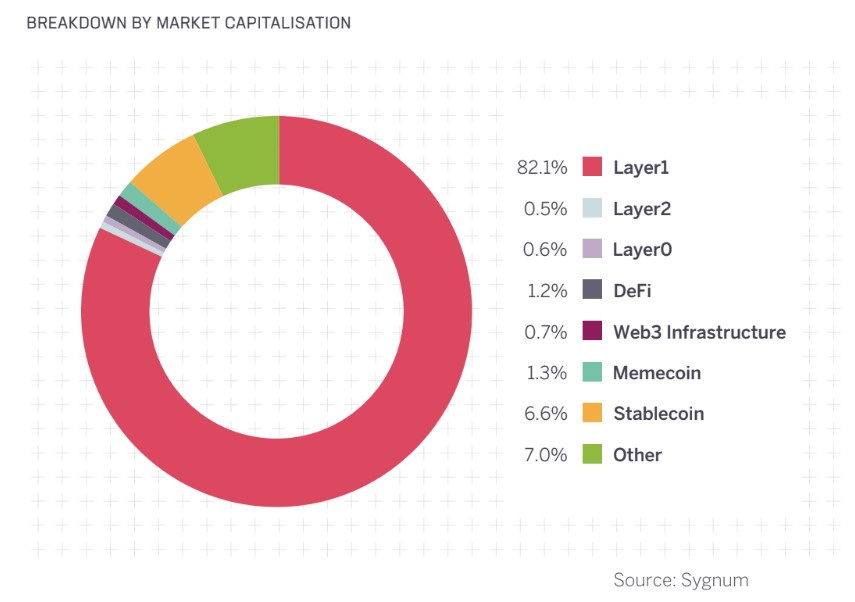

In a remarkable twist, Bitcoin recently achieved a four-year peak in market dominance, which has led many investors to gravitate toward what they perceive as a safer asset. Despite this, Sygnum anticipates that upcoming regulatory advancements in the U.S., such as President Donald Trump’s announcement of a Digital Asset Stockpile and the progression of stablecoin regulations, could pave the way for wider crypto adoption.

“We expect protocols successful in gaining user traction to outperform and Bitcoin’s dominance to decline,” Sygnum stated.

As the industry matures, Sygnum predicts that heightened competition will emerge as various projects vie for economic value. The report indicates that a market focusing on economic benefit will encourage innovation and refinement of offerings, ultimately leading to a better experience for consumers. New blockchain protocols like Toncoin, Sui, Aptos, Sonic, and Berachain are highlighted for their innovative strategies aimed at attracting users and driving growth.

The bank also notes that while they see potential in several high-performance blockchains, these platforms face obstacles in achieving widespread adoption and generating significant revenue. Sygnum points out some notable strategies that have fostered more sustainable practices, including Berachain’s incentives for validators, Sonic’s rewards for developers, and Toncoin’s access to a vast user base through its affiliation with Telegram.

The report also emphasizes that while the memecoin craze—lasting into early 2025—has propelled user engagement and revenue to new heights, it has also faced steep declines in interest as trends shift.

In parallel, layer-2 networks such as Base are examining their potential amid a dynamic market. The memecoin phenomenon, despite its ups and downs, retains a stronghold in the market narrative, capturing significant investor attention, with a CoinGecko report noting that memecoins accounted for 27.1% of global investor interest in Q1 2025. However, institutional investors are taking a different tack, as evidenced by asset manager Bitwise reporting that at least a dozen public companies purchased Bitcoin this quarter, bringing their collective holdings to a noteworthy $57 billion.

Altcoins Potential Resurgence in Q2 2025

The outlook for altcoins in 2025 suggests an optimistic trajectory driven by regulatory advancements and market competitiveness. Here are the key points to consider:

- Regulatory Improvements:

- Significant regulatory enhancements for digital assets are anticipated.

- These developments may lead to a strong rally in the altcoin sector.

- Current positive news has not yet affected market pricing.

- Bitcoin Dominance:

- Bitcoin’s market dominance has recently reached a four-year high.

- Investors are shifting funds into Bitcoin, perceived as a safer asset.

- Regulatory changes, such as the establishment of a Digital Asset Stockpile may influence crypto adoption.

- Rise of Economic Value Focus:

- Increased market focus on economic value is leading to intensified competition among altcoins.

- Successful protocols are expected to outperform Bitcoin, lowering its dominance.

- Key competitors include Toncoin, Sui, Aptos, Sonic, Berachain, and notable layer-2 networks like Base.

- Memecoins’ Popularity:

- Despite recent price drops, memecoins remain a dominant narrative, capturing 27.1% of global investor interest.

- This category is second only to AI tokens, indicating a continuous retail interest.

- Institutions, in contrast, are accumulating Bitcoin, emphasizing differentiated strategies between retail and institutional investors.

- Market Implications:

- Improved regulations and competitive altcoin landscape could enhance investment opportunities for retail and institutional investors.

- As the market matures, consumers could benefit from better products and services.

- The variability of interest between memecoins and Bitcoin may shape investment strategies moving forward.

“We expect protocols successful in gaining user traction to outperform and Bitcoin’s dominance to decline,” – Sygnum.

Comparative Analysis of Altcoin Resurgence in Q2 2025

As we enter the second quarter of 2025, the digital asset landscape is brimming with optimism, particularly for altcoins, as highlighted by Swiss bank Sygnum in its recent investment outlook. The bank suggests a significant uptick in regulatory clarity around cryptocurrency will pave the way for a robust altcoin sector rally. This presents a stark contrast to the current Bitcoin dominance, which has reached unprecedented heights, as investors seek safety in well-established assets.

Competition and Market Shift: Unlike past trends dominated by Bitcoin and Ethereum, Sygnum emphasizes a potential shift in the competitive landscape, where emerging protocols like Toncoin, Sui, and Berachain could gain traction. These projects, while addressing scalability and usability concerns inherent in legacy blockchains, face the challenge of capturing market share and generating significant revenue streams. The competition promises better products and innovation; however, it may also lead to a dilution of investor focus, as new entrants vie for attention and resources.

For retail investors, this burgeoning competition could be advantageous, as improved options may push down costs and enhance user experiences. However, it could also create confusion amidst a flood of new offerings, particularly for those less familiar with the crypto space. On the other hand, institutional investors retain a solid preference for Bitcoin, as shown by firms amassing significant holdings. Their cautious approach might stifle the momentum of altcoins that require time to establish market confidence despite their potential for high returns.

Potential Pitfalls: While the improved regulatory environment is expected to bolster overall crypto adoption, not all sectors may equally benefit. For instance, as Sygnum notes, the rise of economic value competition can overshadow projects that fail to demonstrate robust user engagement or sustainable revenue models. Hierarchical preferences could leave niche players struggling to find their footing, especially in the shadow of Bitcoin’s renewed popularity.

Furthermore, the strong appeal of memecoins, which captured significant investor interests in Q1 2025, starkly contrasts with the institutional focus on foundational assets. As retail investors remain enamored with the speculative allure of memecoins, there’s a risk that essential innovations in the altcoin space may be overlooked. This could create a significant divide between retail and institutional strategies moving forward, potentially leading to sector-wide volatility.

In summary, while the altcoin sector is primed for potential growth aided by diverse competition and evolving regulations, the inherent challenges it faces, coupled with entrenched market preferences toward Bitcoin, highlight a complex and dynamic landscape that could provide substantial opportunities but also pose serious risks. The next few months will be crucial in determining not only which altcoins gain traction but also how investor sentiment evolves in a rapidly changing digital asset ecosystem.