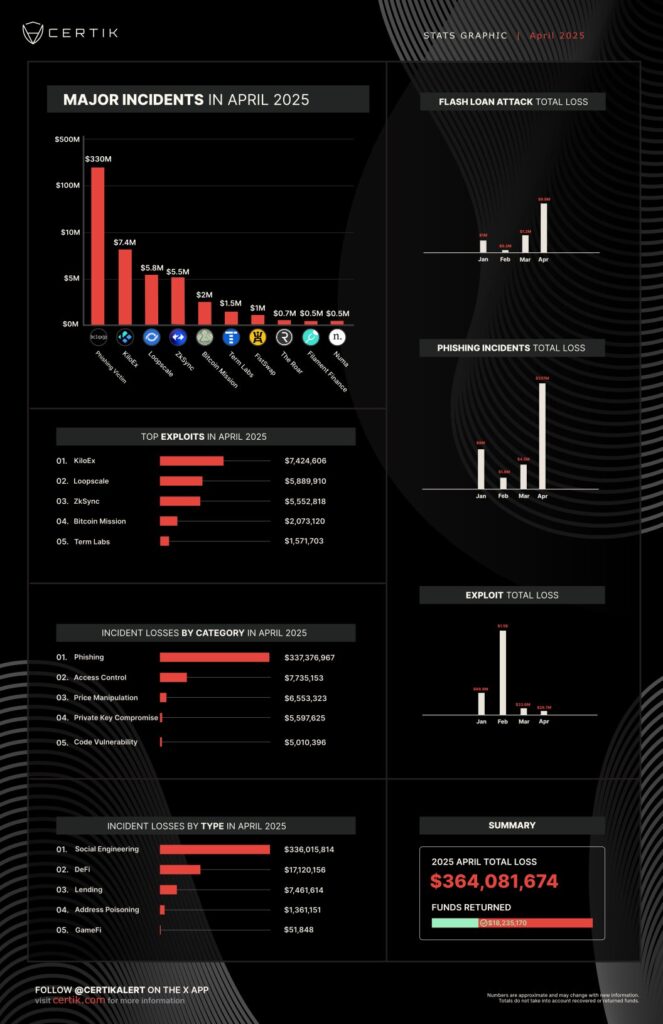

The cryptocurrency landscape faced a staggering surge in losses throughout April 2023, with reports highlighting a shocking 1,163% increase in funds lost to hacks, scams, and exploits. According to blockchain security firm CertiK, a total of $364 million vanished in April, a stark contrast to the $28.8 million recorded the previous month.

A major contributor to this spike was an unprecedented heist involving an elderly individual’s wallet in the U.S., resulting in the theft of 3,520 Bitcoin (BTC), valued at approximately $330.7 million. This incident, marked by sophisticated social engineering tactics employed by the attacker, occurred on April 30 and stands as the fifth largest crypto hack in history.

“Phishing scams emerged as the primary threat, while social engineering, access control hacks, and price manipulation exploits rounded out the top four methods of attack,” noted CertiK in its analysis of the trends impacting the crypto market.

Despite the hefty losses, April was not without positive notes, as over $18 million was returned from various exploits. Events like these shed light on the potential for recovery within the decentralized finance (DeFi) space. For example, the decentralized exchange KiloEx managed to recover all $7.5 million lost shortly after being exploited, while the ZKsync Association successfully retrieved $5 million from a security incident related to its airdrop distribution contract.

It’s worth noting that February 2023 still holds the record for the highest losses in the crypto sector this year, primarily driven by a devastating $1.4 billion heist attributed to North Korea’s Lazarus Group. As the industry grapples with these ongoing threats, the significant spike in losses within just one month has raised alarms and prompted a closer examination of security measures across the crypto ecosystem.

Significant Spike in Crypto Losses: April Analysis

The month of April 2023 experienced a staggering increase in crypto-related losses, which can have profound implications for individuals involved in the cryptocurrency market. Here are the key points from the reported findings:

- 1,163% Increase in Crypto Losses:

- Total losses reached $364 million in April, a sharp jump from $28.8 million in March.

- This drastic increase could indicate growing vulnerabilities in the crypto space, urging users to exercise caution.

- Major Heist Involving Elderly Individual:

- A single hack resulted in the loss of 3,520 Bitcoin (~$330.7 million) from an elderly user’s wallet.

- The attack highlights the importance of security awareness among all users, especially those less familiar with technology.

- Types of Attacks Leading to Losses:

- Phishing scams were identified as the primary driver of losses.

- Other forms of attacks included social engineering, access control hacks, and price manipulation exploits.

- Understanding these attack vectors can help users better protect themselves and their assets.

- Recovery of Stolen Funds:

- Over $18 million was returned through various exploits, hinting at the complexity of the crypto landscape where some funds can be recovered.

- Specific exchanges like KiloEx and ZKsync managed to recover stolen assets, showcasing efforts in community trust rebuilding.

- Historical Context of Crypto Losses:

- February 2023 still holds the record for the largest losses this year at $1.53 billion, primarily due to the Bybit hack.

- This historical perspective may affect readers’ confidence in investing and engaging with cryptocurrencies.

“This increase in losses underscores the necessity for enhanced security measures and education within the crypto community to protect against future attacks.”

Each of these points not only highlights the risks associated with cryptocurrency investments but also serves as a call to action for users to prioritize their security hygiene. As these statistics reveal growing threats, individuals engaged in crypto trading must remain vigilant and informed to mitigate potential losses in their financial ventures.

April’s Crypto Crisis: An Analysis of Exploits and Recovery Efforts

The dramatic surge in crypto losses during April has sent ripples through the industry, revealing both vulnerabilities and resilient responses from various platforms. At the forefront of this alarming trend is CertiK, a blockchain security firm that reported an astounding 1,163% increase in losses, predominantly due to a single theft that involved a shocking 3,520 Bitcoin taken from an elderly individual’s wallet through sophisticated social engineering tactics.

In stark contrast to previous months, where exploits totaled a comparatively low $28.8 million, April’s figure skyrocketed to $364 million. This significant uptick underscores the ongoing battle against cyber threats within the decentralized finance (DeFi) sector. Interestingly, while the dramatic figure raises alarm bells, it also highlights the potential competitive advantage for robust security firms and protocols that have systems in place to recover funds. For instance, the recovery of over $18 million showcases that not all hope is lost post-exploit; this effort could bolster user confidence in platforms that severely mitigate risks.

However, the disproportionate losses linked to phishing schemes and social engineering attacks present a significant disadvantage for the overall perception of the crypto market. Many investors, particularly those less experienced, may retreat or reconsider their engagement with cryptocurrencies, fearing security breaches like those witnessed in April. This retreat could dampen market innovation and adoption, leading to fewer new entrants and higher volatility as confidence wanes.

The implications of these losses extend beyond individual investors to larger institutions as well. Exchanges and wallets must reevaluate their security protocols to prevent a repeat of such incidents. On the other hand, firms specializing in crypto security could see a surge in demand for their services, putting them at a competitive advantage amid rising scrutiny over crypto safety. Companies that prioritize security measures will likely attract users reluctant to expose their assets to potential hacks.

In this environment, advanced social engineering defenses become essential. As highlighted by the stark theft experienced by the elderly individual, the need for education surrounding security measures is paramount. Those who may find themselves benefiting include seasoned investors who can navigate these threats, while novices could face hurdles if they don’t become aware of the dangers lurking in this rapidly evolving landscape.

While recovery efforts, as displayed by KiloEx and Loopscale’s return of stolen assets, could inspire action and trust, the alarming statistics from April reiterate that the crypto sector remains a double-edged sword—offering both opportunities and threats. As stakeholders, including developers and security experts, push forward to build stronger frameworks, the focus will increasingly be on striking a balance between innovation and protection in this high-stakes arena.