In a significant development for both the cryptocurrency and investment sectors, ARK Invest has enhanced its portfolios by including staked Solana (SOL) in two of its exchange-traded funds (ETFs), according to details shared in a client email that was reviewed by Cointelegraph. As of April 21, the ARK Next Generation Internet ETF (ARKW) and the ARK Fintech Innovation ETF (ARKF) now feature shares from 3iQ’s Solana Staking ETF (SOLQ), which is based in Canada and holds staked SOL.

These innovative ARK funds aim to provide diverse exposure to emerging technologies, featuring a mix of technology stocks alongside crypto-centric companies such as Coinbase, Block, and Robinhood. Notably, ARK claims that this addition makes ARKW and ARKF the first US-listed ETFs to offer exposure to Solana.

This noteworthy move follows the recent launch of Solana futures on the Chicago Mercantile Exchange (CME), stirring speculation that more US-listed SOL ETFs may be on the horizon.

While the asset manager Volatility Shares previously introduced two ETFs utilizing financial derivatives for SOL exposure, spot Solana ETFs remain in the waiting phase for regulatory approval in the United States. In Canada, however, the landscape is shifting rapidly; just last week, 3iQ successfully launched its Solana ETF after receiving the nod from the Ontario Securities Commission (OSC).

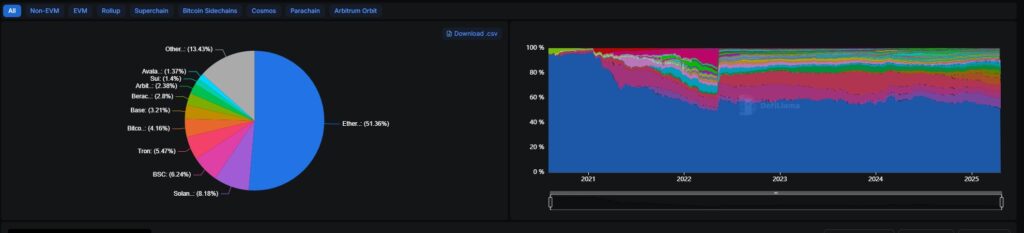

Solana is rapidly emerging as a key player in the blockchain space, currently ranking as the second-most popular network after Ethereum, with a total locked value exceeding $7 billion compared to Ethereum’s roughly $45 billion, as cited by DefiLlama. The growing interest in Solana is mirrored by regulatory moves, such as the US Securities and Exchange Commission’s approval for trading spot Ether ETFs, which may pave the way for similar opportunities in the future.

In a bid to expand its offerings, ARK Invest also partnered with 21Shares to introduce the ARK 21Shares Bitcoin ETF (ARKB), which boasts nearly $4 billion in net assets, and had previously collaborated on an Ether ETF before dissolving the partnership just before its launch under 21Shares’ brand.

ARK Invest Expands Exposure to Staked Solana (SOL)

In a recent development, ARK Invest has significantly increased its exposure to Solana (SOL) through its exchange-traded funds (ETFs). Here are the key points regarding this move:

- Inclusion in ARK Funds: ARK Next Generation Internet ETF (ARKW) and ARK Fintech Innovation ETF (ARKF) have added shares of 3iQ’s Solana Staking ETF (SOLQ).

- Emerging Technology Focus: Both ARK funds aim to provide extensive exposure to emerging technologies, incorporating a mixture of tech stocks and cryptocurrencies.

- First US-Listed Solana ETFs: ARK claims that these funds are the first US-listed ETFs to gain direct exposure to Solana, enhancing their appeal to investors.

- Regulatory Context: Despite the launch of Solana futures on the Chicago Mercantile Exchange, spot Solana ETFs are still pending approval from US regulators.

- Popularity of Solana: Solana is recognized as the second-most popular blockchain network after Ethereum, boasting a total value locked (TVL) of over $7 billion.

- Market Influence: The SEC has already authorized spot Ether ETFs, suggesting a growing acceptance of cryptocurrency ETFs that could benefit ARK’s offerings in the future.

- Partnerships: ARK has previously partnered with 21Shares to launch a Bitcoin ETF and is currently seeking expansion in the cryptocurrency ETF market.

The inclusion of staked Solana in ARK’s ETFs may provide investors with an innovative way to diversify their portfolios and maximize their exposure to emerging blockchain technologies.

This latest move by ARK Invest not only opens new investment avenues but could also signal a shift in the regulatory landscape for cryptocurrency-based financial products, influencing both individual and institutional investor strategies.

ARK Invest Expands into Staked Solana: Opportunities and Challenges

In an intriguing maneuver, ARK Invest has integrated staked Solana (SOL) into two of its prominent exchange-traded funds (ETFs), namely the ARK Next Generation Internet ETF (ARKW) and the ARK Fintech Innovation ETF (ARKF). This move highlights ARK’s commitment to emerging technologies and its proactive approach in enhancing its funds’ exposure to cryptocurrencies. However, while there are notable strengths in this strategy, there are also challenges and potential complications that could affect both investors and the broader crypto market.

Competitive Advantages: One of the standout aspects of ARK’s decision is the distinction of becoming the first US-listed ETFs to feature exposure to Solana. This advantage not only appeals to early adopters looking for innovative investment options but also positions ARK as a leader in the crypto ETF landscape. Moreover, including a diversified mix of technology stocks alongside staked SOL provides investors with a unique opportunity to engage with the growing sector of decentralized finance (DeFi) without diving directly into the cryptocurrency market.

Additionally, the recent listing of Solana futures on the Chicago Mercantile Exchange (CME) suggests a growing interest and increasing legitimacy of Solana within institutional contexts. This backdrop could enhance investor confidence and draw institutional and retail investors alike to ARK’s offerings, potentially driving demand for the fund.

Competitive Disadvantages: Nevertheless, ARK’s strategy comes with its challenges. The continued uncertainty surrounding spot Solana ETFs and the current regulatory landscape in the US may deter some investors, particularly those who are risk-averse. While ARK’s funds can offer a safer entry point into the crypto market, the lack of regulatory clarity for other Solana-related investments raises concerns, particularly around long-term sustainability.

Moreover, the existing competition from entities like Volatility Shares and the recent launches of derivatives-focused ETFs could dilute ARK’s unique appeal. As other firms vie for market share, ARK might find it challenging to attract and maintain inflows to its funds.

Potential Beneficiaries and Challenges: Investors seeking exposure to the burgeoning decentralized internet and fintech ecosystem stand to benefit significantly from this development. The influx of capital and interest in Solana could also bolster the ecosystem, leading to increased innovation and growth in projects built on its platform. However, the establishment of a multitude of competing ETFs could potentially overwhelm investors, creating confusion about which products offer the best value and security.

To summarize, while ARK Invest’s foray into staked Solana opens up fresh avenues for investment and signals a commitment to the growing crypto landscape, the complexities of regulatory approvals, competition, and market uncertainties remain critical factors that could influence investor sentiment and decision-making in this space.