Crypto exchange giant Binance is making waves with an innovative feature that bridges the gap between centralized exchange (CEX) and decentralized exchange (DEX) trading. Users can now seamlessly execute DEX trades using funds directly from their Binance wallets, effectively eliminating the cumbersome need for asset bridging or manual transfers. This significant development promises to simplify the user experience in the complex world of cryptocurrency trading.

With this new capability, Binance customers can utilize Circle’s USDC and various supported stablecoins to purchase tokens across popular blockchain networks, including Ethereum, Solana, Base, and BNB Smart Chain. This advancement addresses a common pain point for many users, particularly newcomers who often struggle with intricate user interfaces associated with crypto transactions.

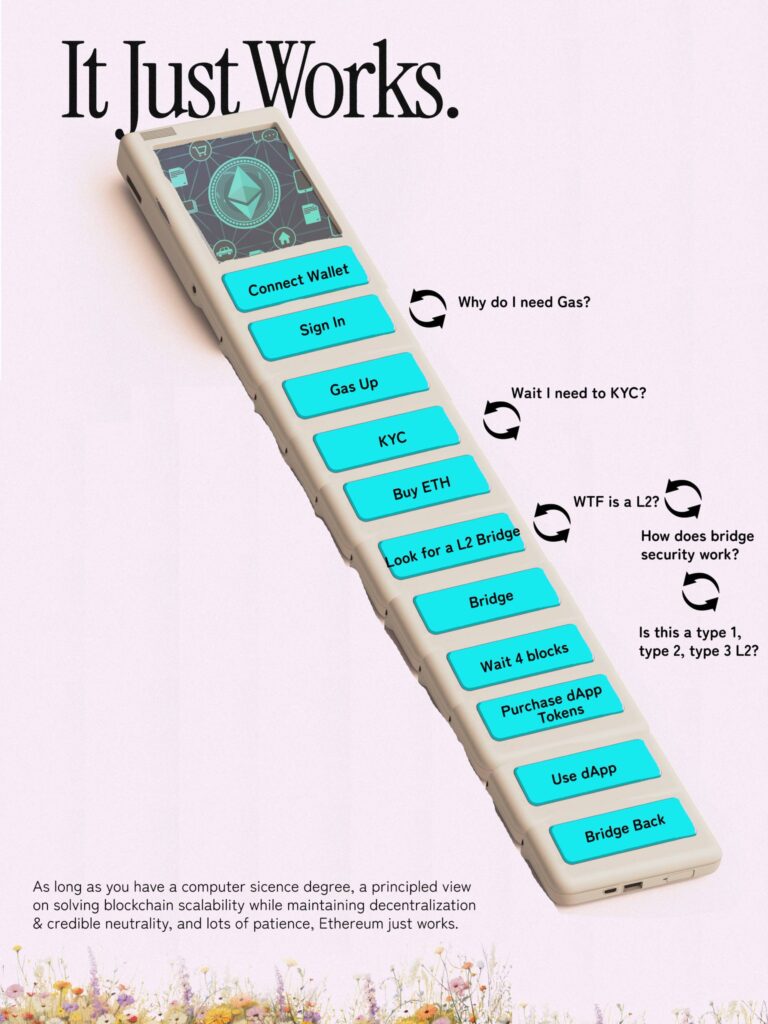

“Complex user interfaces and clunky user experiences are widely cited issues in crypto,” notes a recent analysis on the fragmentation of blockchain solutions.

Binance’s enhancement is indicative of a broader trend within the crypto community aimed at overcoming technical barriers that currently deter mass adoption. Industry leaders like Pedro Gomes of the WalletConnect Foundation have emphasized the importance of reducing friction in transactions while enhancing interoperability and user engagement. Gomes outlined foundational changes in wallet standards that focus on minimizing clicks and simplifying the overall experience for users.

Echoing these sentiments, Anurag Arjun, co-founder of the unified chain abstraction solution Avail, highlighted the urgency of improving blockchain interoperability. With multiple networks presenting unique security challenges, bridging techniques often lead to user frustration. Sandeep Nailwal, co-founder of Polygon, compared the current state of cryptocurrency to the internet in the late 1990s, advocating for advancements like smoother fiat onboarding and better custody solutions to boost user comfort and drive wider adoption.

In a landscape riddled with complexity, Binance’s latest move is a step toward a more user-friendly approach in crypto trading. By removing barriers and enhancing accessibility, this feature not only opens the door for seasoned investors but also welcomes newcomers eager to explore the promising world of digital assets.

Enhancements in Crypto Trading Experience

The recent developments in the crypto exchange landscape have significant implications for users, particularly in terms of simplifying trading processes and improving user experience.

- Introduction of CEX to DEX Trading:

- Binance now allows users to trade directly from their wallets on decentralized exchanges, improving accessibility.

- Eliminates the need for asset bridging or manual transfers, streamlining the trading process.

- Support for Stablecoins:

- Users can leverage Circle’s USDC and other stablecoins for transactions across various networks including Ethereum, Solana, Base, and BNB Smart Chain.

- This flexibility enhances liquidity and trading options for users, impacting daily trading efficiency.

- Improving User Experience:

- Reduction in technical barriers facilitates easier interaction with digital assets for newcomers.

- Addressing complex user interfaces in crypto is crucial for attracting a broader user demographic.

- Framework for Crypto Wallets:

- The WalletConnect Foundation and Reown are working on user-friendly wallet standards to minimize clicks and transaction friction.

- Improved interoperability and clear information aim to enhance the overall trading experience.

- Calls for Enhanced Adoption:

- Industry leaders stress the need for seamless fiat onboarding and better custody solutions to drive mass adoption.

- Comparisons to the early internet highlight the potential for growth in the crypto space once user experience is prioritized.

“Crypto needs to adopt smoother fiat onboarding, better custody solutions… to achieve mass appeal.” – Sandeep Nailwal

Binance Bridges the Gap Between CEX and DEX Trading

In an impressive move that underscores its dominance in the ever-evolving cryptocurrency landscape, Binance has rolled out a feature that merges centralized exchange (CEX) functionalities with decentralized exchange (DEX) trading. This innovation allows users to efficiently execute DEX trades directly from their Binance wallets, eliminating the cumbersome process of asset bridging and manual transfers. This seamless integration represents a pivotal step in addressing the complicated user experience that has often deterred newcomers from entering the crypto arena.

Competitive Advantages: Unlike many of its competitors, Binance’s latest offering significantly lowers the technical barriers faced by new crypto enthusiasts. The ability to use widely accepted stablecoins like Circle’s USDC across multiple blockchain networks, including Ethereum and Solana, makes transactions easier and fosters a welcoming environment for less tech-savvy users. Other platforms often require multiple steps and platforms to achieve similar results, which can frustrate potential customers. Additionally, Binance Alpha and the quick buy tool provide users with invaluable resources to quickly discover and acquire emerging tokens, enriching their overall trading experience.

Competitive Disadvantages: However, the integration of CEX to DEX trading is not without its complexities. Critics may argue that relying on a centralized platform like Binance to facilitate decentralized trades still introduces a layer of bureaucracy not aligned with the ethos of decentralization. Other decentralized exchanges, such as Uniswap and SushiSwap, may capitalize on this and promote themselves as truer alternatives, emphasizing user autonomy and complete control over assets. This dynamic may create a rift within the community, as enthusiasts might prefer platforms that adhere more closely to decentralized principles.

This development comes at a time when user experience in crypto is under intense scrutiny. Platforms like WalletConnect and Avail are advocating for standardized wallet frameworks that simplify user interactions, while industry leaders like Sandeep Nailwal from Polygon stress the urgency of improving the overall experience for mass adoption. Thus, Binance’s new feature could either significantly lower the entry barriers for mainstream users or expose the existing friction in inter-chain communication to its dedicated user base, who might see this as an unnecessary compromise on decentralization.

Overall, this strategic move by Binance could greatly benefit newcomers eager to explore the crypto universe without getting bogged down by technical issues. Conversely, it may pose challenges for purists who prioritize autonomy and trustless transactions, highlighting the ongoing tug-of-war between convenience and decentralization in the cryptocurrency market.