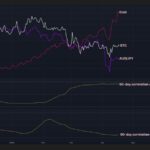

In a dramatic display on Wednesday, the movements of bitcoin (BTC) and U.S. equities captured the eyes of investors, hinting at a potential shift in their long-standing correlation. This week’s trading showcased a distinctive divergence, with bitcoin responding differently than traditional stocks, particularly the tech-heavy Nasdaq 100. This change is noteworthy, as historically, cryptocurrencies have often mirrored the performance of tech stocks, leading some to view bitcoin as a high-risk, high-reward play within that sector.

For instance, while the Nasdaq plummeted over 3%—experiencing its steepest decline in recent memory—BlackRock’s iShares Bitcoin Trust (IBIT) finished the day modestly up, increasing by 0.46%. This contrast underscores the evolving dynamics of market behavior, especially as mainstream assets like gold continue to thrive, establishing 12 new daily records this year, detached from the fluctuations of tech stocks.

Adding another layer to this complex landscape, the bitcoin-leveraged MicroStrategy (MSTR), which is included in the Invesco QQQ Trust, also managed to close positively, rising 0.30%. This is particularly striking given that most tech giants known as the “Magnificent Seven” were in the red, highlighting a growing gulf between digital currencies and traditional market leaders.

“During a pivotal speech by Federal Reserve Chair Jerome Powell, both bitcoin and U.S. equities experienced a dip; however, bitcoin quickly bounced back to surpass $84,000, whereas the Nasdaq struggled further before ending the day on a stabilization note.”

Investor sentiment was further rattled by Powell’s responses regarding inflation and market stability, particularly his remarks dismissing the notion of a ‘Fed put’—a term suggesting the Fed as a safety net for the stock market during downturns. The Fed’s potential withdrawal from its stabilizing role raises questions about the future of traditional investments, and in turn, how assets like bitcoin may navigate a changing financial landscape devoid of conventional safeguards.

As the continued interplay between bitcoin and U.S. equities unfolds, it remains to be seen whether this decoupling marks a significant trend change or is merely a fleeting moment in the intricate tapestry of financial markets. Investors are closely examining these movements, searching for clues within the data that could indicate broader implications for both cryptocurrency and traditional equity investments.

Bitcoin and U.S. Equities: Emerging Trends and Implications

The recent price action between bitcoin and U.S. equities reveals noteworthy trends that could impact investors significantly.

- Fading Correlation:

- Indicates a potential shift in investment strategies as traditional asset classes diverge.

- Investors may seek to reassess portfolio compositions, particularly concerning cryptocurrencies and equities.

- Gold’s Performance:

- Gold has consistently set new records this year, highlighting its stability against falling equities.

- This could prompt investors to consider diversifying into precious metals as a hedge against equity market volatility.

- BlackRock’s iShares Bitcoin Trust (IBIT):

- IBIT’s resistance to the Nasdaq’s decline signifies changing dynamics in crypto investment strategies.

- This divergence suggests potential for bitcoin to act as a more stable asset under certain market conditions.

- Federal Reserve’s Position:

- Chair Jerome Powell’s hawkish comments raise concerns about the Fed’s willingness to support markets during downturns.

- The absence of a “Fed put” could lead to increased volatility in both stock and cryptocurrency markets.

- Market Reactions:

- During critical updates, both bitcoin and the Nasdaq reacted similarly, but divergence was noted later—indicating fluctuating investor sentiment.

- Understanding these trends is crucial for investors looking to navigate complex market interactions effectively.

Bitcoin vs. U.S. Equities: Diverging Paths in a Shifting Market

The recent trading dynamics between bitcoin (BTC) and U.S. equities have captivated the attention of investors, signaling a potential shift in their historically intertwined relationship. In recent news, the divergence in performance between these assets has raised eyebrows, especially as gold continues to shine brightly, hitting record highs. This development presents both competitive advantages and disadvantages for different types of investors.

Comparative Advantage: Bitcoin’s resilience amidst a sharp decline in the Nasdaq 100 showcases its potential as a distinct asset class. The performance of BlackRock’s iShares Bitcoin Trust (IBIT), which slightly advanced even when major tech stocks faltered, highlights its growing appeal as a portfolio diversifier. This can be particularly advantageous for investors seeking exposure to alternative currencies while minimizing reliance on traditional market fluctuations.

Gold’s recent successes further emphasize the potential benefits of holding non-correlating assets. Investors looking for safe havens during volatile times may find both gold and bitcoin appealing. Conversely, for those heavily invested in U.S. equities, this correlation decay may signal a dawn of new diversification strategies that could enhance returns and mitigate risks.

Disadvantages: However, this divergence isn’t without its challenges. Bitcoin, while showing signs of independence, still lacks the safety net often associated with traditional equities, particularly during market downturns. Fed Chair Jerome Powell’s comments about inflation and the absence of a “Fed put” imply that without monetary support, assets like bitcoin may be more vulnerable during systemic crises. Investors reliant on the theoretical backing of central banks might find themselves in a precarious position as the landscape shifts.

This evolving scenario could benefit hedge funds and institutional players who are nimble enough to capitalize on these market dislocations. In contrast, retail investors and traditional equity holders might find this unpredictable environment troublesome, as they navigate between emerging opportunities in cryptocurrencies and traditional asset classes that would typically offer stability.

With inflationary pressures and unclear fiscal policies becoming more prevalent, those accustomed to the safety of the stock market may need to reevaluate their strategies. This is especially crucial for long-term investors who may now need to consider a broader spectrum of assets to safeguard their portfolios.