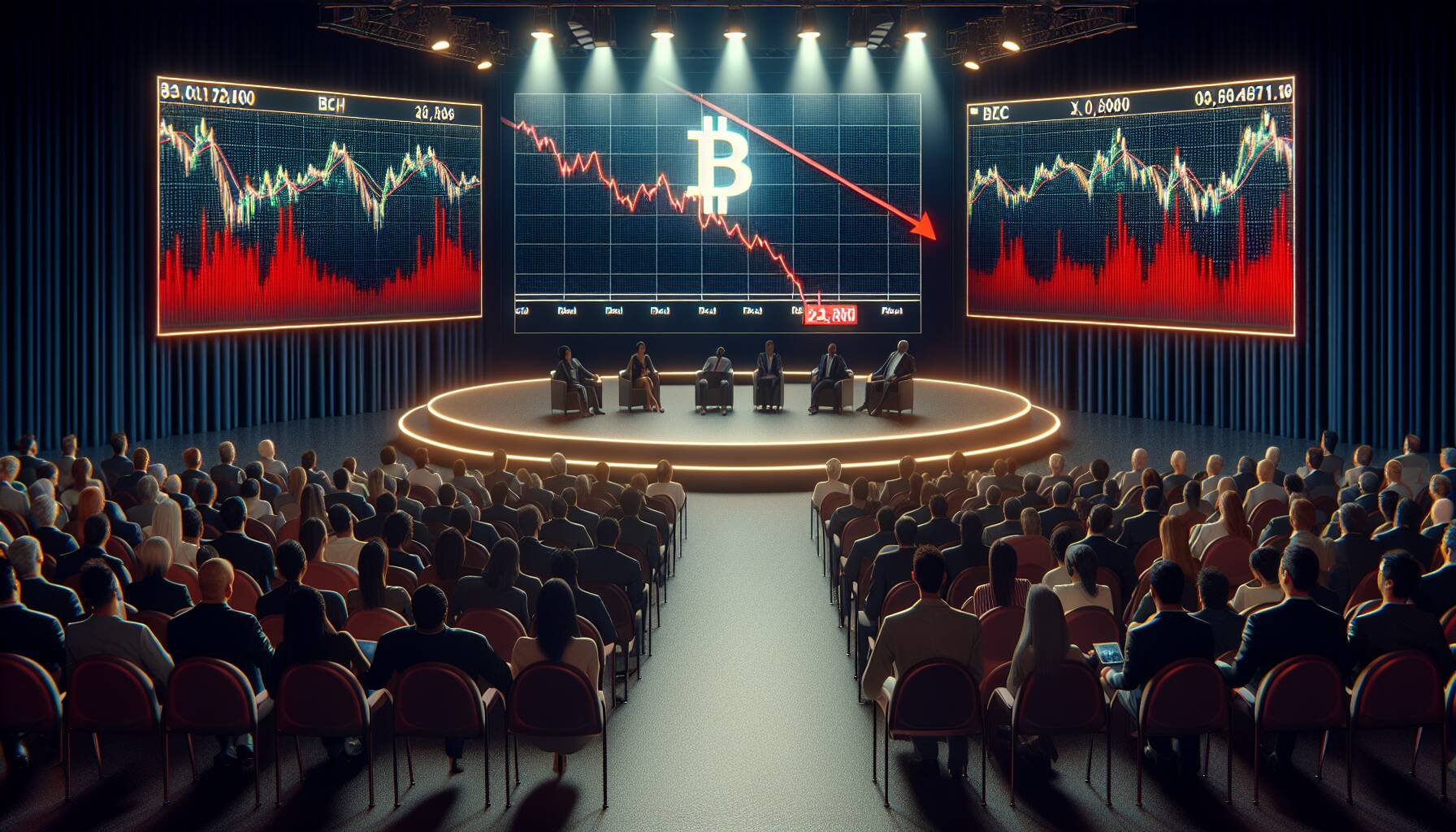

The cryptocurrency market experienced a significant shift today, marked by a sharp decline in Bitcoin’s value that has sent shockwaves through the trading community. In pre-market trading, shares connected to this industry plummeted over 13%, reflecting growing investor concerns. The unexpected tumble in Bitcoin’s price has led to mounting speculation about the reasons behind this downturn and its potential implications for the broader market.

Many analysts are now closely monitoring factors such as regulatory news, market sentiment, and macroeconomic indicators that could influence the volatile landscape of cryptocurrencies.

This recent dip underscores the unpredictable nature of digital currencies, which can be heavily influenced by market dynamics and investor psychology. As Bitcoin continues to be a bellwether for the overall crypto ecosystem, its movements will be watched with keen interest by both seasoned traders and newcomers alike.

Impact of Bitcoin Price Decline on Shares

The recent decline in Bitcoin’s price has significant implications for investors and the market, particularly affecting shares of companies closely tied to cryptocurrency. Below are the key points regarding this situation:

- Bitcoin Price Drop: The price of Bitcoin has experienced a significant decline.

- Market Reaction: Shares associated with cryptocurrency have seen a slump of more than 13% in pre-market trading.

- Investor Sentiment: The downward trend in Bitcoin can lead to increased volatility and uncertainty among investors.

- Potential Losses: Investors may experience immediate financial impacts due to share price declines.

- Broader Market Effects: The slump may affect industries linked to Bitcoin, such as technology and finance.

This situation may prompt investors to reassess their portfolios and strategies in response to fluctuating cryptocurrency values.

Bitcoin Price Drop Impacts Shares: A Competitive Analysis

The recent drastic drop in bitcoin prices has triggered a substantial decline in shares, with a notable plunge of over 13% observed in pre-market trading. This downturn reflects a broader trend seen in similar market scenarios where digital currencies face volatility. The comparative analysis reveals distinct competitive advantages and disadvantages for companies linked to cryptocurrency investments or transactions, positioning them uniquely amidst this fluctuating landscape.

On one hand, businesses that have heavily invested in bitcoin and other cryptocurrencies may experience significant losses and reduced investor confidence. The abrupt decline can deter potential investors, raising concerns about the stability and reliability of such digital assets. This situation could create challenges for companies reliant on the crypto market, impacting their stock performance directly.

Conversely, firms that have managed to fortify their portfolios with more diversified assets may find themselves at a competitive advantage. By not being solely reliant on bitcoin, they may mitigate risks associated with the cryptocurrency’s volatility. This strategic positioning enables them to retain investor trust and navigate financial markets more effectively.

Furthermore, this slump could benefit companies that specialize in services like cryptocurrency trading and investment management. With prices retracting, these businesses could see an uptick in trading volumes as investors capitalize on lower prices, looking for opportunities to buy on the dip. However, they must also brace for a potential surge in client inquiries regarding market risks, requiring adept risk management strategies to address heightened concerns.

On a larger scale, this volatility could pose problems for those companies directly connected to bitcoin transactions or those leveraging it as a payment method. They might face increased scrutiny from regulators and a demand for better risk policies. Investors in these sectors should remain vigilant, as sustained market fluctuations could lead to overall hesitancy in consumer and investor confidence, ultimately impacting their bottom line.

In summary, the current state of the bitcoin market not only illustrates the inherent volatility associated with cryptocurrency but also highlights the crucial need for companies to adopt flexibility in their investment strategies. Those able to pivot efficiently may emerge stronger, while others overly exposed to bitcoin’s fluctuations could face significant challenges in maintaining market integrity.