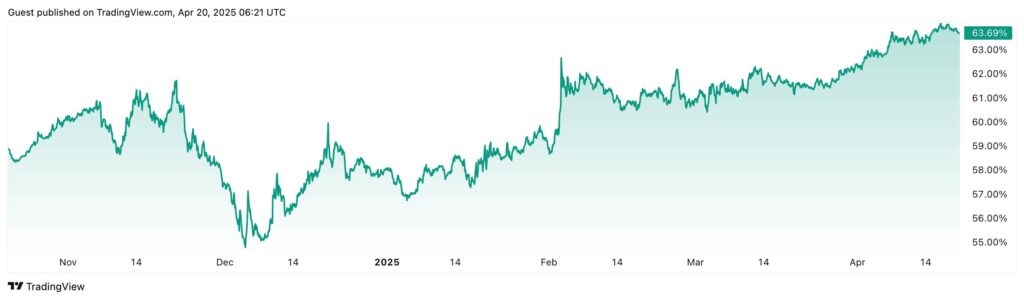

In a bold prediction within the cryptocurrency realm, Jan3 CEO Samson Mow has made headlines by asserting that Bitcoin (BTC) dominance has not yet reached its peak. Mow’s analysis suggests that the current enthusiasm surrounding Bitcoin could see its market share, which currently stands at 63.66%, continue to rise beyond initial expectations by late 2024. His insights were shared via a post on social media platform X, where he discussed the concept of “unit bias,” a behavioral economics phenomenon that influences investors to prefer owning full units of cheaper altcoins rather than fractions of Bitcoin.

“Unit bias is absolutely destroying the uninitiated,” Mow stated, underlining how psychological factors affect investment choices in the crypto space.

Mow takes a critical stance on the perceived value of several prominent altcoins, suggesting that if they were measured on an equal footing with Bitcoin—considering their total supply—many would be significantly overvalued. For instance, he estimates that Ether (ETH) should be priced at $9,200, XRP at $5,800, and Solana (SOL) at $3,400, marking astronomic increases from their current valuations at the time. This perspective poses a question: how much of altcoin valuation is influenced by the notion of owning complete tokens?

“No way these alts are worth that much,” Mow remarked, challenging the fundamental valuation metrics utilized by many crypto investors.

Historically, Bitcoin dominance is a key indicator in the cryptocurrency market, often signaling shifts in investment patterns. As dominance rises, traders typically anticipate that Bitcoin may be nearing a price peak, while a decline in dominance often heralds an “altcoin season,” where investors diversify their portfolios into alternative cryptocurrencies. Currently, Bitcoin dominance has seen an increase of 9.11% over the past six months, defying some analysts who previously forecasted a cap at 60% dominance by 2024. The crypto community continues to watch these developments closely, as Mow’s forecasts may influence market sentiment and investment strategies moving forward.

Bitcoin Dominance Insights by CEO Samson Mow

Samson Mow, CEO of Jan3, highlights important trends regarding Bitcoin dominance and its implications for investors in the cryptocurrency space. Here are the key points drawn from his insights:

- Bitcoin Dominance Growth:

- Bitcoin’s dominance, currently at 63.66%, has exceeded many analysts’ expectations and is projected to rise further beyond 60% by late 2024.

- This dominance reflects Bitcoin’s share of the total cryptocurrency market capitalization, used by traders to predict market trends.

- Unit Bias Impact:

- Unit bias refers to the tendency of investors to prefer owning whole units of cheaper altcoins over fractional ownership of Bitcoin.

- Mow argues that this psychological effect misleads investors regarding the true value and potential of altcoins.

- Valuation of Altcoins:

- Mow challenged the current market valuations of altcoins, suggesting that if unit bias is removed, Ether (ETH) should be valued at $9,200, XRP at $5,800, and Solana (SOL) at $3,400.

- Such values imply enormous percentage increases compared to current prices, raising questions about the sustainability of their valuations.

- Market Dynamics:

- Historically, a decline in Bitcoin dominance often marks the beginning of an “altcoin season,” where traders seek to invest in altcoins for potential higher returns.

- Despite expectations, Mow asserts that Bitcoin’s dominance could continue to rise rather than decline as predicted by other analysts.

“Most altcoins take advantage of unit bias by having a very high total supply, which confuses market participants about what they are actually purchasing.” – Samson Mow

Understanding these key points can significantly impact readers’ investment decisions in the cryptocurrency market. By recognizing the influence of unit bias, they can make more informed choices about allocating their investments towards Bitcoin and altcoins, possibly leading to better financial outcomes.

Analyzing Bitcoin Dominance: Insights from Samson Mow’s Forecast

The recent commentary by Jan3’s CEO, Samson Mow, has ignited discussions around Bitcoin’s dominance in the cryptocurrency market, particularly as it potentially surpasses expectations set for late 2024. Mow’s assertion that Bitcoin (BTC) dominance will rise lends a competitive edge to Bitcoin, especially against altcoins, by addressing the psychological phenomenon of unit bias. His analysis highlights that the perceived value of altcoins may be overly inflated due to this bias, where investors prefer whole numbers over fractions, leading to distorted market valuations.

Comparatively, other analysts, like Benjamin Cowen of Into The Cryptoverse, predict that Bitcoin dominance would peak at 60%, suggesting that sentiment may shift towards altcoins as their season approaches. Mow counters this by emphasizing that unit bias leads many to misjudge the actual worth of altcoins. His observations align with a broader trend where influential voices within the crypto community continue advocating for a stronger focus on Bitcoin’s intrinsic value versus its competitors.

Advantages and Disadvantages

Mow’s insights may benefit seasoned investors who understand Bitcoin’s scarcity and true market dynamics, potentially encouraging a re-evaluation of investment strategies within the crypto space. Conversely, novice investors drawn in by the allure of cheaper altcoins might face hurdles as they struggle to grasp the deeper economic implications—this misalignment could lead to poor investment choices and losses. Mow’s critique indirectly serves to warn these less experienced participants that they may be misled by superficial metrics, hence increasing reliance on authoritative assessments of asset values.

Furthermore, highlighting the serious discrepancies in altcoin pricing, as Mow does, could create a shift in capital flows among investors who might begin scrutinizing their portfolios more rigorously. This could foster a more skeptical environment for altcoins, creating challenges for projects that rely heavily on marketing illusions of value through unit bias. Ultimately, while Bitcoin may solidify its position as a more stable and rational investment choice, the altcoin market might see volatility as investor confidence is put to the test.

In sum, while Mow’s perspective presents a compelling case for Bitcoin’s continuing ascent, it simultaneously casts doubt on the sustainability of altcoins, favoring a recalibration in how investors perceive value within the cryptocurrency ecosystem.