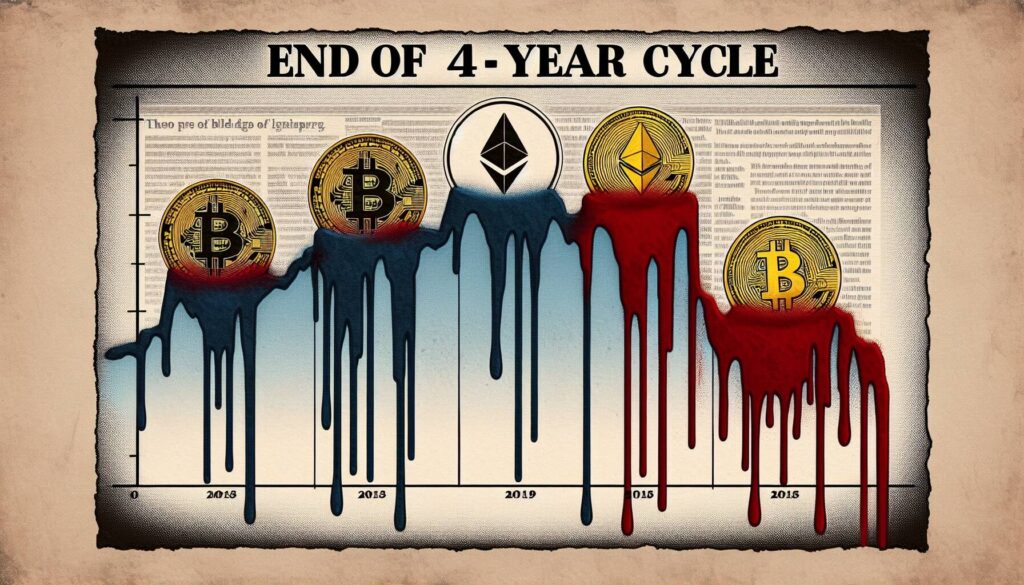

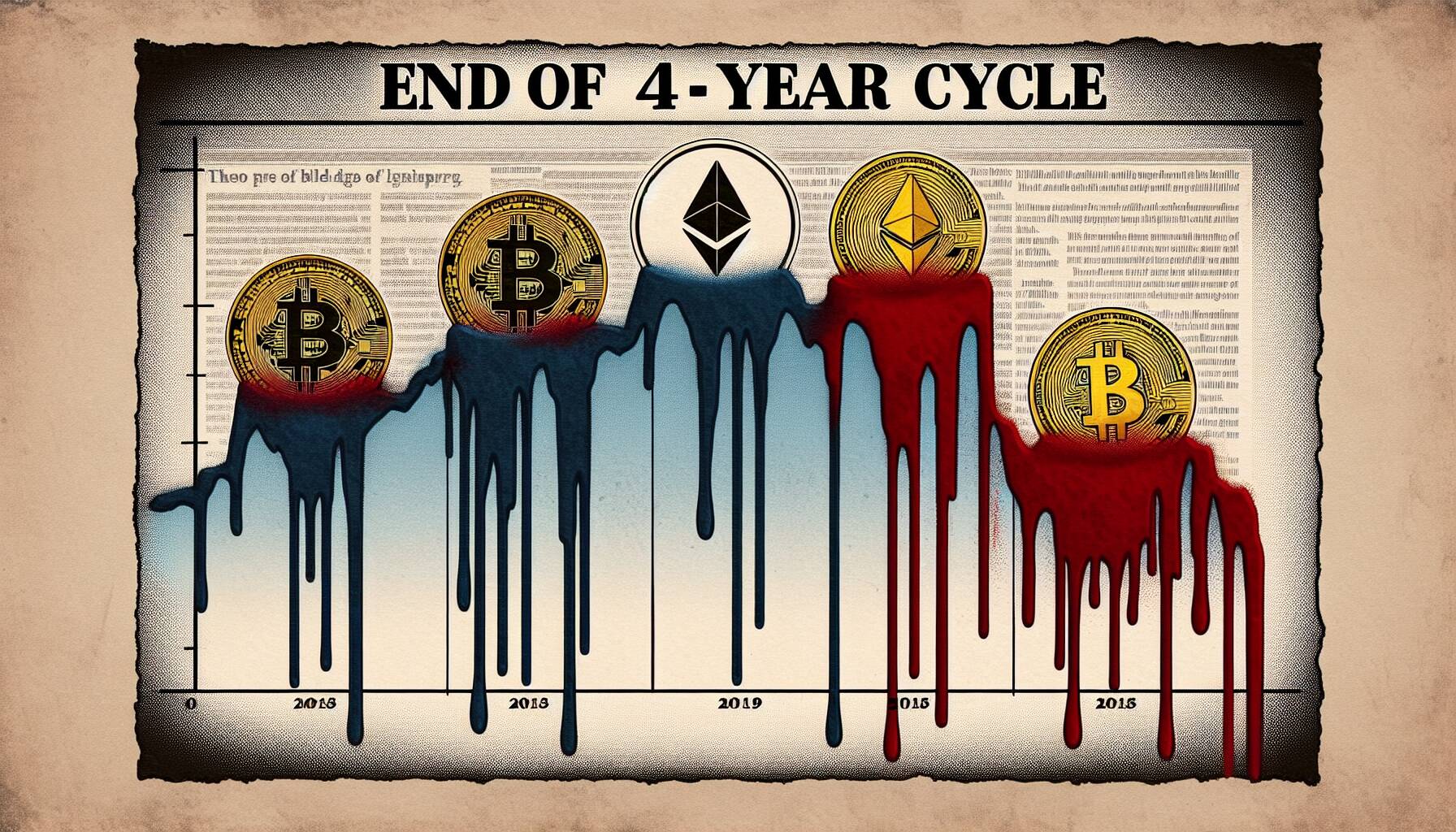

The cryptocurrency market is experiencing a turbulent shift as major players like Bitcoin, Ethereum, and XRP witness declines in value. Traders are closely analyzing the potential end of a significant four-year market cycle, which has sparked a mix of anxiety and speculation.

Market dynamics are ever-changing, and investors are keenly observing how these shifts will affect their portfolios.

As concerns grow over the sustainability of these digital currencies, many are left wondering what the future holds for crypto investments. Will this period of decline pave the way for new opportunities, or is it a harbinger of a prolonged downturn?

With heightened volatility, traders are urged to stay informed and vigilant in this evolving landscape.

Bitcoin, Ethereum and XRP Bleed as Traders Weigh End of 4-Year Cycle

Recent market trends indicate significant declines in major cryptocurrencies. Here are the key points:

- Bitcoin’s Decline: Bitcoin experiences a notable price drop, reflecting broader market trends.

- Ethereum’s Performance: Ethereum also faces losses, indicating investor uncertainty.

- XRP Volatility: XRP’s value fluctuates as traders assess market conditions.

- 4-Year Cycle Considerations: Traders are speculating about the conclusion of a four-year market cycle, which could impact future investments.

- Market Sentiment: Fear and uncertainty are prevalent, potentially influencing traders’ decision-making processes.

These factors may affect readers by:

- Investment Strategies: Understanding market cycles may compel investors to reassess their strategies.

- Financial Planning: Increased volatility can impact personal finance decisions and risk management.

- Education on Cryptocurrency: Awareness of market trends can enhance knowledge and investment acumen.

Market Doldrums: The Impact of Bitcoin, Ethereum, and XRP Price Adjustments

The recent downturn in cryptocurrency values for Bitcoin, Ethereum, and XRP has caught the attention of traders, signaling a potential end to the current four-year market cycle. As these major players bleed value, it’s crucial to assess what this means for the broader cryptocurrency ecosystem. One competitive advantage of being aware of these trends is allowing traders to act swiftly, possibly capitalizing on lower prices for strategic investments. However, this also presents a significant downside as panic selling could intensify, driving prices even lower.

Investors who are accustomed to the cyclical nature of cryptocurrency markets might embrace this as a buying opportunity, giving them a chance to snag assets at discounted prices. On the other hand, newcomers or less experienced traders may find themselves overwhelmed, potentially leading to losses if they react impulsively to the market’s fluctuations. This situation serves both as a benefit for seasoned investors looking to expand their portfolio and a problem for those unprepared for volatility.

Furthermore, the broader sentiment around these cryptocurrencies can influence succeeding projects and altcoin markets. As Bitcoin often sets the tone for the industry, its decline could trigger a ripple effect impacting smaller coins. Altcoin investors may need to brace for significant swings influenced by Bitcoin’s performance, particularly during uncertain market conditions.

In summary, while veteran traders might identify an opportunity for strategic investment amid the bleeding of Bitcoin, Ethereum, and XRP, this scenario also poses substantial risks for less experienced participants. The evolving landscape calls for keen analytical skills to navigate these potential gains and losses effectively.