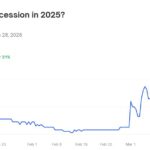

Bitcoin (BTC) investors are hoping to turn the page after experiencing four consecutive losses on Mondays. Recently, the largest cryptocurrency has been caught in a whirlwind of price fluctuations, influenced by macroeconomic factors such as geopolitical tensions, tariffs, and rising global bond yields. This backdrop of uncertainty seems to have a particular impact on Mondays, which have been marked as challenging days for Bitcoin trading.

According to data from Velo, Mondays and Thursdays tend to rank as the most negative days of the workweek in terms of performance, while Sundays emerge as the worst day overall, averaging a price decline of 1%. Bitcoin’s recent streak of losses has been quite notable: on February 17, it fell by 0.31%, followed by a larger drop of 4.6% on February 24, an even more significant 8.5% on March 3, and a decline of 2.6% on March 10. Overall, Bitcoin has seen a staggering 30% decrease from its all-time high at the end of January, paralleling a sharp 10% slide in the S&P 500 index, which similarly faced three consecutive Mondays of loss.

Interestingly, despite the turbulent performance, Bitcoin managed a slight uptick of 1.4% over the past 24 hours, while S&P 500 futures showed a slight downturn. With the market landscape as unpredictable as ever, the cryptosphere watches intently to see what unfolds next. The coming days will be critical for Bitcoin, an asset that has become synonymous with both opportunity and volatility in the financial world.

Bitcoin’s Recent Performance and Market Impact

Bitcoin (BTC) investors are currently facing challenges as market volatility continues to affect returns. Here are the key points regarding Bitcoin’s performance and its broader implications:

- Four Consecutive Monday Losses:

- BTC has lost value on the last four Mondays, indicating a troubling trend for investors.

- Recent losses include:

- 0.31% on February 17

- 4.6% on February 24

- 8.5% on March 3

- 2.6% on March 10

- Price Volatility Driven by Macroeconomic Factors:

- Geopolitical tensions, tariffs, and rising global bond yields are contributing to the instability of Bitcoin prices.

- This volatility has been affecting both Bitcoin and traditional markets, as seen in the decline of the S&P 500.

- Weekday vs. Weekend Performance:

- Analysis from Velo indicates that Mondays and Thursdays tend to be the most negative days in the workweek for Bitcoin.

- Interestingly, Sundays have the highest average price decline of 1%, suggesting investor concern leading into the week.

- Overall Market Trends:

- Bitcoin has seen a cumulative decline of 30% from its all-time high in late January.

- The S&P 500 is also experiencing a downturn, with three consecutive Mondays of losses, highlighting a broader market trend affecting Bitcoin.

- Potential Impact on Investors:

- The ongoing market turbulence may require investors to reassess their strategies and timelines for Bitcoin investments.

- Understanding these trends could impact decisions on buying or selling BTC, influencing personal financial management and risk tolerance.

What happens next is anyone’s guess, making it crucial for investors to stay informed on market conditions.

Bitcoin’s Monday Blues: A Closer Look at Investment Trends and Market Sentiment

In recent news, Bitcoin (BTC) investors are grappling with the challenges posed by a series of consecutive Mondays marked by losses. This trend aligns with broader market conditions, where geopolitical tensions, tariffs, and rising global bond yields have introduced a wave of uncertainty. Both Bitcoin and the S&P 500 have shown vulnerability, with the latter also suffering from three back-to-back Mondays of declines.

The primary advantage of this situation for informed investors lies in the opportunity for strategic buying. As Bitcoin experienced a 30% drop from its peak in late January, savvy traders might view this as a potential entry point. This sentiment is echoed in the behavior of the S&P 500, where trends can indicate favorable short or long positions. However, the volatility may deter risk-averse investors who prefer stability over speculative assets.

Another critical observation is the performance difference between weekends and weekdays. Data suggests weekends are generally less favorable for Bitcoin, with Sundays consistently being the worst day for price performance. This could be problematic for investors who hold through the weekend and face potential losses when the market opens on Monday. For day traders and those looking for quick turnarounds, such patterns can present lucrative opportunities if timed correctly.

Yet, the looming question remains: who stands to benefit from these fluctuations? Active traders and those skilled in technical analysis may thrive amidst the current volatility, while long-term holders might experience undue stress as they ride the market’s ups and downs. Conversely, this environment poses risks for less experienced investors who might not be equipped to navigate the challenges of a tumultuous market atmosphere.

Moreover, the ongoing issues with macroeconomic factors may lead to further price fluctuations, creating an unpredictable arena for both Bitcoin and U.S. equities. As uncertainty reigns, market participants must weigh these dynamics carefully, as the current landscape could spell significant opportunity for adept investors but challenges for those unprepared for rapid changes.

As we move forward, it’s clear that the interplay between Bitcoin, global economic variables, and investor sentiment will shape market dynamics. The question of what lies ahead is on everyone’s mind, underscoring the need for vigilance and adaptability in a landscape defined by volatility.