In recent developments, Bitcoin (BTC) has maintained a price level above ,000 since early March, suggesting that bullish sentiment is strong among traders who are eager to buy rather than waiting for a downturn. However, the struggle to push past the ,000 mark indicates that bearish forces are still active, selling during price increases. According to CoinShares’ latest report, the cryptocurrency market has experienced significant outflows, totaling .7 billion just last week, bringing the five-week total to an alarming .4 billion. This streak of outflows, now stretching to 17 consecutive days, marks the longest negative trend recorded since CoinShares began tracking in 2015.

ShayanBTC, a contributor at CryptoQuant, offers a glimmer of hope, suggesting that investors who bought Bitcoin between three and six months ago are currently displaying signs of accumulation—a behavior historically correlated with market recoveries.

This backdrop raises intriguing questions about Bitcoin’s ability to breach key resistance levels, and how alternative cryptocurrencies, or altcoins, are faring in this tumultuous environment. Meanwhile, the S&P 500 Index has been navigating its own rough waters, showing signs of recovery but facing challenges at various resistance levels, which may affect broader market sentiment.

Analysis continues in the cryptocurrency space, with varying fortunes for assets like Ethereum (ETH), XRP, BNB, and Solana, among others, as traders assess support and resistance zones that could dictate future movements. Whether the bulls or bears will take the upper hand remains to be seen as market participants keep a close eye on evolving trends.

Current Trends in Cryptocurrency and Market Analysis

The following key points outline the present situation in the cryptocurrency market, especially focusing on Bitcoin, and how these dynamics could impact investors and traders:

- Bitcoin’s Stability Above ,000:

- Bitcoin has maintained prices above ,000 since March 11, which indicates strong buying interest from bulls.

- The inability to break above ,000 suggests resistance from bears selling during rallies.

- Significant Outflows from Cryptocurrency ETPs:

- There were .7 billion in outflows from cryptocurrency exchange-traded products last week, totaling .4 billion in five weeks.

- This marks a 17-day streak of negative outflows, the longest recorded by CoinShares since 2015.

- Accumulation Patterns Among Long-term Investors:

- Investors who bought Bitcoin three to six months ago are showing accumulation behaviors, indicating potential market stabilization.

- This historical pattern often precedes market bottoms and can signal the start of upward trends.

- Performance of Other Cryptocurrencies:

- Ethereum, XRP, BNB, and Solana are experiencing varied price actions, indicating a mixed outlook across the market.

- The analysis includes potential support and resistance levels that could dictate future price movements.

- Impact of Economic Indicators:

- The S&P 500 Index shows corrective movement, indicating investor sentiment may be negative, affecting overall market confidence.

- The behavior of the US Dollar Index (DXY) also plays a crucial role in the cryptocurrency landscape, influencing trading strategies.

- Risk of Market Downturn:

- Price drop scenarios are outlined for several cryptocurrencies, underscoring the importance of monitoring support levels closely.

- Failure to hold key support levels could signal deeper corrections and potential losses for investors.

Understanding these points can help readers better navigate their investment strategies, make informed decisions in a volatile market, and recognize patterns that signal shifts in price trends. Being aware of both bullish and bearish indicators, as well as market sentiment, could significantly influence their trading outcomes and overall investment performance.

Bitcoin’s Resilience and Market Dynamics: A Competitive Analysis

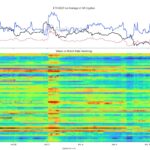

The current landscape surrounding Bitcoin (BTC) presents a compelling narrative of resilience amidst ongoing market fluctuations. Since March 11, BTC has consistently managed to hold above the ,000 mark, demonstrating the bullish sentiment among investors eager to capitalize on potential price gains. This steadfastness, however, is contrasted by challenges faced in breaking past the ,000 resistance level—a reality that underscores the enduring struggle between bullish and bearish forces in the cryptocurrency market.

Compared to traditional financial indicators like the S&P 500 Index, which is currently embroiled in a corrective phase and teetering on key support levels, Bitcoin’s stability is noteworthy. The S&P 500’s struggles, driven by sentiments of negative trading, may lead to heightened volatility that adversely affects the investor confidence across all market sectors, including crypto. Here, Bitcoin stands out as a relative safe haven, attracting investors who might otherwise shy away from equities during tumultuous periods.

Despite BTC’s bullish tendencies, the troubling trend of significant outflows—totaling .4 billion over the past five weeks from cryptocurrency exchange-traded products (ETPs)—casts a shadow over its allure. Such outflows can discourage new investors considering entry into the crypto space. In contrast, established players might view these conditions as prime opportunities for accumulation, especially as historical patterns suggest that acquisitions made during downturns often herald forthcoming market rebounds. This duality creates a fertile ground for speculation, particularly among long-term investors confident in Bitcoin’s overarching trajectory.

Furthermore, market watchers should keep an eye on the altcoins alongside Bitcoin. For instance, Ethereum (ETH) has been locked in a sideways trading pattern that raises concerns about aggressive buying activity at current levels. If ETH fails to regain upward momentum, it could compound the bearish sentiment spilling over from Bitcoin, potentially dragging down prices across the board. This scenario presents challenges for altcoin investors, particularly those hoping for a lift in their investments through Bitcoin’s rise.

On the flipside, Bitcoin’s recent price action may still prompt a wave of buying interest from institutional investors, especially if it shows signs of breaking past the 200-day SMA. Strong performances in Bitcoin typically bolster altcoins, potentially invigorating sectors like Solana and Dogecoin as they seek recovery. However, any failure to maintain critical support levels across key assets could yield negative repercussions, sending shockwaves through crypto portfolios globally.

Ultimately, this environment highlights the interconnectedness of the crypto and traditional financial markets. While Bitcoin remains a stabilizing force for some investors, it poses risks for those overly reliant on bullish trends, particularly if bearish movements take hold. Each decision, therefore, carries weight, urging all players—experts and novices alike—to approach the market with diligent foresight.